Driver pay data highlight earnings gain

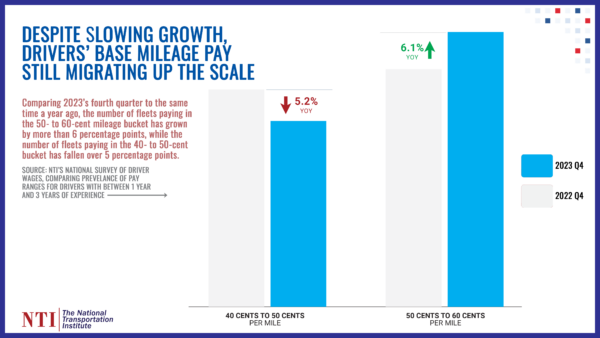

The National Transportation Institute (NTI) recently released Q4 2023 driver pay data that shows driver earnings continue to climb in spite of the freight market undergoing a correction. Drivers’ base mileage pay brackets saw a shift, with the 40-to-50-cents-per-mile pay bracket falling 5.2% year over year as fleets raised wages to attract and retain drivers. The 50-to-60-cents-per-mile bracket saw a 6.1% y/y increase.

Fleet wage growth also saw changes with cap pay. The report noted, “From 2020’s Q4 to 2022 Q4, drivers with 1 year and 3 years of experience saw the biggest per-mile wage gains. Since late 2022, however, the trend shifted. Cap earners, those with the most experience and highest base pay have seen the biggest percentage wage gains through 2023.” The report adds that new drivers to the industry with one year of experience are now earning more per mile in Q4 2023 than drivers in 2020 who had the most experience and base pay.

Amid overabundant trucking capacity evident in the current glut of drivers, the report noted that recruiting momentum in the forms of sign-on and referral bonuses saw declines. The average dollar amount for those bonuses in Q4 2023 fell the first time since Q2 2022, while referrals saw their first decline since Q3 2023. Referral bonuses fell $29, while sign-on bonuses fell $53 from Q4 2022 to Q4 2023.

ATA survey: Carriers spend $14B per year on safety

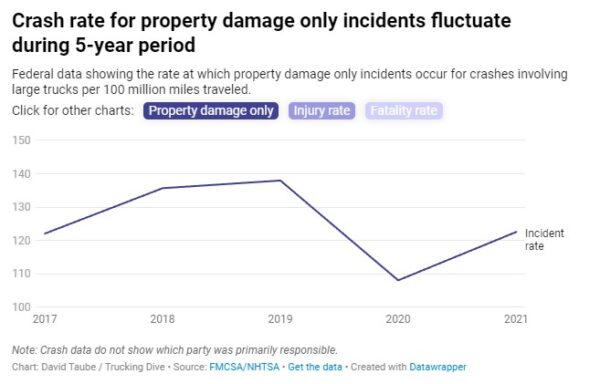

New data released by the American Trucking Associations shows that the trucking industry invests $14 billion annually in technology, training and other costs to improve highway safety. According to the survey, which is still accepting submissions, the $14 billion was “over 40% higher than our last survey conducted in 2015. ATA surveyed a variety of motor carriers — from fleets with just a few trucks to carriers with more than 10,000 power units on the road, running the full breadth of the industry. In total, companies responding to the survey accounted for almost 170,000 drivers and nearly 160,000 trucks.”

This comes as federal data looking at truck fatalities from 2017 to 2021 saw a rising trend after fatalities declined from 2019 to 2020. Reviewing the data, David Taube with Trucking Dive writes, “But truck crashes only involving property damage fared better in 2021 than incidents in 2018 and 2019. And from 2019 through 2021, the industry posted a decreasing rate of injuries in trucking crashes per 100 million miles traveled.”

The Federal Motor Carrier Safety Administration data noted that crash location and day of week were additional considerations, with 83% of fatal crashes and 87% of nonfatal crashes with large trucks occurring on weekdays. The FMCSA adds, “Fatal crashes involving large trucks often occur in rural areas and on Interstate highways. Approximately 54 percent of all fatal crashes involving large trucks occurred in rural areas, 26 percent occurred on Interstate highways, and 12 percent fell into both categories by occurring on rural Interstate highways.”

Market update: Motive December Economic Report

ELD provider Motive’s December economic report saw increases in retailer inventories leading up to the holiday season, while fuel prices continued to decline. Motive’s Big Box Retail Index, which measures trucking warehouse visits for the top 50 retailers in the U.S., fell 3% in November compared to the previous year.

The report notes: “The rally in visits through November is more prominent when looking at durable goods such as appliances, electronics, furniture and other ‘hard goods.’ The transportation of these items to retailer warehouses saw a 16-point increase from early October to the end of November. When comparing average activity for October and November, visits for companies focusing on durable goods were down 5.9% year-over-year, while those focused on non-durable goods fell by 10.9%.”

Carrier exits and net revocations were another topic examined. The report states, “The number of carriers exiting the trucking market jumped to 4,931 in November, a 55% increase compared to October. Simultaneously, new carrier registrations also declined, with 6,792 registrants representing a 9% drop since October and a 16% drop since the end of Q3. Both of these numbers represent the continued market contraction being compounded by typical seasonal changes.”

FreightWaves SONAR spotlight: Strong foundations for 2024

Commentary courtesy of the Daily Watch, a newsletter for SONAR subscribers

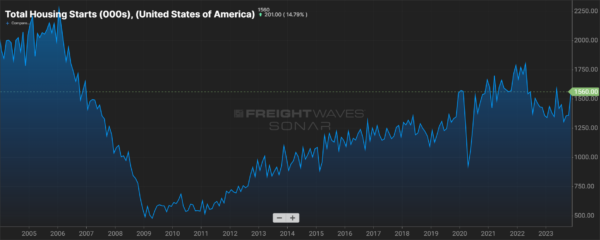

Summary: As the Federal Reserve dangles potential rate cuts on a quicker timeline than previously expected, economic sectors that are sensitive to interest rates are seeing some early relief. One such sector is the housing market, which informs truckload demand not only through the shipment of raw materials needed for homebuilding, but also through the movement of bulky durable goods needed to furnish a typical house.

To the surprise of many analysts, housing starts surged in November, rising 14.8% month over month against an expected decline of 0.2%. Construction on new homes is now near its highest peak since May 2022, thanks almost exclusively to an 18% m/m swell in single-family housing starts. Sentiment among homebuilders, despite lingering pessimism, also gained distance in December from its prior 11-month low. Taken as a whole, this picture implies that sales of existing homes would suffer from an uptick in newly constructed homes.

Yet that sorrow was sidestepped, as existing-home sales rose 0.8% m/m in November against expectations of a 0.4% m/m decline. In short, the housing market is clawing its way back into recovery as mortgage rates have fallen from multidecade highs over the past two months. The promise of softer monetary policy led to a boost in consumer confidence, as the Conference Board’s Expectations Index — which tracks consumers’ short-term outlook for financial and labor market conditions — rose 8.2 points m/m in December to 85.6. This latest rise is critical since, historically, any reading under 80 has signaled a coming recession within the next 12 months.

A vigorous housing market coupled with a confident consumer promises tailwinds to come for the trucking industry.

The Routing Guide: Links from around the web

State of Freight: Strong volume, stuck OTRI and caution for shippers in ’24 (FreightWaves)

C.H. Robinson’s new CEO doubling down on lean management, large language models (FreightWaves)

Autonomous trucking 2023: Leaders emerge amid exits and entries (FreightWaves)

DECEMBER 2023 FOR-HIRE TRUCKING INDEX (ACT Research)

Environmental groups sue BNSF over grizzly bear deaths (FreightWaves)

Nikola founder sentenced to 4 years on fraud convictions (FreightWaves)