Safety officials want brakes on braking mandate

Proposed rulemaking on automatic emergency braking (AEB) introduced in June by the National Highway Traffic Safety Administration and the Federal Motor Carrier Safety Administration is getting more pushback from a coalition of state law enforcement officials and brake manufacturers that argue more dialogue is needed before moving forward.

To illustrate some of the math that impacts government rulemaking, both the NHTSA and FMCSA collected research and field testing over 10 years to make their case. FreightWaves’ John Gallagher wrote, “The rule would prevent an estimated 19,118 crashes, save 155 lives, and prevent 8,814 nonfatal injuries annually. It would eliminate an estimated 24,828 property-damage-only crashes annually as well.”

Not all are convinced and argue the technology is still too new and untested. One commenter wrote negatively of AEB systems, stating, “They engage on ‘false positives’ too often and we need to not have anything that causes big rigs to ‘throw on the brakes’ without warning or cause. The actual conditions on the road (downhill, slick, curvy, heavy traffic, low speed) all create different and dynamically changing conditions. Experienced truckers can utilize technology when available but should not be at the mercy of the sensors and programming to crash/not crash.”

Nuclear verdicts, trucking insurance and fleet impacts with Joe Nibley

FreightWaves spoke with Joe Nibley, vice president at Milepost Insurance, on Tuesday about recent developments in Florida regarding nuclear verdicts, the commercial truck insurance landscape and how AB5 is impacting fleets on the West Coast. Nibley has more than 20 years of underwriting and insurance experience and noted one of the major developments he has observed is the rise of nuclear verdicts and their impacts on motor carriers.

For those unaware, a nuclear verdict occurs when a jury awards more than $10 million. According to the American Transportation Research Institute, the average size of a verdict against a trucking company rose from $2.3 million in 2010 to $22.3 million by 2018, an increase of nearly 1,000%. Marathon Strategies reported that by 2022 the total sum awarded by juries rose to $65.4 million.

Nibley also highlighted during the interview the impacts that state regulators can have on insurance policies for motor carriers. Nibley highlighted efforts by Florida Gov. Ron DeSantis through Florida House Bill 837, which may decrease the likelihood of nuclear verdicts in the state. California State Assembly Bill AB5 was also highlighted, with far-reaching impacts to lease and owner-operators who operate under a motor carrier. Employment status and worker classification changes under AB5 bring up workers’ compensation challenges, which can put additional costs on the carrier.

You can view the entire interview here.

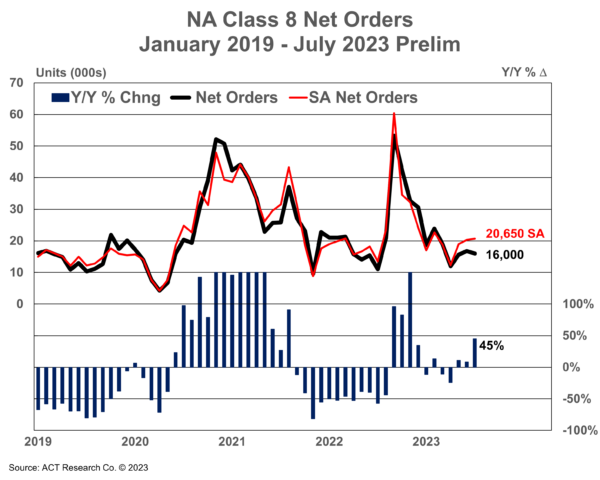

Market update: July Class 8 preliminary data shows orders up 45% year over year

July preliminary Class 8 orders are in and according to ACT Research, net orders rose 45% year over year to 16,000 units. The final order number for July is expected by mid-August, according to the report. Putting the order numbers in context, Kenny Vieth, ACT president and senior analyst, said, “As represented by seasonal factors, this is the time of the year when expectations for orders are low. For both the MD Classes 5-7 and HD Class 8 markets, July is the traditional low-water mark for monthly order placements.”

In spite of the summer doldrums in orders, expectations remain optimistic. FreightWaves’ Alan Adler wrote, “No one is calling for a major downturn. Fleets still have orders pending to catch up with pent-up demand caused by the two-year pandemic and supply chain slowdown. That forced them to keep their trucks in service longer because so few new trucks were available.”

The report noted that backlogs continue to constrain order flows based off of backlog-to-build ratios, which can indicate further fleet demand and a renewed increase in orders once the 2024 order books open. Adler said in an earnings call, Paccar Inc. CEO Preston Feight reported build slots for Kenworth and Peterbilt trucks are essentially full for the year.

FreightWaves SONAR spotlight: Spot rate forecast predicts Labor Day bump

Summary: The forecast for spot market rates over the next 28 days shows signs of optimism as rates move from the summer doldrums of August into September activity fueled by the Labor Day weekend leading up to the holiday on Sept. 4. The FreightWaves National Truckload Index Forecast 28-Day Outlook (NTIF28) is forecasting spot rates to rise 5.38%, or 12 cents per mile, from the current NTI rate of $2.23 per mile all-in to $2.35 by Sept. 5. Spot rates currently remain relatively flat, with a week-over-week decline of 1 cent per mile from $2.24 per mile all-in on July 31 to $2.23. Carriers without access to fuel surcharges fared worse over the past week, with the FreightWaves National Truckload Index (Linehaul Only) posting a decline of 2.45%, or 4 cents per mile, from $1.63 on July 31 to $1.59 per mile without fuel added.

Rising fuel prices may spoil the party. Higher diesel prices continue to negatively impact operating margins for carriers that lack access to reimbursements via a fuel surcharge. The Department of Energy/Energy Information Administration average weekly retail price posted its fifth consecutive weekly gain, with prices rising 11.2 cents per gallon to $4.239. FreightWaves’ John Kingston said the total increase in fuel over the past five weeks is 47.2 cents per gallon, levels not seen since March of this year.

The Routing Guide: Links from around the web

Chassis pool to open in October for seaports throughout South Atlantic region (DC Velocity)

3 questions to consider before investing in AI (FreightWaves)

Contract rate decline takes pause despite significant spot market discount (FreightWaves)

FMCSA cites safety record in granting CRST’s CDL exemption (FreightWaves)

Fresh leap in DOE/EIA diesel price tacks on 11.2 cents a gallon (FreightWaves)

Why C-store chains are all-in on travel centers (Transport Dive)