Autonomous trucking startup TuSimple goes private

On Wednesday, autonomous trucking startup TuSimple went private after voluntarily delisting from Nasdaq following two years of stock and boardroom drama. FreightWaves’ Alan Adler writes, “TuSimple was the first autonomous trucking company to demonstrate driverless operations on an open highway. One of its trucks traveled 80 miles with no human on board from Tucson, Arizona, to Phoenix in December 2021.”

TuSimple’s decision to delist and focus on operations in China and Japan leaves only two startups — Aurora Innovation and Kodiak Robotics — as autonomous players, with both companies planning for limited commercial launches in Texas later this year. TuSimple was under threat of delisting since last year due to delinquent financial reporting, which saw the company change auditors when KPMG quit amid a boardroom shakeup. Nasdaq requires shares listed on its exchange to trade above $1. Price per share was originally not an issue for TuSimple, which had a $1.1 billion initial public offering in April 2021 that saw shares trading at nearly $70 per share after going public. Adler notes when the decision to go private was announced, TuSimple shares plummeted 57% to intraday lows of 30 cents per share.

For TuSimple’s operations in China and Japan, there appear to be resources to work with. Adler writes, “Unlike other transportation startups, TuSimple is relatively flush, reporting cash and cash equivalents of $776.8 million as of Sept. 30. The company caught up with required financial filings in November when it reported an operational loss of $248.6 million for the first nine months of the year.”

Analysts cut trucking Q4 earnings expectations

Truckload earnings season may begin not with a bang but with a whimper, according to recent analyst cuts to projected earnings leading up to Q4 results later this week. FreightWaves’ Todd Maiden writes, “Recent channel checks revealed a notable falloff in fundamentals in the back half of December, dispelling hopes that the quarter would be a transitionary period.”

Morgan Stanley analyst Ravi Shanker told clients, “In fact, we are starting to hear of potential scenarios where inventory levels may never return to prior decade levels as long as interest rates remain elevated with Shippers preferring to limit SKUs and running shorter, faster, tighter supply chains with higher turnover instead.” Shanker made earnings estimate cuts to all the public transportation and logistics companies he watches while publishing an outside-of-consensus bullish 2024 outlook a week ago.

Bank of America Global Research, using survey data to feed its proprietary Truck Demand Indicator, believes that better signs are ahead against the current soft backdrop. Its 2024 Year Ahead report notes, “While it is early, the stabilization and solid base sets up well for the next upturn. Given extended inventories, strong carrier balance sheets, shift in consumer preference from goods to services, and excess capacity (in trucking), it may still be a few months before we see strength in results.”

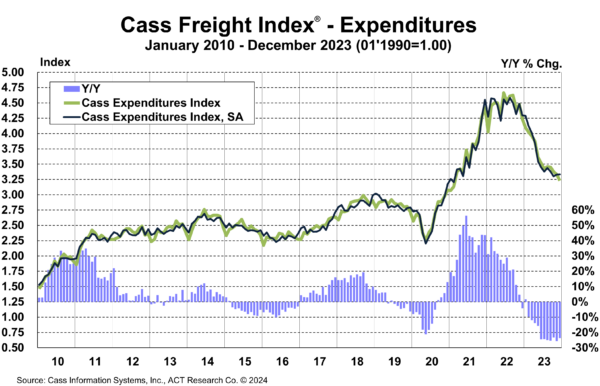

Market update: Cass December data shows early signs of rate stabilization

On Monday, freight audit and payment provider Cass Information Systems released its December Transportation Index, which saw freight and linehaul rates show early signs of stabilization. The Cass Shipments Index fell 1.6% month over month and 7.2% year over year. Total freight expenditures fell 3% m/m but seasonally adjusted rose 0.1%. The Truckload Linehaul Index saw a small bump of 0.4% m/m.

ACT Research’s Tim Denoyer noted in the report: “With spot rates steady over the past several months, downward pressure on the larger contract market is lessening, with some instances of contract rate increases bucking the downtrend of late.”

A trend to watch moving into Q2 2024 will be shippers’ restocking strategies to determine if the freight cycle upswing begins in earnest. The report notes, “Destocking and declining goods consumption have been key features of the freight recession, but both cycle drivers seem to be starting to reverse course. Real retail sales recently turned positive after a year of declines, and after 18 months of destocking, a restock is drawing near, likely spurred by ocean risks.”

FreightWaves SONAR spotlight: Spot rates fall despite winter’s best efforts

Summary: Nationwide all-in spot rates continue to decline following New Year’s despite nature’s best efforts from winter storms and Arctic air masses, which impacted transit across much of the Lower 48 states. The FreightWaves National Truckload Index (NTI), highlighted in blue, fell 6 cents per mile w/w from $2.39 on Jan. 8 to $2.33. NTI Linehaul rates less an estimated fuel surcharge saw a similar decline, falling 5 cents per mile w/w from $1.77 on Jan. 8 to $1.72. Excess truckload capacity remains the largest impediment to positive movement in spot market rates.

Declines in contracted freight volumes may be a contributing factor, as nationwide outbound tender volumes fell 1,338.26 points or 11.24% w/w from 11,909.66 points on Jan. 8 to 10,571.4 points. OTVI levels more closely resemble levels not seen since Dec. 24, when OTVI was at 10,657.21 points. Falling tender volumes are a development worth watching, as freight volumes are seasonally lower in Q1 before spring inventory movement causes higher truckload demand beginning in Q2.

The NTI spot market 28-day outlook (NTIF28) suggests further spot rate declines through the first weeks of February. Spot market rates are forecast to fall 7 cents per mile from $2.33 all-in to $2.26 by Feb. 12.

The Routing Guide: Links from around the web

FTR Forecasts Only Incremental Freight Market Improvement in 2024 (Heavy Duty Trucking)

TIA warns Congress of rampant fraud in trucking (FreightWaves)

Truck parking 2024 outlook: optimistic but no miracles (Fleet Owner)

Congress again floats massive increase to trucking insurance minimums (Commercial Carrier Journal)

Shortages 2024: What supplies are still at risk after years of disruption? (Supply Chain Dive)

Is FMCSA tipping its hand on carrier safety fitness? (FreightWaves)