BP buys TravelCenters of America

On Thursday, according to a news release, BP Products North America Inc., a subsidiary of BP, reached an agreement to purchase TravelCenters of America for $1.3 billion in cash. The purchase of TA is expected to add around 280 travel centers and double BP’s global convenience gross margin.

Regarding the reasons behind the acquisition, the release noted growth opportunities in EV charging, biofuels, renewable natural gas (RNG) and hydrogen in addition to the convenience store offerings.

Given the rise of environmental, social and governance initiatives, alternative fuel sources and the greater need for alternative fueling locations, this looks like a clever move by an energy giant to expand and hedge against changes in fueling.

FreightWaves staff writer John Kinston reports the acquisition is notable in that all three major U.S. truckstop companies — TA, Love’s and Pilot Flying J — will be privately owned. For the sale itself, Kingston adds it appears to be the culmination of various rounds of bidding from potential buyers over a long period of time.

In spite of many potential suitors at the end of the day, TA appears to have gone with the familiar. The Commercial Carrier Journal’s Jason Cannon writes, “This is the second time BP has owned TA. Standard Oil of Ohio bought TA in 1984 from Ryder and BP bought Standard Oil in 1987. BP sold TA in 1993.”

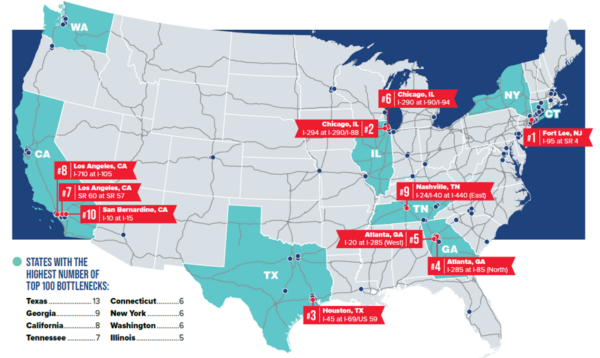

ATRI reveals top bottlenecks of 2023

Recent data from the American Transportation Research Institute (ATRI) indicates traffic congestion cost truck drivers 6% more time on average in 2022 than the previous year. FreightWaves Washington correspondent John Gallagher writes, “Average peak-hour speeds were clocked at 36.3 mph at the top 100 freight bottlenecks, ATRI found, compared with 38.6 mph in 2021. The decrease follows an 11% drop in average speeds between 2020 and 2021.”

Each year the ATRI analyzes over 300 locations identified as freight-significant, according to various state and federal agencies, then uses truck location and speed data from wireless onboard communications systems. The data collected is used to determine indicators such as average speed, hourly freight congestion rate and congestion value.

Regarding the bottlenecks, many of the worst offenders were segments in Fort Lee, New Jersey, Chicago, Houston, Atlanta, Los Angeles and Nashville, Tennessee. While many locations maintained their top rankings, there were some improvements. Gallagher notes, “Most improved among the 2021 top 10 bottlenecks was Chattanooga, Tennessee’s Interstate 75 at I-24 location, dropping from its No. 10 rank in 2021 to 59 in 2022. It had the second-highest increase in average rush-hour speed on the top 100 list, up 12% to 51.3 mph in 2022.”

The state with the most freight bottlenecks, according to the report, was Texas with 13. Out of those, there were nine spots in Houston alone.

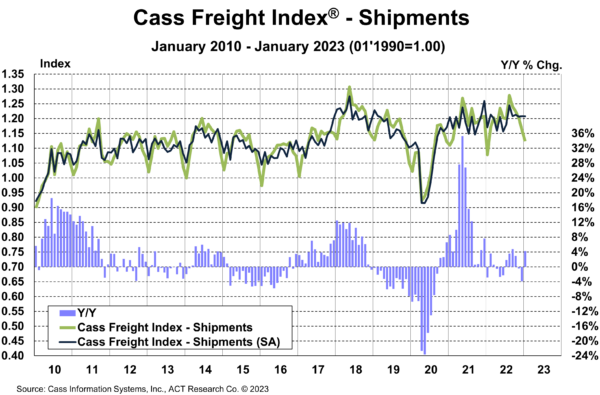

Market Update: Cass January shipments improve on truckload modal gains

On Tuesday, freight payment company Cass Information Systems released its January freight data indicating shipments were better than expected due to modal shifts back to truckload.

FreightWaves staff writer Todd Maiden notes, “The shipments component of the Cass Freight Index was flat with December on a seasonally adjusted basis but down 3.2% on an unadjusted comparison. The index normally sees a low- to mid-single-digit sequential decline in January. Better weather during the month and improving auto production were cited as tailwinds.”

Regarding the modal shift and truckload gains, the report outlined a considerable increase in proportions of truckload freight over the past several months, suggesting shippers are taking advantage of lower truckload rates relative to less-than-truckload and intermodal.

“The resilience of volumes thus partly rejects share gains by the truckload sector, particularly contract and dedicated freight currently, admit declines in LTL and intermodal volumes,” the report said.

Reading the tea leaves for what comes next remains uncertain. ACT Research’s Tim Denoyer comments, “After a soft holiday season with inventories overstocked and imports falling sharply, the outlook remains cautious, but volumes are on a high plateau.”

FreightWaves SONAR spotlight: Fuel spread volatility’s chaotic persistence

Summary: Volatility in the Retail to Wholesale Fuel Spread (FUELS) continues to impact diesel fuel prices due in part to geopolitical events like the war in Ukraine. The spread as of Tuesday came in at $1.455 per gallon, a decline of 10.6% week over week from $1.627 on Feb. 7. The Department of Energy/Energy Information Administration fuel update for diesel declined 9.5 cents a gallon as of Monday, marking the second week in a row of decreases for a total of 17.8 cents per gallon.

While fuel spreads are moving chaotically due to speculation on commodity exchanges and futures contracts, the impact at the pump has been more muted. FreightWaves market expert Zach Strickland writes, “As unbelievable as it may seem, the retail price that most people see at the pump is much more stable than the wholesale or rack price that many retail gas stations purchase.”

Part of this stability comes from the lack of retail stations to keep up. Kingston writes, “The big fluctuations in futures and wholesale prices on a daily basis have been far too rapid for retailers to track. They are simply not set up or of a mindset to change prices as much as 5 cents to 10 cents per gallon — or more — multiple times per week.”

Regarding the typical wholesale fuel spread, Kingston pointed out this historic norm is between $1 to $1.10 per gallon.

The Routing Guide: Links from around the web

Countdown begins for hydrogen-powered trucks? (FreightWaves)

Convoy restructuring leads to layoffs, closing of Atlanta office (FreightWaves)

Trucking associations push to end vaccine mandate at US borders (FreightWaves)

Uber Freight expects ‘broad-based volume recession’ in 2023 (FreightWaves)

Heartland Express acquisitions nearly double age of its trailer fleet (Transport Dive)

FMCSA changing how it identifies unsafe carriers (FreightWaves)