Supreme Court blocks COVID vaccine mandate for large businesses

On Thursday, the Supreme Court ruled in a 6-3 decision that blocked enforcement for vaccine or testing requirements for large private companies over 100 employees. Prior to the decision, the Occupational Safety and Health Administration issued new guidance, stating the vaccine mandate rule would not apply to solo truck drivers.

In an unsigned opinion, the Supreme Court wrote, “Although Congress has indisputably given OSHA the power to regulate occupational dangers, it has not given that agency the power to regulate public health more broadly. Requiring the vaccination of 84 million Americans, selected simply because they work for employers with more than 100 employees, certainly falls in the latter category.”

American Trucking Associations CEO and President Chris Spear, said “Today, ATA has won a tremendous victory on behalf of the trucking industry and workers and employers everywhere,” adding, “Trucking has been on the front lines throughout the pandemic — delivering PPE, medical supplies, food, clothing, fuel, and even the vaccines themselves. Thanks to this ruling, our industry will continue to deliver critical goods, as our nation recovers from the pandemic and we move our economy forward.”

Next Steps

Expect more analysis and reporting on the effects of this decision in the coming days. While solo truck drivers were exempt, the impacts of a vaccine mandate on all businesses over 100 employees affected warehousing, retail, logistics, and other parts of the supply chain. Moving forward, expect to hear revisions and clarifications on vaccine and testing requirements from executives as companies navigate the tricky topics of vaccination and government regulations.

Cass index on freight costs to climb 25% in 2022

A Wednesday report from Cass Information Systems on December data saw shipment costs increase 7.7% year-over-year with expenditures up 43.6%. Port chassis limited capacity and rail congestion caused an increase in full truckload shipments, which accounted for half of the index’s freight spend.

Tim Denoyer, senior analyst at ACT Research, said, “While signs that an easing in the everything shortage were beginning to emerge prior to the omicron wave, the challenges to industry capacity are worsening again as 2022 begins. Absenteeism is surging across drivers, maintenance staff and administrative personnel at transportation companies, and the effects of the latest COVID variant on factory workers will likely slow the recovery in equipment production.”

To the Moon

Consumer spending remains a major driving force behind the increase in transportation costs. Even with the disruptions caused by the recent spike for COVID cases due to the omicron variant, demand for goods remains solid at the beginning of 2022.

Additionally, inflation is becoming a growing concern among business executives and buyers alike.

We are currently in a feedback cycle where consumer demand causes an increase in freight volumes, leading to higher transportation costs as the supply of capacity in the market cannot meet the new demand. These higher costs are then passed back onto the consumers, who in turn are seeking more income, taking advantage of a competitive and tight labor market.

Market Update: Consumer Confidence Increases amid inflation concerns

The Consumer Confidence Index represents how optimistic or pessimistic consumers are in relation to their expected financial situation. Understanding this index is useful, as consumer spending currently comprises 68.8% of GDP as of Q3 2021.

Lynn Franco, senior director of economic Indicators at the Conference Board, said, “… concerns about inflation declined after hitting a 13-year high last month as did concerns about COVID-19, despite reports of continued price increases and the emergence of the Omicron variant. Looking ahead to 2022, both confidence and consumer spending will continue to face headwinds from rising prices and an expected winter surge of the pandemic.”

Spending is the lifeblood of the economy and knowing how confident consumers are can be a leading indicator for future spending. This is important for logistics and supply chain professionals, as higher spending leads to greater freight demand, and can influence rates and volumes.

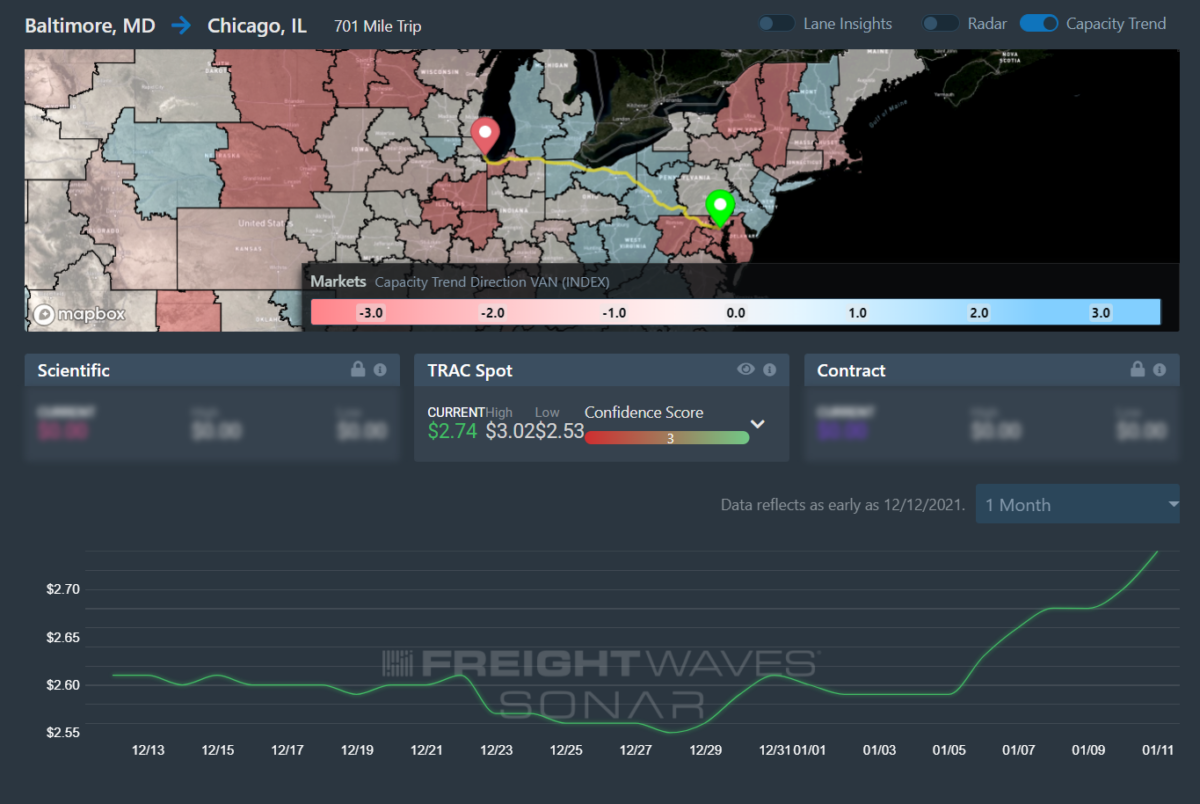

FreightWaves TRAC lane spotlight: Baltimore to Chicago

Commentary courtesy of FreightWaves Daily Watch

Summary: Spot rates are increasing; capacity is expected to get even tighter as outbound rejections rise 6.9% w/w.

Highlights:

- Baltimore outbound tender volumes are up 45% w/w, signaling that demand for outbound capacity has increased significantly from last week.

- The Headhaul Index in Baltimore is up 10% w/w, signaling that there is a growing imbalance between inbound and outbound volumes.

- Baltimore outbound tender rejections are up 6.9% w/w, signaling that capacity has likely tightened w/w.

What does this mean for you?

Carriers: Stay firm on your rates coming out of Baltimore. With a 10% w/w increase in the Headhaul Index, and rejections already up 6.9% w/w, pricing power is likely to shift even further into your favor. FreightWaves TRAC spot rates are already showing a one-month high, and rates are expected to trend even higher in the days to come.

The Routing Guide: Links from around the web

Truckers using cocaine more than marijuana, study finds (FreightWaves)

There Is A Massive Trucker Shortage Causing Supply Chain Disruptions And High Inflation (Forbes)

Imports take ‘dramatically longer’ to reach the US as bottlenecks bite. (FreightWaves)

Public-sector efforts to boost truck parking face path filled with hurdles (FreightWaves)