Trailer pools as a hedge against contract rate declines

While digging through earnings reports and CEO comments, I found a few very interesting quotes on how enterprise carriers utilize trailer pools as a form of hedging against drastic contract rate reductions. Not only is this strategy useful for the carrier to avoid the often two-plus hours of waiting for a live load/unload appointment, but it frequently gives shippers flexibility to load equipment at their convenience.

Knight-Swift CEO David Jackson noted on a Q1 earnings call: “We’ve seen huge demand for our trailers that electronic logs have changed supply chains to using trailer pools … . Further evidence of this trend [and] the increased resilience in our truck load model is that over 90% of the truckloads that we move involve a trailer pool on at least one side if not both. It was never that high before this regulation took effect in early 2018.”

Brad Hicks, executive vice president at J.B. Hunt, noted on a Q2 earnings call: “We continue to see evidence of our customers valuing our drop trailer network service offering. Volume growth of 14% in the quarter supports that view. We see tremendous opportunity, as customers begin to think differently about the blending of their live network and drop trailer network capacity needs.”

Mark Rourke, CEO of Schneider, noted on a Q1 earnings call: “From a shipper standpoint, again, we play largely in the contract trailer pool market. And so why would [a] shipper value a contract is really around the trailer pool and the efficiency that creates. And so I think there are limitations to how effectively and efficiently people can try to get after the tail of the spot market because of the live-load, live-unloading inefficiencies that come with that type of capacity.”

For freight brokers or shippers used to dealing with smaller carriers, these quotes highlight some of the complexity that large truckload carriers with tens of thousands of assets deal with when navigating contracted freight markets.

Loaded and Rolling Podcast: Electric truck infrastructure — breakthroughs versus misconceptions

I interviewed Rich Mohr, global vice president fleet at Chargepoint, regarding some of the recent breakthroughs and common misconceptions associated with electric vehicle infrastructure. Some highlights include how total cost of ownership impacts buying decisions, and the potential opportunities for fleets based on how they plan on using electric trucks. There are better use cases for local drivers and drayage than there are for over-the-road drivers. That’s because with predictable routes you can plug the tractor into an electrical outlet at the end of each workday. For over-the-road drivers, the innovation is taking more time, as semi-random irregular routes pose unique challenges for charging. We also discussed charging as a service and the opportunities to let Chargepoint handle the logistics of charging up.

This interview was a continuation of the conversation I had with Mohr from an earlier Chargepoint webinar I hosted, a recording of which can be found here. Given the recent passage of the Inflation Reduction Act by Congress, there will be greater attention to electric vehicles and infrastructure.

You can view the entire episode here.

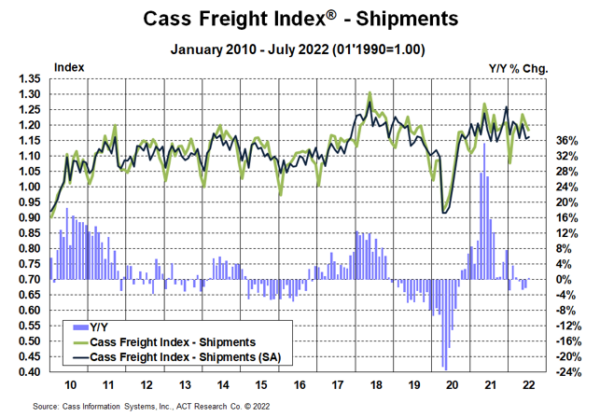

Market update: Cass July report shows more of the same

The July report by Cass Information Systems shows freight demand flattening as inflation near 9% is impacting consumer goods consumption. The shipments component of the Cass Freight Index rose 0.6% month over month in July seasonally adjusted after a 4.1% decline in June.

The pricing power carriers enjoyed for the past two years appears to be over. ACT Research’s Tim Denoyer noted: “After an extraordinary truckload rate cycle over the past two years, the market balance has shifted, with capacity now growing briskly and demand falling slightly year to date. Similar to what has occurred in the spot market, the surge in fuel costs to shippers, which are excluded from this index, will also likely act as a brake on linehaul rates.”

Regarding the freight rate outlook, the Cass report noted: “With the tight supply/demand balance in U.S. trucking markets easing considerably this year, industry rates are topping out and set to slow sharply in the months to come. Based on the weekly trends, fuel should provide additional relief in August as well. Diesel prices continue to reflect elevated refining margins and could fall further, but could also easily revert higher if the situation in Europe worsens.”

The situation in Europe will be worth watching, as FreightWaves’ John Kingston writes that the latest International Energy Agency report raises concerns for diesel consumers.

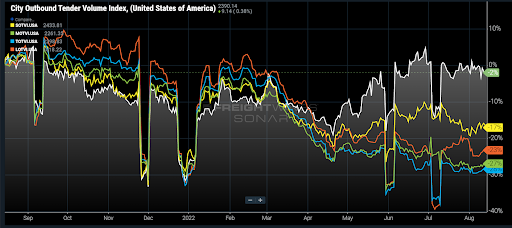

FreightWaves’ SONAR spotlight: Short-haul demand remains robust through mid-August.

SONAR Tickers: COTVI.USA, SOTVI.USA, MOTVI.USA, TOTVI.USA, LOTVI.USA

Summary: Tenders for loads moving less than 100 miles (COTVI) are still showing the most resilience from a year-over-year (y/y) perspective. Tenders for loads moving between 101 and 250 miles (SOTVI) were a distant second at -17% y/y. A major reason for this is increasing upstream activity as shippers struggle to manage too much of the wrong inventory with downstream warehouses near capacity. Long-haul freight tends to be at or near its peak in September, but the current trend suggests we may have already seen the “peak” of 2022.

The Routing Guide: Links from around the web

What do carriers think of AB5? It’s less clear than you might think (FreightWaves)

FMCSA updates guidance for truck driver medical examiners (FreightWaves)

Keynote: Economist Vaclav Smil talks globalization (FreightWaves)

Navistar’s new internal combustion engine will be its last (FreightWaves)

The plunge in dry bulk shipping: Ominous signal on China’s economy? (FreightWaves)

Freight Demand Is Moderating Heading Toward the Fourth Quarter (The Wall Street Journal)