The Taylor Swift $100,000 driver bonus

Media outlet TMZ reported that singer-songwriter Taylor Swift gave each truck driver who worked as part of her Eras Tour a bonus check of $100,000 before her Santa Clara, California, show last Saturday. The article on Tuesday notes there are around 50 drivers associated with her current U.S. tour and the bonuses totaled about $5 million. This end-of-tour bonus pales in comparison to the estimated $1 billion in sales the nationwide tour has generated, enough to garner attention from the U.S. Federal Reserve. In a beige book report from July 12, the Federal Reserve Bank of Philadelphia noted the strongest month for hotel revenue in Philadelphia since the pandemic, attributed to a large influx of guests for the Swift concert in May.

Transportation media were quick to pick up on the story, with FreightWaves’ What the Truck!?! recording an interview about the bonus. Highlighting the tour’s costs was FreightWaves founder and CEO Craig Fuller, who noted back in May that The Eras Tour alone will cost more than $30 million for transportation and logistics. The tour is so large, Fuller noted, that Swift hires a fleet of around 90 trucks that exclusively haul equipment for the shows and cost as much as $500,000 each week.

Specialized truckload carriers that only haul for concerts are not uncommon with many giving dedicated capacity for the duration of a tour. Additionally, while carriers can use standard 53-foot dry van trailers, there are also custom-fabricated trailers to handle specific types of stage equipment depending on the artist’s needs.

U.S. Bank Q2 freight data shows Southwest outperforming

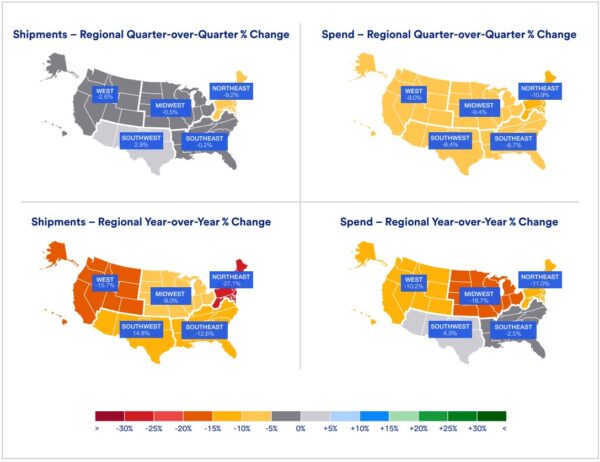

Recent data in the U.S. Bank Freight Payment Index pointed to a mixed picture, as national shipment and spending indexes fell quarterly and year over year, something not seen in the past three years. The report notes that for the fourth straight quarter, the national shipments index contracted, with shipments falling 1.2% from Q1 and down 9% y/y. The spending level declines were also notable, with the report adding that “after six consecutive quarters of historically high levels of spend nationally, the 8.3% decline in Q3 brings spending back to the still relatively strong levels of mid 2021.”

In spite of these declines, breaking down this info by region yields a more nuanced picture. The Southwest region continues to outperform other regions in shipping volume, rising 2.9% compared to Q1 and 14.8% year over year. The Southeast defied expectations, falling only 6.7% in spending q/q and only 2.5% y/y.

One region to watch in the coming months is the West, as FreightWaves SONAR outbound tender volume data shows West Coast freight volumes rising in July, spurred by higher imports from Asia. Regarding the West, U.S. Bank noted that due to slower coastal seaport activity, the region was one of only two that saw double-digit declines for spend and shipments in Q2.

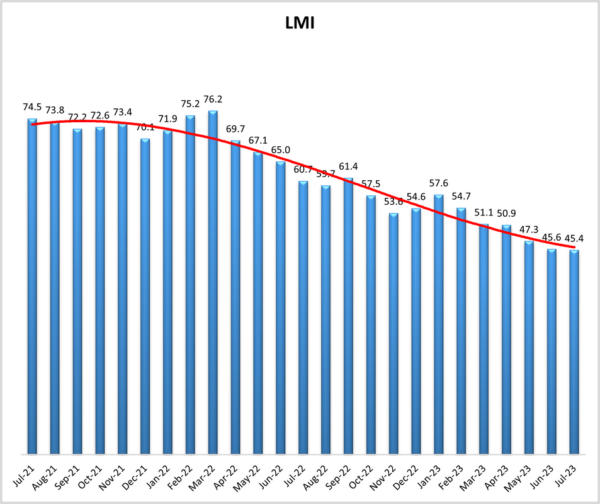

Market update: LMI July data shows transportation prices and inventory remain contracted

The July Logistics Managers’ Index data is in. The bad news for carriers is that transportation prices are still falling, but at a slower rate compared to the past two months. FreightWaves’ Todd Maiden writes, “Prices registered a 35.6 reading during the month, well below a neutral level of 50, but the falloff wasn’t as sharp as the record rate of decline set in May (27.9). The Tuesday report showed the growth rates for transportation capacity (65.6) and capacity utilization (41.8) slowed by mid-single digits from June.”

Inventory levels remained low and reached their lowest point in the index’s history, falling 1 point from June to 41.9 points. The report notes that the current destocking process continues based on upstream respondent data. Motor carriers continue to postulate that large-scale destocking is near the end, and Knight-Swift CEO David Jackson speculated on an earnings call that the seasonality should return in the “coming quarters.” The report retorts, “While this is reflected in the respondent future predictions discussed below, it should be pointed out that some carriers have been predicting a restock to happen for months and it has still not yet materialized.”

The overall index remains in contraction territory at 45.4 points, the third month in a row of contraction and the fifth month the index reached an all-time low.

FreightWaves SONAR spotlight: DOE/EIA ongoing diesel surge not out of gas

Summary: The price for diesel paid at the pump just got 22.2 cents per gallon higher. On Monday the Department of Energy/Energy Information Administration weekly average price paid for diesel came in at $4.128 cents per gallon, surging 22.2 cents week over week on the heels of a 9.9-cents-per-gallon gain the week prior. Notably, sudden surges in diesel prices are typically tied to major events like weather, a geopolitical black swan or refinery shutdowns. What makes this current surge in prices out of the ordinary is the banality of its underlying components.

FreightWaves’ John Kingston notes this surge was primarily driven by higher crude oil and other product prices. Honorable mentions for the rise also include the May OPEC cuts led by Saudi Arabia, and increased Chinese demand from economic activity after the country haphazardly emerged from its post-COVID hibernation in fits and starts. For those unaware, according to the DOE/EIA, in June, around 44% of the price paid at the pump for diesel was from crude oil.

The Routing Guide: Links from around the web

Ryder launches technology lab with FreightTech acquisition Baton (FreightWaves)

Brakes, HOS again top list of Roadcheck OOS violations (Commercial Carrier Journal)

Bill Would Set Carrier Selection Standards for Brokers (Trucking Info)

Heartland Express sees no demand uptick in Q2 (FreightWaves)

Unseasonable rise in demand provides much-needed optimism for transportation providers (FreightWaves)

Truckers deal with fallout after fraudsters steal DOT numbers (FreightWaves)