Podcast interview: The scope of Scope 3

On Tuesday, FreightWaves interviewed Josh Bouk, president of Trax Technologies, about the recent Securities and Exchange Commission rule-making recommendation back in March 2022 regarding scope 3 emissions. Scope 3 is a part of a larger greenhouse gas emissions overhaul by the SEC, the intent being for companies to disclose their impact on the environment.

Climate-related and emissions disclosures can cause more stress for trucking executives than late-night Taco Bell on a college kid’s GI tract. For motor carriers, shippers and brokers, these rules bring additional challenges with assigning values to how much one emits.

Bouk goes into detail about strategies for identifying carbon emissions, mapping out supply chains and finding commonsense ways to reduce overall emissions. Trax technologies is a freight audit and transportation spend management platform, which gives the company unique insights into the current emissions landscape.

Finally, there are opportunities to turn emissions reduction into a marketing tool. I’m predicting companies will slowly integrate a zero-carbon or carbon-neutral indicator on packaging to show eco-friendly consumers which brands are attempting to address their carbon footprint.

You can view the entire episode here.

Wasted space: World Economic Forum wants fuller trucks

The World Economic Forum is concerned about half-empty trucks and their impact on the environment. This comes from a recent article from the WEF’s annual meeting, which I was unfortunately not popular enough to attend. The key point of the article boils down to the fact that the supply chain is not utilizing all the space in a trailer.

The article notes that WEF research in partnership with Flock Freight found that 51% of truckloads moved with empty space in 2021. Part of this comes from consumer behavior and changes in e-commerce: We want our goods faster regardless of cost. The study notes, “While truckload service yields high on-time delivery rates, TL shippers with small and midsize freight face a tough decision: wait to send finished goods until they fill an entire trailer or ship them right away in underutilized trucks. In 2021, 31% of TL shippers ‘often’ chose to hold on to a shipment until they could fill an entire truckload trailer.”

While wasted space is a huge LTL issue, for full truckload, part of this waste comes from weight. One thing I want to see is if a fully laden trailer around 45,000 pounds still fails to meet the empty space reduction goals. For LTL and air cargo, there is huge demand for package size optimization, but full truckload may continue to lag due to how palletization and 53-foot dry van trailers interact. Still, the research is fascinating, as smaller carriers and owner-operators prefer to haul less than full truckloads (under 45,000 pounds) to reduce wear on their equipment.

Market update: Shipper survey suggests spot rate bottom

It is much easier to describe declining spot rates and truckload rejection rates than to predict when they will end. To do this, we often must look at survey data, and the equity analyst folks are super helpful since they get access to companies that would not give me the time of day.

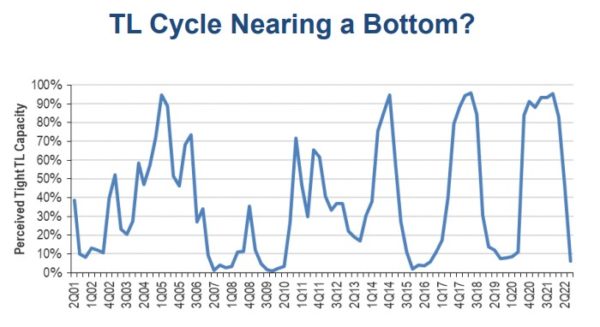

Which brings me to trucking predictions. What falls must eventually rise in the trucking business cycle. In a recent transportation outlook, Wolfe Research noted, “in our latest shipper survey, less than 10% of respondents noted tight TL (Truckload) capacity, historically a sign that we’re nearing a bottom in the cycle.”

This data follows a similar consensus among analysts of a market bottom between Q1 and Q2 of 2023 for spot rates, but contract rates may remain trickier to predict. This is due to the large gulf between spot and contract rates, currently at 72 cents between linehaul spot and contract rates.

FreightWaves SONAR spotlight: Used truck pricing power fades

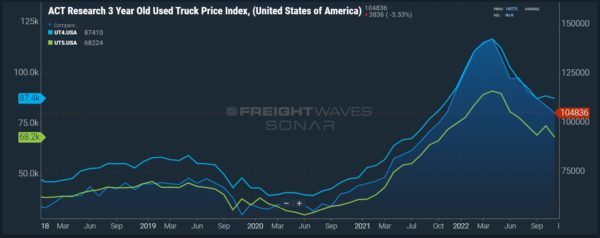

Summary: The price of a used Class 8 tractor is declining, which is either good or bad news depending on whom you ask. It’s good news for carriers wishing to purchase newer equipment but bad news for carriers who bought overpriced equipment and are dealing with the unfortunate nature of hindsight.

Regarding the changing face of the market, FreightWaves’ Alan Adler wrote: “At retail, the average sleeper tractor was 73 months old, had 469,492 miles and brought $89,810, according to [J.D. Power Valuation Services]. For the first time since August 2020, year-over-year prices for used trucks dropped in the aggregate, ACT Research reported.”

Class 8 sales data comes in delayed, but the outlook indicates continued downward movement. Steve Tam, ACT Research vice president, noted in a report: “We are expecting the total market to decline in 2022. Looking ahead to 2023, the market is expected to continue falling as inflation triggers a short, shallow general recession, concentrated in the manufacturing segment.”

While used prices tank, newer truck orders for OEM manufacturers point to more optimism. John O’Leary, president and CEO of Daimler Truck North America, told FreightWaves: “The demand that we saw out there for ’22 that none of us were able to build, that will continue in ’23. They’re very committed to make those buys this year regardless of what the economic headwinds may look like.”

The Routing Guide: Links from around the web

Tender acceptance at all-time high level for the holidays (FreightWaves)

Analysts make divergent calls on trucking in 2023 (FreightWaves)

C.H. Robinson Reaches Standstill Agreement With Activist Investor (The Wall Street Journal)

Rising interest rates, skyrocketing inflation will affect trucking M&A landscape (Truck News)

Daughter of clown seeks to join wrongful death trucking suit (FreightWaves)

How changes in supply chain finance disclosure could impact shippers (FreightWaves)