FMCSA crash reporting category expansion draws ire

A proposal by the Federal Motor Carrier Safety Administration to alter and expand reporting categories for crashes is drawing criticism from the Owner-Operator Independent Drivers Association, which argues the FMCSA should take stronger action to protect driver safety records.

FreightWaves’ Washington correspondent John Gallagher wrote, “Since May 2020, FMCSA has accepted Requests for Data Review (RDRs) in its DataQs system to evaluate accident preventability by truck drivers in 16 crash types. By modifying them and adding four more categories, FMCSA wants to better identify nonpreventable accidents used in its Crash Preventability Determination Program (CPDP).”

Typically carriers must submit a crash report to the FMCSA if a vehicle was towed from the scene or an injury or fatality occurred. OOIDA President Todd Spencer said, “The system forces drivers/carriers to step out of their roles as professional truckers and become crash investigators, evidence collectors, and perform multiple functions to upload necessary documentation for review.”

The resources required to identify and dispute reported crashes are easier for larger carriers with a dedicated safety and compliance department compared to smaller fleets and owner-operators who lack the back-office resources. Bryan Griffith, a lawyer with Sandborn, Brandon, Duvall and Bobbitt, argued the current rules put undue burdens on drivers and carriers, saying, “When a state agency reports a crash, the safety points for that crash are added to the motor carrier’s CSA [compliance, safety, accountability] scores within a month, when the next snapshot is released.”

CSA scores matter as a carrier with a negative safety rating loses access to freight opportunities with brokers and shippers in addition to paying higher insurance premiums.

New truck sales as a recession indicator confusion

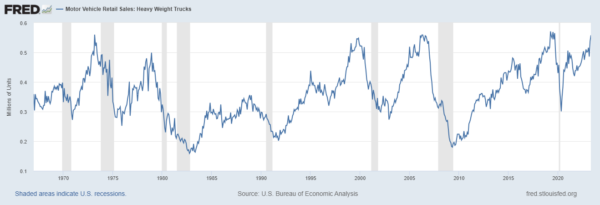

Some social media users on Twitter have begun to argue that new truck sales can be used as an indicator if a recession is imminent. The thought process goes that if sales are declining, the economy is contracting as fleets cannot afford new equipment, but if sales are expanding, that implies fleets are bullish and are buying more units to expand and take market share. Typically, this rule of thumb holds true in a normal freight business cycle. FreightWaves founder and CEO Craig Fuller argued in an article Tuesday that this heuristic is currently misleading, as pandemic supply chain delays forced medium to large asset fleets to use existing older equipment longer as Class 8 OEMs were unable to meet demand.

Paying attention to trucking fleet purchasing patterns is the missing ingredient to analyzing the current sales trend. While fleets with more than 100 tractors can be considered a midsize fleet, any fleet with more than 100 power units is in the top 1% of total available authorities and these fleets own around 42% of all trucks on the road. It’s these medium to large fleets that heavily influence new truck sales and with Class 8 backlog to build times declining, there’s more opportunity for updating aging equipment than years prior.

Fuller cautioned armchair supply chain experts from getting the wrong takeaway with the current Class 8 sales data, saying, “What is occurring in truck order data is not related to robust freight demand, but rather a bulking of orders from the COVID economy among midsized and large fleets.” He added, “The midsize and large fleets also held on to trucks longer than usual — two years longer than normal. Some fleets delayed orders in 2020 because of the unprecedented uncertainty and then continued to hold off in 2021 because of the inability to find truck drivers to ‘seat their trucks.’”

Cass May data: Excess capacity remains a drag on freight rates and expenditures

May data from Cass Information Systems released Tuesday highlighted a continued deterioration in freight rates, expenditures and truckload linehaul indexes. Cass freight expenditures fell 6.8% month over month (m/m) and 15.7% year over year (y/y) in May as changes in fuel, modal mixes and accessorial charges drove down total freight spend. The Cass truckload linehaul index saw a decline of 2.6% m/m in May after falling 0.8% in April as new contracted rates took effect. The report noted the linehaul index includes both spot and contracted freight rates with expectations for further contract rate declines.

In spite of falling rates and expenditures, the Cass shipments index rose 1.9% m/m from May but fell 5.6% y/y. The report said, “Freight markets continue to work through a downcycle which featured its first y/y decline 17 months ago. The past three downcycles have ranged from 21 to 28 months.”

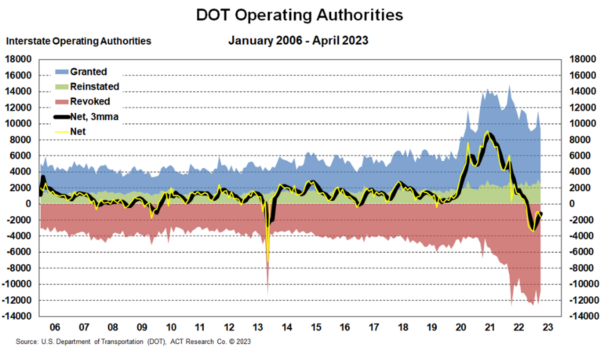

Excess truckload capacity continues to weigh down rates. Regarding freight expectations, the report said, “Supply is key to the freight rate cycle, and too much capacity is continuing to chase too little freight. Even as spot rates rose in May and so far in June, it hasn’t been much of a bounce. But, net of grants and reinstatements, DOT operating authorities are being revoked at a record rate of about 2,000 per month since October 2022. So, capacity is contracting at a record pace, which is key to the bottoming process.”

Based on DOT data on operating authorities, net revocations continue to climb but record new entrants data remains a headwind for rate improvement.

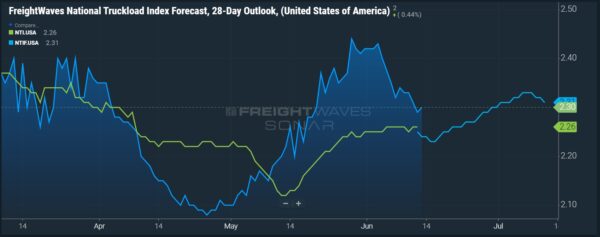

FreightWaves SONAR spotlight: Spot rate forecast predicts slight July 4th boost

Summary: The summer doldrums for spot market rates are expected to see a slight uptick moving closer to the Fourth of July weekend. The National Truckload Index Forecast 28-Day Outlook (NTIF28) highlighted in shaded blue reflects the forecast NTI value predicted from 28 days prior. Highlighted to the right in light blue is the FreightWaves National Truckload Index (NTIF), the 30-day forecast for NTI spot market rates extending from the current date. The current forecast for the next 30 days is an increase in spot rates by 5 cents per mile, or 2.12%, from $2.26 per mile to $2.31 per mile by July 11. This model takes into account the historical rise in spot rates leading up to the Fourth of July as capacity leaves the market for an extended period of time while shippers adjust their hours of operation and tender volume levels.

Week-over-week NTI spot rates remained unchanged at $2.26 per mile all-in, including fuel. Over the past 30 days spot rates rose 6.6%, or 14 cents per mile, from $2.12 per mile on May 13 to $2.26 per mile as the Memorial Day holiday weekend took truckload capacity out of the market. While rising spot market rates are a welcome sight for small fleets and owner-operators, the outlook for a freight volume rally in the second half of the year remains bearish as shippers take a cautious approach to inventory restocking. The amount of excess truckload capacity continues to be the primary hindrance to a meaningful rally in spot rates, as import data and consumer spending expectations do not point to a return to higher freight volumes last seen in 2021 and Q1 2022.

The Routing Guide: Links from around the web

NHTSA side underride analysis slammed by safety, insurance advocates (FreightWaves)

Philly-area trucking comes to grips with monthslong closure of I-95 (FreightWaves)

TIA establishes task force to fight freight fraud (Commercial Carrier Journal)

Economic Trucking Trends: Loss of capacity, not increase in demand, will lead recovery (Truck News)

Bullwhip effect cracking US imports’ peak season (again) (FreightWaves)

Manufacturers are anticipating a recession: NAM survey (Manufacturing Dive)