Kodiak Robotics, Pilot open 1st autonomous truckport

On Thursday, self-driving trucking company Kodiak Robotics and Pilot Co. opened their first truckport for autonomous vehicles at the Pilot Travel Center in Villa Rica, Georgia. According to the news release, the truckport will be used by Kodiak to launch and land its autonomous trucks and serve as a hub for drivers to pick and drop off loads for first- and last-mile deliveries. This location will support the Kodiak autonomous freight lane between Dallas and Atlanta and will complement the company’s Dallas-Fort Worth hub, which is the main terminal.

By partnering with a travel center, the release notes, “Additional comprehensive services at the truckport will include refueling at the Pilot Travel Center, light maintenance, and pre-trip inspections, including Enhanced Inspections specifically designed for self-driving trucks.” This investment comes after a yearlong effort in which Pilot Co. invested in Kodiak Robotics back in August 2022 to design and develop the truckport.

The field for autonomous vehicles has shrunk over the past few months as other entrants have left the market, including the sale of Embark Trucks in May, TuSimple leaving the U.S. autonomous market for China in June and Alphabet’s Waymo Via exiting in July. For Kodiak Robotics, partnerships for infrastructure is the go-to strategy while it develops the technology. Kodiak CEO Don Burnette told FreightWaves last August, “We’re not going to do it by building our own infrastructure throughout the entire country. We have to partner with folks who are already embedded in that industry.”

Werner CEO on small fleet health

The debate on when enough small fleets and owner-operators will leave the market continues. In spite of falling rates and rising fuel costs, it remains challenging to pinpoint the amount of truckload capacity that must exit the market to materially impact rates. For large, publicly traded truckload carriers with thousands of assets, questions on the financial health of these small fleets garnered extra attention during Q2 earnings season.

During a Deutsche Bank transportation conference, Derek Leathers, chairman and CEO of Werner, said, “We underestimated the cash pile that small, medium-size carriers had built up over COVID and have allowed them to survive longer than we thought they’d be able to.” Leathers added that more truckload capacity is expected to leave the market: “I underestimated the resiliency of them being able to survive below their operating costs for as long as they have, but I think those days are over.”

Less truckload capacity means less competition and an opportunity to increase revenues if the market turns and spot rates rise. FreightWaves’ Todd Maiden writes of Werner’s performance that “revenue per total mile in its one-way segment was down just 5% year over year in the second quarter, which was better than most carriers in the industry. Management said it walked away from some opportunities during bid season, opting to place more trucks in the spot market, essentially banking on a recovery sooner than later.”

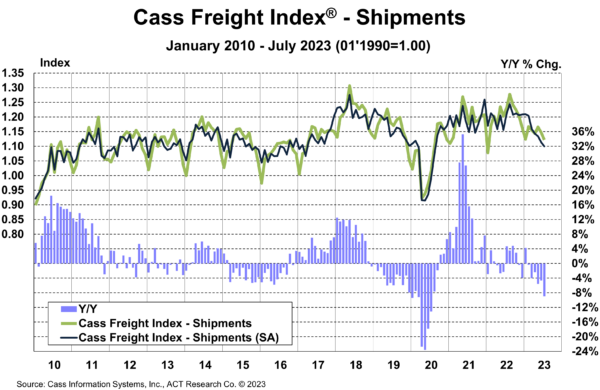

Market update: Cass July report suggests market ‘lower for longer’

On Monday freight audit and payment provider Cass Information Systems released the Cass Transportation Index Report for July highlighting the potential for the freight market to stay “lower for longer.” The report noted that shipments fell 2.2% m/m in July with volumes being on par with January 2023 in absolute terms even after a 10% stronger seasonality. Year over year the shipments index was 8.9% lower after a 4.7% y/y decline in June. Downcycles can take time to run their course, the report added: “The freight market downcycle is now 19 months old, which compares to a range of 21 to 28 months in the past three downcycles.”

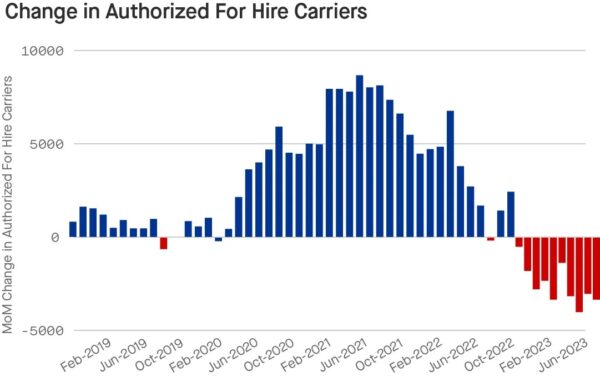

Regarding freight market expectations, the report highlighted the growth of private fleets as an overlooked component compared to traditional inventory and other macroeconomic indicators. The report highlighted publicly traded for-hire truckload fleets reduced their overall tractor counts by around 3% in the first half of 2023. Additionally, net revocations of operating authority remain elevated suggesting further deterioration in the for-hire truckload segment. This has been a boon for private fleets, as the report adds, “Private fleets represent over half of Class 8 tractor capacity, and we believe their growth is pulling freight out of the for-hire market, prolonging the industry downturn.”

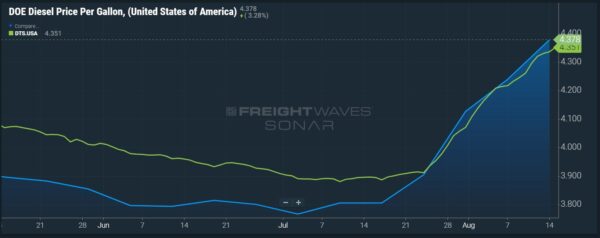

FreightWaves SONAR spotlight: DOE/EIA price hikes not out of fuel yet

Summary: The price of diesel continues to rise based on the recent Department of Energy/Energy Information Administration weekly retail diesel report. The benchmark price used in many fuel surcharges rose 13.9 cents a gallon on Monday to $4.378, the highest level since Feb. 21, and marks the fifth straight week of price hikes.

For this recent run of price increases, inventory levels and commodity moves are two culprits. One reason prices are disrupted is backwardation, which FreightWaves’ John Kingston notes “is a market condition in which the price of a commodity for future delivery is lower as the calendar moves forward.”

Kingston cites noted energy economist Philip Verleger, who wrote of the current inventory situation, “Markets are in backwardation. With backwardation, the customers of refiners — marketers — will do everything they can to limit their stocks.”

Kingston adds, “Because prices with a further-out delivery date are lower than the current price in a market backwardation, it discourages building inventories. As soon as a barrel available today is put in inventory, its value declines in a market backwardation.” For carriers exposed to these higher fuel prices, backwardation might also apply to their shrinking operating margins.

The Routing Guide: Links from around the web

Motive Monthly Economic Report — August 2023 (Motive)

FMCSA’s erratic history on meal/rest break preemption (FreightWaves)

What’s behind the summer of supply chain labor unrest? (Transport Dive)

Louisiana staged accident scam investigation springs back to life with 5 new indictments (FreightWaves)

216 transportation and logistics companies make Inc. 5000 list (FreightWaves)

Economic Trucking Trends: Spot market carriers reach ‘critical point’ as exits extend to larger fleets (Truck News)