FMCSA truck leasing panel drafts recommendations

The first meeting of the Federal Motor Carrier Safety Administration’s Truck Leasing Task Force (TLTF) discussed and drafted recommendations on Tuesday regarding limiting or eliminating the power a trucking company has over lease purchase agreements with drivers. The task force was created through the Bipartisan Infrastructure Law of 2022. As FreightWaves’ John Gallagher writes, “It is tasked with examining financing arrangements among motor carriers, entry-level drivers, driver training providers and others that may result in new drivers entering the trucking workforce.”

Task force member Jim Jefferson with the Owner-Operator Independent Drivers Association, felt carriers had an outsize impact on driver decisions, noting, “They treat him like an employee, but they give him all the responsibilities of an independent contractor, and in a lot of cases they make less money than what a company driver can make. So maybe there should be some separation between a lease-purchase company and a carrier so that that company doesn’t control every aspect of the [relationship] with the driver.”

Large enterprise trucking companies typically use a third-party leasing company to handle the contracts to avoid potential driver legal woes should a driver fail to meet the requirements or payments. One problem with the arrangement is the no-money-down, no-credit-check-required offers that can attract drivers who may lack the experience or means to repay the leasing agreement.

Q2 ‘peak pain’ for trucking, says Morgan Stanley report

A recently released report by Morgan Stanley’s transportation equities team estimates that Q2 earnings reports for trucking companies will represent ‘peak pain’ and argues trucking is likely reaching the bottom of the business cycle. Ravi Shanker, Morgan Stenley transportation equities analyst, noted in the report, “The quarter began with most companies reporting on 1Q calls that there was virtually no spring seasonal pickup and while this improved somewhat going into the end of the quarter, the lift was likely too little, too late to save the quarter.”

One sign for earnings of publicly traded truckload carriers’ troubles came early when Knight-Swift announced in a news release that following the close of the U.S. Xpress acquisition, its consolidated operating margin would likely fall 1,100 to 1,200 basis points year over year as soft demand impacts truckload volumes and pricing.

Truckload carriers are not the only ones seeing earnings pain. FreightWaves’ Todd Maiden writes, “Shanker said the 3PLs are likely in for a challenging quarter, with a tougher second half on the horizon if spot rates rise. Higher spot rates would force brokers to pay up for capacity compared to their contractual agreements where rates are off y/y by high single to low double digits. Additionally, 3PLs with forwarding units will see pressure as the space unwinds from a period of inflated earnings, as air and ocean rates ballooned during the pandemic.”

Market update: Cass June data shows freight rates down 21% y/y

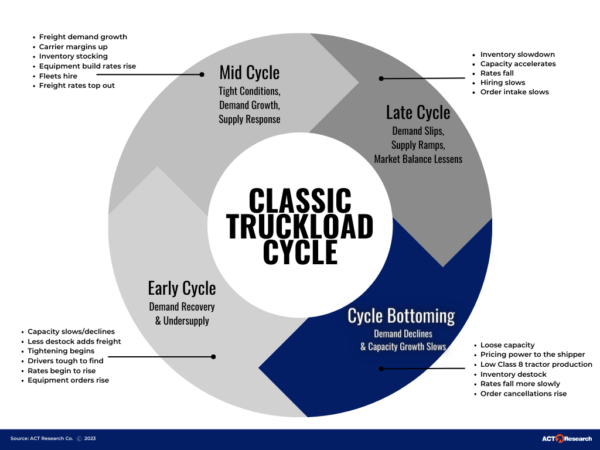

On Wednesday, freight audit and payment processor Cass Information System released its June transportation index report, arguing the truckload business cycle is bottoming out. The report noted inferred freight rates fell 1% month over month but are down 20.9% year over year as greater truckload capacity relative to demand caused rates to deteriorate. The shipments index declined 1.6% in June, down 4.7% y/y as inflation and consumer buying patterns resulted in a normalization of shipments to around pre-pandemic levels.

The report provided a chart from ACT Research highlighting conditions typically seen during the bottom of the trucking business cycle. One ingredient missing from a typical market bottom involves lower Class 8 production, as the report notes Class 8 build rates remain elevated as fleets continue to upgrade aging equipment which was hampered by pandemic supply chain disruptions.

What remains to be seen are numbers from the Bureau of Labor Statistics on trucking jobs and future trends, with the report noting that BLS employment data suggests owner-operators are moving back to for-hire jobs but resilient employment numbers in the overall trucking sector threaten to prolong the trucking cycle bottom.

FreightWaves SONAR spotlight: Spot market summer doldrums

Summary: Short-term spot rate expectations suggest the slight bump in rates caused by the July Fourth holiday heralds a plateau that is expected to continue through mid-August, according to FreightWaves’ National Truckload Index Forecast. Twenty-eight-day forecast spot rates are expected to remain around $2.30 per mile all-in as truckload capacity returns to the market and shippers tender more freight through contracted volumes due to favorable outbound tender compliance levels. The seven-day average National Truckload Index (NTI) rate remained relatively flat week over week, falling only 1 cent per mile from $2.31 all-in on July 3 to $2.30 per mile.

Nationwide outbound tender rejection rates are currently at 3.09% as carriers continue to accept as many electronically tendered loads as possible before testing their luck with spot market options. In spite of falling diesel fuel prices, carriers exposed to spot market transactions typically do not receive a fuel surcharge, with NTI linehaul only (NTIL) rates remaining flat week over week, falling only 1 cent per mile from $1.71 on July 3 to $1.70. Shippers should expect continued favorable pricing power, with carriers focusing on increased service and tender compliance, as failure to service these volumes could see a carrier further down the routing guide win the freight and reap the rewards of higher contracted revenue.

The Routing Guide: Links from around the web

High-mileage, late-model used trucks fetching lower prices (FreightWaves)

CARB and engine manufacturers compromise on emissions timing (FreightWaves)

FreightWaves opens 2024 FreightTech nominations (FreightWaves)

Has the freight bubble burst? (FreightWaves)

DOE/EIA diesel price higher after more bullish trend in oil markets (FreightWaves)