Convoy shuts down

Seattle-based digital freight broker Convoy on Wednesday canceled all shipments from its marketplace and company representatives promised more details of a business transition were forthcoming. By Thursday, company employees were told in a meeting that Convoy was “closing down its core business operations.”

FreightWaves’ John Kingston wrote: “In the letter from … CEO and co-founder Dan Lewis that followed a companywide phone call, there was no suggestion that Convoy was about to see its digital brokerage operations snatched up by another suitor, as the rumor mill had churned out several names Wednesday. The company will retain a small team that will not only wind down existing operations but ‘handle … future strategic options.’ Beyond that, every other employee was let go.”

This comes after a Convoy spokeswoman issued a brief statement to FreightWaves, citing potential developments in the next 24 to 48 hours, without elaborating further. As of Thursday afternoon, there had been no bankruptcy filing by Convoy, according to a check of public records by FreightWaves. Convoy’s departure comes after an April 2022 Series E capital raise with $3.8 billion valuation and investment of $260 million.

Freight brokerage bubble bursts

Craig Fuller, founder and CEO at FreightWaves, wrote an article Wednesday highlighting how changes in the financial climate paired with an ongoing weak freight market are creating conditions for an increase in freight brokerage failures. One common challenge for freight brokers is managing cash flow. Fuller said that compared to trucking companies that may use factoring companies to handle receivables and speed up cash flows, brokerages were alternate lenders like pledging receivables as collateral against lines of credit.

These asset-based lines of credit, or ABL, were a big factor in brokerage growth, since they cut out the tedious process of collecting from shippers at the expense of a percentage fee paid to the financial institution that gives you the credit.

An ABL itself isn’t a problem until paired with higher interest rates, which caused brokerage lenders to ask for a larger percentage cut of receivables. Fuller wrote, “Freight brokers went out and borrowed against their AR portfolios to fuel growth, racking up debt at cheap rates. When the Fed changed the cost of capital, that debt became more expensive.”

The very capital brokerages were using to fund growth and purchases is now a liability due to the debt that remains. Finance companies, aware of freight volatility, placed covenants on these lines of credit. Fuller added, “As margins compressed, the covenants were violated, and the financiers became nervous. Now some of them are facing a dilemma: continue to fund the line of credit or call it in. In Convoy’s case, it appears the line of credit was called in.”

Market update: Cass September data suggests freight cycle flattening

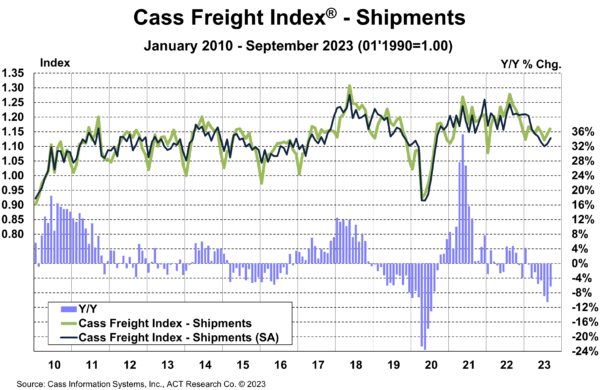

Payment provider Cass Information Systems on Wednesday released its September index data showing a slight uptick in freight shipments but lower freight rates and expenditures compared to the previous month. The Cass Shipments Index rose 1.7% month over month to 1.163 points but was down 6.3% year over year. This marks the 14th consecutive decline in monthly freight volumes in the past 21 months, with the report adding this is similar to prior downcycles in length and magnitude, excluding the pandemic.

Linehaul rates had some positive movement. FreightWaves’ Todd Maiden wrote, “Cass’ truckload linehaul index, which excludes fuel and accessorials, ticked up 0.5% sequentially in September, reversing a decline of an equal amount in August. This was the first sequential increase since May 2022.”

Tim Denoyer, vice president and senior analyst at ACT Research, noted, “With both the shipments component of the Cass Freight Index and the Cass Truckload Linehaul Index rising sequentially this month, the freight cycle is at least starting to flatten out, with smaller y/y declines. We continue to expect the freight cycle to turn once capacity tightens, but early signs of 2024 equipment production suggest that may be a while.”

FreightWaves SONAR spotlight: Autumn heralds falling outbound tender volumes

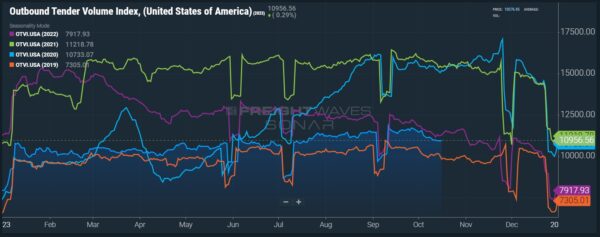

Summary: The beginning of fall typically marks changes in foliage but also declining outbound tender volumes beginning in the last week of September. Revised outbound tender volumes nationwide declined 1.23% or 140.56 points in the past week from 11,097.12 points Oct. 9 to 10,956.56 points. Month-over-month outbound tender volumes fell 3.72% or 423.44 points from 11,380 points on Sept. 17 to 10,956.56 points. In spite of the beginning of Q4 and trucking’s traditional peak season, tender volumes appear to mimic similar declines in October from 2022 and 2019 (highlighted in purple and orange, respectively) with volume increases occurring in the run-up to Christmas Day.

Compared to 2019 and 2022 volume levels, outbound tender rejection rates appear worse for carriers, with the Outbound Tender Reject Index currently at 3.85% nationwide versus 4.8% in 2019 and 4.5% in 2022. For the time being, there remains an abundance of truckload capacity relative to demand. Outbound tender rejection rates typically between 5% and 7% suggest a balanced market between truckload supply and demand, with many shippers requiring a tender compliance level of 95% or more.

The Routing Guide: Links from around the web

Marten’s earnings reflect weaker truckload market (FreightWaves)

Year-on-year gain in J.B. Hunt intermodal volumes highlight of overall weak quarter (FreightWaves)

Motive’s Holiday Outlook Report forecasts continued challenges for carriers (Truck News)

California Trucking Association sues to block Advanced Clean Fleets rule (FreightWaves)

ATA’s Spear rips ‘self-promoting union bosses’ in annual address (FreightWaves)

Trucking driver shortage falls significantly to 60K, ATA reports (Trucking Dive)