ATRI reports on California’s electric truck challenges

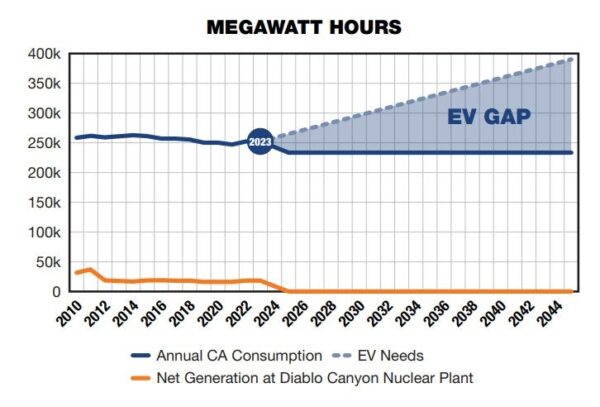

A report released Monday by the American Transportation Research Institute (ATRI) examines the costs and potential impacts associated with California’s push for zero-emission vehicles. This report is a companion to a December 2022 ATRI report titled “Charging Infrastructure Challenges for the U.S. Electric Vehicle Fleet.” Both reports highlight that full vehicle fleet electrification would require substantially more electricity generation than currently available.

For California, its greenhouse gas emission-reduction laws seek to have trucks and buses operating in the state be 100% zero emission by 2045 while sales of new passenger cars and trucks are slated to be zero emission by 2035. To power this zero-emission plan, ATRI noted that California would need to generate 57.2% more electricity than it currently produces. Cost is another factor, with the report adding a new battery-electric truck would cost more than $425,000 with a projected cost per mile as high as $1.21 if equipment, utility upgrades and electricity costs are factored in.

The report also said more trucks will be required to haul goods based on data ATRI collected. “If today’s diesel tractors were replaced with much heavier electric trucks — one-third of the truckload sector would suddenly be too heavy for U.S. roads. The result — additional electric trucks would be needed to move the same amount of freight as a diesel truck. For every 1,000 trucks, an additional 343 trucks would be required due to battery weight,” it said.

Battery-electric truck tires in the spotlight

Tires specifically made for Class 8 battery-electric vehicles (BEVs) are gaining more attention from OEMs and tiremakers, according to a recent article by David Cullin with the Commercial Carrier Journal. The push for tire modifications is in part influenced by Class 8 BEVs’ higher base weight from components such as battery packs and different performance profiles such as acceleration and torque, which can impact tire wear and performance.

“Truck tare weights vary considerably,” said Rick Mihelic, director of emerging technologies for the North American Council for Freight Efficiency (NACFE). “Some daycab EV tractors are within 2,000 lbs. of sleeper-equipped diesel trucks. But some may be 5,000 lbs. and some as much as 10,000 lbs. more than a sleeper diesel. And daycab diesels are 3,000 to 5,000 lbs. lighter than sleeper diesels. So, yes, tare weights of electric-powered daycabs are heavier and that will wear tires more quickly.”

This purchasing and maintenance challenge will be an additional factor for large fleets as they examine possible replacements from traditional internal combustion engines (ICE). Tom Clauer, senior manager of commercial product planning at Yokohama Tire, told CCJ that larger battery configurations can cause weight increases up to 5,000 pounds compared to ICE units. Clauer added that for long-haul applications, larger batteries or hydrogen/battery power sources will also impact tire wear due to extra torque applied on drive-axle positions. Acceleration and deceleration for BEVs will impact tread profiles, possibly creating situations in which fleets that are early adopters may require separate tire profiles for their ICE or BEV Class 8 units.

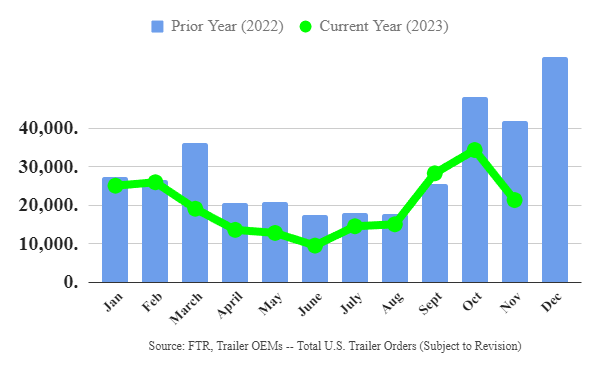

Market update: November net trailer orders plunge 38% from October

Recent data from FTR Transportation Intelligence suggests trailer orders are approaching pre-pandemic historical averages. FTR reported November U.S. net trailer orders declined 13,000 units or 38% month over month (m/m) to 21,362 units. Compared to one year ago, orders fell 45% but remain 7% above the average for 2023. Trailer production also fell in November 12% m/m to 23,770 units. The report noted lower trailer production is typically normal after October.

Eric Starks, chairman at FTR, added in the report, “With orders coming in under production levels, backlogs in November fell slightly, shedding almost 2,500 units to end at just over 140,000 units. The more pronounced fall in production resulted in an increase for the backlog-to-build ratio to 5.9 months. This ratio is in line with the historical average prior to 2020 and suggests the industry is moving towards a pre-pandemic level of stability.”

FreightWaves’ Alan Adler wrote that OEM maker Wabash said during its third-quarter earnings call “that its first-to-final-mile portfolio would offset softer near-term demand for dry vans.” Adler had earlier written that long-term trailer supply deals such as the one announced with J.B. Hunt Transport Services in January was part of Wabash’s strategy of hedging against economic or market swings that can result in higher order cancellations.

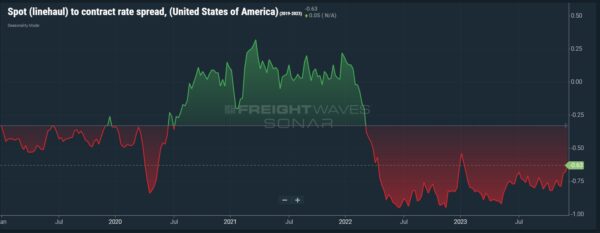

FreightWaves SONAR spotlight: Spot linehaul to contract spread narrows

Summary: The spread between the spot linehaul rate and contracted initial reported base rate per mile (RATES) narrowed to 63 cents per mile in favor of contracted freight. Part of the improvement can be attributed to truckload capacity disruptions leading up to and following the Thanksgiving holiday. This improved spot to contract spread may be short-lived as the initial contract reported base rate per mile (VCRPM1) is on a 14-day lag, with the most recent value at $2.32 per mile on Dec. 5. The gap is expected to widen again as spot market linehaul rates (NTIL) fell from $1.69 per mile on Dec. 5 to $1.62 per mile as of Monday.

Overabundance of truckload capacity remains the central theme explaining recent spot market declines with the FreightWaves National Truckload Index 7-Day Average (NTI) falling 6 cents per mile all-in from $2.31 per mile on Dec. 11 to $2.25 per mile. Falling fuel prices may be impacting recent spot rate declines with the DOE/EIA average weekly price of diesel fuel declining 9.3 cents per gallon to $3.894 per gallon in spite of recent geopolitical events in the Red Sea.

Recent improvements in nationwide outbound tender rejection rates suggest contracted truckload supply is tightening leading up to the Christmas and New Year’s holidays with OTRI rising 72 basis points from 3.57% on Dec. 11 to 4.29%. The rise in rejection rates is in contrast with nationwide outbound tender volumes, which fell 559.93 points or 4.72% from 11,876.1 points on Dec. 11 to 11,316.17 points.

The Routing Guide: Links from around the web

Nuclear verdict alert: More than $16M awarded in Georgia court (FreightWaves)

Diesel benchmark down again, futures markets up amid Red Sea tension (FreightWaves)

Overtime for truckers: A behind-the-scenes look at proposed legislation (The Trucker)

Knight-Swift pares back executives’ equity incentives (Trucking Dive)

Help Us Launch Truck Driver Barbie! (Change.org)

Convoy autopsy continues: Panel sees capacity issues, lack of discipline (FreightWaves)