Every year, the global supply chain grapples with a major disruptive event: Chinese New Year (CNY). Volumes at sea plunge as Chinese factories shut down. Carriers temporarily “blank” (cancel) sailings due to lack of outbound boxes. Importers pull cargoes forward before the holiday to ensure they have enough inventory.

CNY falls on a different date every year. Its impacts on world trade are so substantial that analysts often plot year-on-year comparisons in relation to CNY timing, not the calendar.

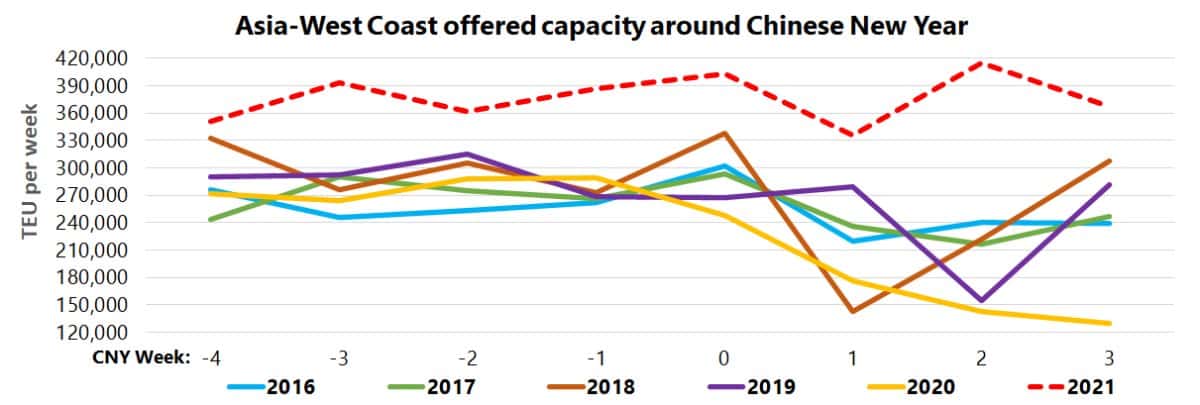

For the second year in a row, the CNY pattern looks like it will break the mold.

The Wuhan outbreak extended the normal CNY period of blank sailings in 2020 by several weeks. The Chinese COVID outbreak essentially lengthened the traditional vacation break. This doubled the usual CNY holiday effect.

The mirror-opposite scenario is taking shape in 2021. Chinese factory workers will still take their vacations, but carriers appear almost certain to blank drastically fewer sailings than usual.

Sharply reduced blank sailings

China is holding its CNY celebrations from Feb. 12-26 this year. According to Sea-Intelligence CEO Alan Murphy, “Carriers are likely having a difficult timing planning capacity management for CNY 2021.”

He added: “With under six weeks left, the clock is ticking.”

As of last Friday, carriers had announced just five blank sailings on the trans-Pacific and seven on the Asia-Europe route for the CNY period.

Last year, there were 73 CNY blank sailings on those routes (excluding blanking due to the COVID outbreak). In 2019, there were 67.

“At present, CNY reductions are hardly visible for 2021,” commented Murphy.

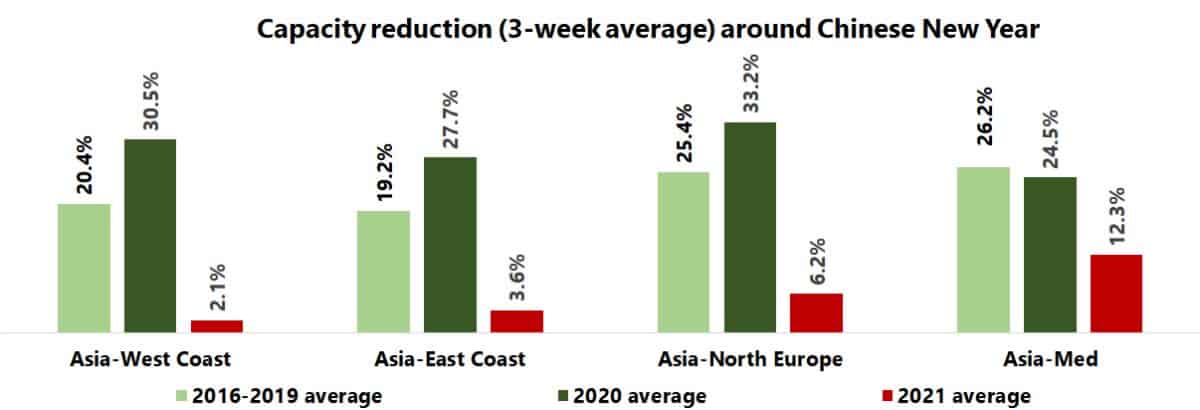

CNY capacity reductions on the Asia-West Coast route for this year are currently just 2.1%. Asia-East Coast reductions are just 3.6%. In sharp contrast, the average CNY reductions in 2016-2019 were 20.4% and 19.2%, respectively.

Carriers can still blank more sailings, but they would need to do so quickly. For “relative capacity reductions of previous years [to] be reached, carriers would need to blank 37-41 sailings on Asia-West Coast and 12-15 sailings on Asia-East Coast,” noted Murphy.

“It is clear that the carriers are currently scheduled to blank far less than in previous years,” he said.

“If they are to reach the level of previous years, a raft of blank sailings would have to be announced very soon.”

American Shipper asked a Maersk spokesman whether the liner giant would curb CNY blank sailings this year. Maersk didn’t answer the question directly but responded, “We continue to see demand strength in North American customers as a carryover from the extended peak of 2020. We’re in close communications with them and our intention is to support their needs and those of our U.S. exporters as we approach CNY.”

Pros and cons of 2021 CNY pattern

The Wall Street Journal recently reported that Chinese exporters are facing unprecedented delays in getting their goods to sea. A sharp reduction in CNY voyage cancellations should help clear cargo logjams on the Asia side.

SeaIntelligence Consulting CEO Lars Jensen told American Shipper, “As a starting point, this is good. Either demand continues to be strong, in which case the capacity is certainly needed. Or demand sees the usual seasonal slowdown, in which case this will be a big help in alleviating the capacity bottlenecks.”

According to Eytan Buchman, chief marketing officer of Freightos, “Carriers have announced far fewer than normal blanked sailings around the CNY lull.”

This “may indicate they will use that time to help relieve the empty container imbalance,” said Buchman.

But it’s not all good news. A normal level of CNY voyage cancellations would have helped ports in Los Angeles and Long Beach clear the queue of ships at anchorage in San Pedro Bay. The Marine Exchange of Southern California reported that there were 33 container ships at anchorage as of Monday.

Asked whether a decline in CNY sailings was good or bad for port congestion, Port of Los Angeles Executive Director Gene Seroka told American Shipper, “Given the import surge that has been ongoing since summer, we expected a reduction in Lunar New Year blank sailings. We have been in touch with carriers about this and we are working with our stakeholders to manage the increased volume.”

Steve Ferreira, founder of Ocean Audit, believes carriers’ decision to not blank nearly as many CNY sailings is an ominous sign. “It’s bad,” he opined. “It means the problem is probably at least two times worse than we imagined.”

Rising regulatory risk

Another reason carriers are highly unlikely to slash CNY services to the usual extent involves regulation.

Freight rates are historically high and have already caught regulators’ attention. The Federal Maritime Commission is monitoring carriers’ blank-sailing actions and increased carrier reporting requirements in late November.

The European Shippers’ Council and European Freight Forwarders Association sent a joint letter to the European Commission on Monday alleging that carriers are violating contracts and “unilaterally setting rates far in excess of those agreed in contracts.”

In its initial public offering (IPO) registration, the carrier ZIM disclosed that two of its subsidiaries “became involved in two separate industry-related investigations regarding competition law issues.”

It also disclosed that “a claim was filed against the company, together with other carriers operating in that jurisdiction, regarding commercial issues. The involved carriers jointly responded to the claim.” ZIM did not disclose the jurisdiction or the nature of the claim.

It is still theoretically possible that carriers could blank their usual number of CNY sailings. But to do so, they would need to announce a very large number of sailing cancellations in the next few weeks — at the very time rates are historically high.

That in itself would not look good to regulators. And if carriers went ahead with their usual blanking strategy and rates in the CNY period stayed high or rose further, it would look even worse. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: Trans-Pacific rates just popped to a new all-time high: see story here. Container shipping 2021: hangover or party on? See story here. Liner capacity control and the future of container shipping: see story here. Container rates are on fire. How can you invest in that? See story here.

Alison Hale

It’s a great pleasure reading your post. It’s full of information. The content of your post is awesome, great work.

http://adeenaskitchen.co.uk/

MrbigR504

With all the shut downs we’ve had and they (China) had in 2020, you’d think they’d wanna have a short CNY this go around and keep the manufacturing going! Man I’m sick of them having such a big impact on our economy every year because they shut down and go on a long’azz vacation! I’m no fan of #44 but I sure hope President Biden doesn’t throw the baby out with the bathwater on what #44 was doing with the trade deal with China. I pull containers and so I witness first hand when the import/export slows down when China shuts down. Freak’n sucks!