Germany’s industrial landscape is undergoing a profound transformation, marked by significant challenges that threaten its long-standing reputation as the maker of the world’s best machines.

Over the past decade, the nation has faced a series of headwinds that have collectively contributed to a noticeable deindustrialization. Understanding the root causes of this shift, as well as the lessons it imparts, is crucial for American policymakers and business leaders aiming to avoid a similar fate.

This is JP Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the ninth edition of our newsletter, where we get caught up on Russian gas, Volkswagen and BASF: ground zero for German deindustrialization.

One of the primary drivers of Germany’s deindustrialization is energy scarcity. The ramifications of Russia’s war on Ukraine have been stark, particularly in the realm of energy supply. Germany’s traditional reliance on natural gas, a cornerstone of its industrial model, was severely disrupted when the Kremlin halted gas deliveries. This abrupt change forced the country to seek alternative energy sources, leading to a significant spike in energy costs. As a result, companies like BASF found themselves grappling with soaring expenses, ultimately deciding to shutter operations such as the Uedesheimer Rheinwerk aluminum smelter by year’s end. Deutsche Bank and now-insolvent payment processor Wirecard illustrate the broader vulnerability within the financial sector, where high energy costs and regulatory pressures have crushed profitability.

Burdensome regulations also weigh on German industry. The ambitious Energiewende, or Green Transformation, aimed to transition the country to renewable energy sources. However, the ideological shift has outpaced the ability to practically implement “greening.” The simultaneous move away from nuclear power and the inadequate expansion of renewable infrastructure have left Germany struggling to meet its energy demands. Currently, Germany pays three times the international average for electricity, a factor that has deterred both domestic and foreign investment.

Volkswagen’s iconic plant in Wolfsburg, Germany. (Photo: Volkswagen)

Demographic challenges compound these issues. Germany faces a looming retirement wave as approximately 30% of its workforce approaches retirement age within the next 15 years. This demographic shift threatens to create a significant skills gap in engineering, science and other critical fields essential for maintaining industrial competitiveness. Efforts to mitigate this shortfall through immigration have largely fallen short, hindered by high taxes, language barriers and societal resistance.

The impact of these factors is evident across key industries. The automotive sector, a pillar of the German economy, has been particularly hard-hit. Traditional players like Volkswagen, Mercedes and BMW have struggled to transition from internal combustion engines to electric vehicles (EVs), losing market share to more agile competitors like Tesla and Chinese manufacturers. Volkswagen’s relocation of investment to China and the U.S. underscores the erosion of Germany’s industrial base. Similarly, the chemical industry faces significant setbacks, with BASF scaling back operations in Germany due to uncompetitive energy costs and shifting investment priorities overseas. The closure of BASF’s fertilizer plant in Ludwigshafen and other facilities resulted in substantial job cuts, highlighting the broader exodus of industrial activity from Germany to more favorable markets.

Amid these challenges, several lessons emerge from Germany’s deindustrialization experience:

- Energy strategy: Diversify energy sources and stabilize energy costs to enhance industrial competitiveness.

- Regulatory reform: Simplify bureaucratic processes to facilitate business operations and infrastructure modernization.

- Workforce development: Invest in education and training to bridge the skills gap and retain young talent within the engineering and scientific sectors.

- Innovation investment: Prioritize investment in cutting-edge technologies and support industries that can lead future economic growth.

- Infrastructure modernization: Upgrade critical infrastructure to meet the demands of modern industry and attract foreign investment.

- Global engagement: Maintain a balanced approach to international investments, mitigating overreliance on any single foreign market.

Despite the bleak outlook, there are glimmers of hope on the horizon. Germany continues to attract significant foreign investment, albeit with conditions. Recent initiatives by major companies like BASF and Intel demonstrate a willingness to invest in German operations, provided they receive substantial government support. BASF’s 175 million-euro ($180.1 million) investment in a new battery plant near Dresden and Intel’s 10 billion-euro ($10.3 billion) subsidy for a factory in Magdeburg are positive signs that strategic incentives can stimulate industrial growth.

Germany’s historical resilience and capacity for innovation have brought the country back from the brink before. The nation’s ability to once again pioneer technological advancements, similar to its early 2000s leadership in solar panel technology and BioNTech’s success with mRNA vaccines, could rekindle its industrial base.

By focusing on emerging sectors such as renewable energy, biotechnology and digital technologies, Germany could reinvent its economic model to better align with the demands of the 21st century — but it has to get the fundamentals of energy and capital markets right first.

Quotable

“Success for the Trump administration would be to do no harm to the exceptionally performing economy it is inheriting.”

– Mark Zandi, chief economist at Moody’s Analytics, to Reuters.

Infographic

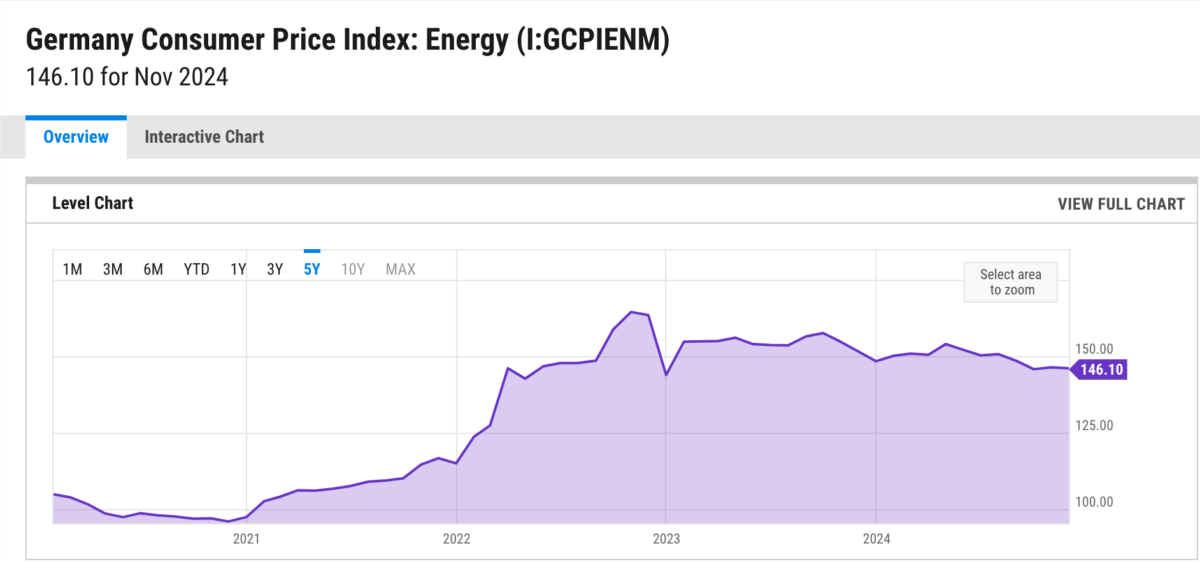

German energy prices have exploded since the onset of the Russia-Ukraine war in February 2022, but they were headed upward even before that. Chart: YCharts.

News from around the web

Semiconductor Manufacturing’s Transformational Challenges

With the deceleration of Moore’s Law, simply increasing transistor density will not yield more computing power.

Not only is Moore’s Law slowing down, but the cost per transistor is no longer decreasing. In fact, for the most advanced nodes, this cost might actually be rising. While achieving performance improvements has become more challenging, requiring more than just scaling down geometries, the demand for these cutting-edge nodes keeps increasing.

Canon Considering Outsourcing Camera Manufacturing to Cut Costs

With less demand for low-end, entry-level-style cameras and office equipment like printers and copiers, Canon is considering moving more manufacturing outside of Japan.

Macom wins $70m in CHIPS funding to expand telco semiconductor manufacturing

Macom Technology Solutions, which produces semiconductor devices used in telco and defense applications, has been awarded $70 million from the U.S. government to expand its manufacturing facilities.

Macom will use the CHIPS Act funding to modernize its plants in Lowell, Massachusetts, and Durham, North Carolina, enabling it to expand production of semiconductor technologies used in optical, wireless and satellite networks.

The projects would create up to 350 manufacturing jobs and nearly 60 construction jobs across both states.