It’s showtime in the California Trucking Association’s legal fight to protect the state’s trucking sector from the AB5 independent contractor law.

For the first time since early 2020, attorneys for the state and the CTA, as well as lawyers for some new players in the litigation, will be in court Monday in person before Judge Roger Benitez in the U.S. District Court for the Southern District of California. Those new participants will feature lawyers from the Owner-Operator Independent Drivers Association, which has joined CTA as an intervenor in the case, as well as legal representation from the Teamsters, which is working alongside the state to keep AB5 the law of the land. OOIDA and the Teamsters were not participants in the original case filed in 2019.

When they met back in January 2020, Benitez already had handed down a temporary injunction, later changed to a preliminary injunction, that prevented the state from enforcing AB5 against the trucking sector on the grounds that AB5 was in conflict with the Federal Aviation Administration Authorization Act (F4A) of 1994. A 78-page transcript of that day records the in-person arguments made to Benitez as to why the temporary injunction from New Year’s Eve 2019 should be upgraded to a preliminary injunction; the judge agreed.

That injunction was ultimately overturned by the 9th Circuit Court of Appeals more than seven months after lawyers had made their arguments to a three-judge panel virtually due to the pandemic. The 9th Circuit action was stayed while the CTA tried to get the Supreme Court to hear the case, an effort that failed.

That lack of action and the end of the injunction combined to implement AB5 in the state’s trucking sector and put the CTA case back to square one, once again before Judge Benitez. And on Monday, lawyers will appear in person to debate the latest CTA/OOIDA request for a new injunction that would block AB5 from trucking in California while the full case proceeds.

AB5 is a state law that seeks to define independent contractors through the ABC test. For trucking, the B prong in the ABC test is a particular burden, as it defines an independent contractor as one who “performs work that is outside the usual course of the hiring entity’s business.” A trucking company hiring an independent owner-operator to move freight could be challenged under the B prong.

The various participants in the case have filed briefs in recent weeks laying out their arguments that will be reiterated in court Monday. The last year has seen revised complaints from CTA and OOIDA, widening the scope of their arguments. Those revisions and the state responses have provided extensive documentation on the positions each side is taking in the case, which is formally known as CTA v. Bonta, after Rob Bonta, the state’s attorney general. (The original defendant in the case was then-Attorney General Xavier Becerra, now the Biden administration’s secretary of Health and Human Services.)

The give-and-take in the most recent briefs and the earlier complaints and responses are by now, four years after the original filling in CTA v. Becerra, increasingly familiar but with the occasional new twist.

CTA/OOIDA argument: F4A preempts state action in trucking that could affect a “price, route or service.” AB5 has the potential to do that. This is the argument that Judge Benitez accepted and used as the basis for the preliminary injunction.

State response: Bonta and his lawyers have the advantage of being able to quote the 9th Circuit’s decision overturning the decision that rejected the F4A preemption argument. “The Ninth Circuit in this case concluded that AB 5’s application to motor carriers is not preempted by the F4A, because AB 5 is a generally applicable law that is not ‘significantly related to rates, routes, or services,” the state wrote in its brief.

And in an argument that pops up repeatedly in the state’s filings in recent months, the attorney general’s office argued that AB5 has been in effect in the trucking sector for more than a year, loomed over trucking even before that as the injunction made its way through the courts, and none of the projected trucking apocalypse has occurred.

“Their dire predictions are supported only by a handful of individual declarations that at most demonstrate personal preferences,” the state wrote in its latest brief. “Such evidence is insufficient to counter the reality that there are many ways to comply with AB 5 and there has been no significant disruption of the motor carrier industry.”

CTA/OOIDA argument: A whole bunch of job classifications got “irrational” exemptions from AB5, but trucking didn’t.

AB5 was followed by another law, AB2257, and the net combination of these two laws was what looks like a patchwork of exemptions granted to various industries that were spared from AB5. From surgeons to hairdressers, it’s a long list, with the CTA saying it tops 100.

The argument made by the plaintiffs is that the exemptions show trucking and gig workers were being targeted and that the authors of AB5, particularly then-Assemblywoman Lorena Gonzalez, didn’t care about many other job sectors except those two.

The CTA brief specifically cites an exemption granted to construction trucking. “When given even moderately close scrutiny, the proffered reasons for the construction trucking services exemption do not pass muster, and instead confirm the unequal treatment offered by the Legislature to (a) similarly situated group,” the CTA argued.

State response: “In the motor carrier industry, the Legislature had before it evidence, confirmed by Defendants’ experts, of the rampant misclassification of truck drivers. AB 5’s inclusion of the motor carrier industry (among hundreds of other industries) therefore serves legitimate state interests.” It also noted that the construction trucking exemption expires next year.

CTA/OOIDA argument: AB5 puts a burden on interstate commerce.

This argument gets complicated, particularly in OOIDA’s brief, because it brings in the business-to-business exemption. The B2B exemption is a 12-part test that if fully met eases the ability to hire an independent contractor.

OOIDA’s brief argues that the B2B exemption treats intrastate and interstate drivers differently, thereby running afoul of the Dormant Commerce Clause, which prohibits states from interfering with interstate commerce.

State response: Citing a precedent, the state argued that “the Supreme Court has made clear that a law is not impermissibly discriminatory, for dormant Commerce Clause purposes, merely because the practical effect may be to favor certain in-state entities.” The state also cited the B2B exception several times in its final brief, and has done so earlier, noting its ability to get companies around AB5. But the trucking industry has argued its 12-step, 100% pass rate requirement is too big a burden for companies to meet and makes that argument in its latest brief.

CTA/OOIDA argument: AB5 is seriously messing up trucking in the state and that could impact the “price, route or service” protection in F4A.

The argument also comes back to the state’s stance that California is trying to eliminate independent owner-operators in the state, and it cites a quote from Gonzalez. She referred to — and it is cited in the CTA brief — the “outdated broker model that allows [trucking] companies to basically make money and set rates for people that they called independent contractors.”

Citing a declaration filed by a driver in support of CTA, the association argued that owner-operators who live in California (citing filings by individual drivers in connection with the case) “are forced to choose between becoming employee drivers or abandoning their chosen profession.”

State response: No, it isn’t.

The state has said multiple times that the record shows AB5 is not turning the trucking industry upside down.

The plaintiffs “have not presented any substantial, let alone compelling, evidence that the implementation of AB 5 over the past year and half in California has disrupted motor carrier services in any significant way,” the state said. “Nor have they shown that the law has had or will have any actual significant impact on the prices, routes, or services, as necessary for their express and implied preemption claims.”

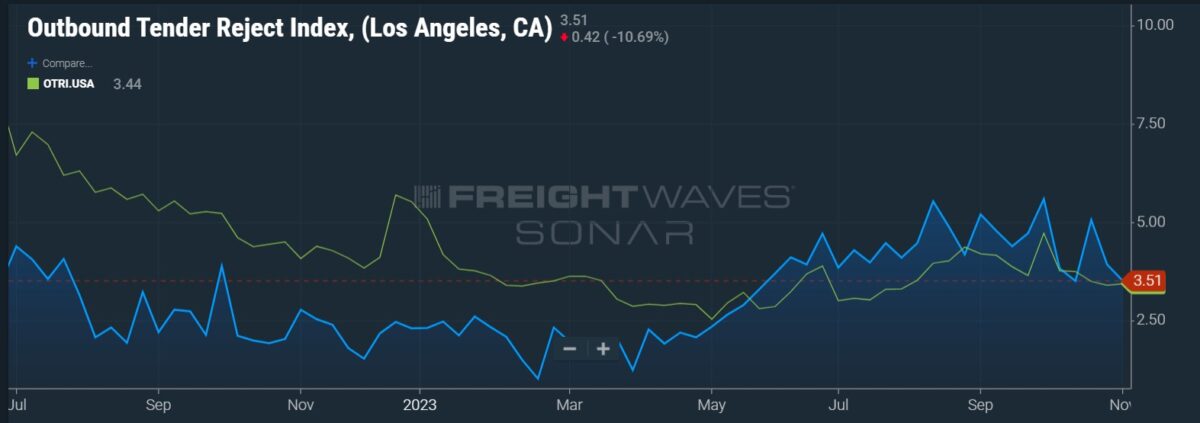

The Outbound Tender Rejection Index in FreightWaves SONAR is a measure of contracted freight rejected by contract carriers. A lower number reflects higher trucking capacity in a market. This chart compares the Los Angeles OTRI against the national OTRI. This data series begins July 1, 2022, right after the Supreme Court denied certioari in the AB5 case, ensuring it would be implemented against trucking in the state.

More articles by John Kingston

AB5 3-ring circus: Full federal appeals court may hear Olson case

Different court findings of broker liability raise prospect of another Supreme Court trip

3PL industry rattled by C.H. Robinson liability decision looks to other cases

Robert McMahon

Instead of dealing with the state make the state make arrangments to get loads hauled in and out of the state.then those people who do not know anything about truckin find out the reality of getting drivers to deal with an unrealistic expectation of a state that wants to operate as its own country.

Lindsey Gatewood

The position by the state is not valid from my point of view as a small business owner:

“Their dire predictions are supported only by a handful of individual declarations that at most demonstrate personal preferences,” the state wrote in its latest brief. “Such evidence is insufficient to counter the reality that there are many ways to comply with AB 5 and there has been no significant disruption of the motor carrier industry.”

I am a small business owner; I understand through experience and good legal advice that it is better to conform and cut the losses as soon as there is even a hint of change rather than have to go back and pay penalties and interest on some retroactive issue. As a small business it is important for me to make sure I am making the most prudent and fiscally responsible decisions and to get caught after the fact puts my business and my employee’s at risk of closing my doors. I would much rather give other small business owners ( hard working and invested truck owners ) the opportunity to do something great with the latitude needed to grow and provide a better life for themselves and their families. I see this as a cash grab by the state ( more taxation ) and suits only the ones that stand to gain from this rather than lose. Sure there are some drivers that want this because it gives them extras that only come as an employee and unlike me as a business owner, those drivers at some point want the hand outs from the state rather than continuing the hard work necessary to build a strong and successful business they started. Bottom line the drivers couldn’t make it and gave up and now those drivers want the state to bail them out.

Thomas Cordova

Great article. If you run clean with clean employees this should not even be a concern for you as a carrier. I know it isn’t for me.

In my opinion this is great for the CA trucking industry. It gets rid of all the folks that drive down freight rates because of cheap labor.