Trucking turnover and retention debate rages on

FreightWaves’ Rachel Premack wrote an article on Wednesday outlining her experience attending a truck driver training conference in Corpus Christi, Texas, by the National Association of Publicly-Funded Truck Driving Schools (NAPFTDS). Premack sought to get more information on a fundamental disagreement in trucking that involves driver turnover and whether there is an ongoing driver shortage. Lobbying groups like the American Trucking Associations estimate there is an industrywide shortage of 78,000 drivers. On the other side of the debate, researchers and the U.S. Bureau of Labor Statistics argue a high turnover rate and broken labor market are to blame.

While at the conference, the debate centered around multiple potential solutions, including more funding for driver training schools; retention programs for existing drivers; adjusting driver pay scales; and changing the trucking business model to include hybrid relay networks. Compared to semi-random point-to-point over-the-road networks, hybrid relay networks resemble a less-than-truckload network with drivers centered around terminals relaying loads between nodes while local drivers handle first- and last-mile assignments. Cost and profitability are challenges, as these networks require higher freight volumes to cover the additional drivers compared to OTR.

At the end of the day, relationships between drivers and office staff appear to be a low-cost common-sense approach while business leaders debate the finer details. Brent Lauber with Kelly Anderson Group told Premack, “Contact that driver and say, ‘Hey, so-and-so will meet you at the front door Thursday morning.’ When they come in, buy that driver a cup of coffee or have coffee there with them. Sit down with them and get to know the driver, get to know their family, get to know what they like and then take them around to the different departments … to make them feel welcome.”

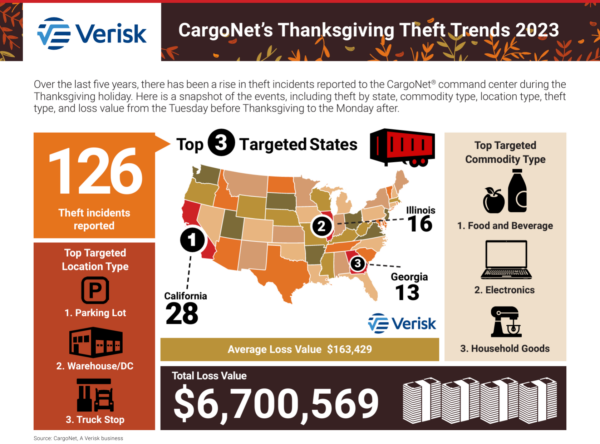

Cargo theft risk rise on the Thanksgiving freight menu

With the arrival of Thanksgiving, CargoNet, a cargo theft recording firm, is cautioning those in the industry of the rising trend in cargo thefts. CargoNet’s data highlighted that since October 2022, the average number of reports of cargo theft filed per week rose 64% to 51 per week using data from January 2012 through October 2022. Looking at data from Oct. 1 through Nov. 11, the number increased to 66 reports per week, up 113% from the previous decade.

Regarding the types of thefts to watch out for, the Commercial Carrier Journal said, “The biggest active threat is that of strategic cargo theft, in which thieves seek to obtain a load by either impersonating a legitimate carrier, using an authority they have registered or otherwise have access to, or deceiving a motor carrier into giving them credentials to vital accounts.”

One area to watch for is the prevalence of fraud activity perpetrated by non-state actors, especially in regions heavily exposed to cross border movement. Karl Fillouer, vice president of sales at Circle Logistics, told FreightWaves in October, “We are seeing a very sophisticated approach to fraudulent activity that’s probably being managed overseas or in some country other than the U.S. This includes not only spoofing and tracking software, but also setting up fake domains for small and large carriers.”

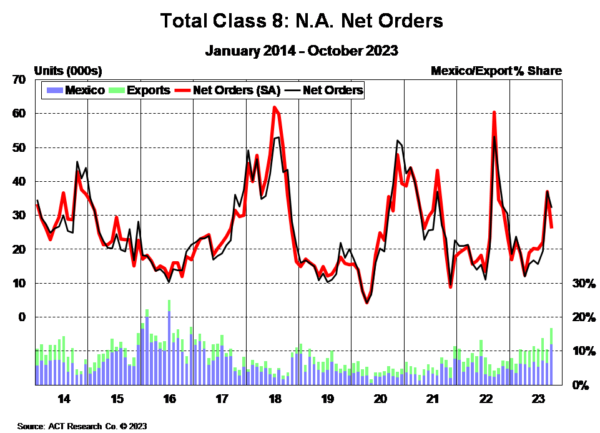

Market update: Pent-up demand propels October Class 8 orders

ACT Research recently released October net Class 8 orders data that showed lingering pent-up demand in spite of comps down compared to the previous year. Class 8 orders fell 24% year over year (y/y) in October coming in at 32,287 units, but breaking down the data by segments yielded some surprises. The report noted the vocational straight truck market saw a 24% y/y increase while exports were up 91% y/y. Of those exports, orders going to Mexico rose 187%. The North American market fared worse, with orders down 34% y/y and U.S.-only tractor orders down 47% compared to October 2022.

Private fleet additions and replenishment compared to for-hire fleets remain a development worth watching. Kenny Vieth, ACT president and senior analyst, said, “For carriers, the long bottom in freight rates continues, with spot rates little changed since April. A big driver of rate weakness has been lagged private fleet capacity additions. As for-hire fleets tend to be the first buyers in line, private fleets have been the drivers of Class 8 market strength in 2023, adding equipment at the bottom of the cycle and prolonging the rate pain.”

Another data provider, FTR Transportation Intelligence, echoes the sentiment that demand remains stable in spite of freight market weaknesses. FleetOwner reported Eric Starks, chairman at FTR, said, “Build slots continue to be filled at a healthy rate. The overall picture for truck demand is steady. Despite freight weakness, fleets continue to be willing to order new equipment, affirming our expectations of replacement demand during 2024.”

FreightWaves SONAR spotlight: Spot rate forecast cleared for takeoff

Summary: Spot rates are forecast to sharply rise in the weeks through Thanksgiving and leading up to Christmas, according to the FreightWaves National Truckload Index Forecast, 28-Day Outlook (NTIF28). The current NTI spot rate is $2.26 per mile all-in but is expected to rise 15 cents per mile, or 6.64%, to $2.41 by Dec. 19. This comes as current NTI spot market rates rose 4 cents per mile in the past week from $2.22 on Nov. 13 to $2.26 per mile.

Spot rate seasonality appears to be a factor, with spot rates increasing through December before gradually declining in January when truckload capacity normalizes and drivers return to work in force, driving spot rates back down. Holiday disruptions from Thanksgiving through New Year’s can be attributed to drivers taking additional home time, which creates localized capacity deficits in both spot and contract markets. Fleets continue to prioritize improving working tractor percentages while juggling driver home time needs and contracted freight obligations.

The week of Thanksgiving will also see a rise in outbound tender volumes as shippers front-load last-minute shipments before their facilities close for the holiday. Outbound tender volume rates remain elevated month over month from 10,993.74 points on Oct. 21 to 11,476.43 points, an increase of 482.69 points or 4.4%.

The Routing Guide: Links from around the web

The logistics of turkey day (FreightWaves)

Another decline in average diesel pump prices; OPEC+ meeting looms (FreightWaves)

U.S. District Court hears AB5 arguments (Land Line)

Trailer Order Season Continues to Show Strong Bookings Despite Lingering Freight Recession (ACT Research)

Brokers, carriers may be targets of fake DAT site (FreightWaves)

LMI showing transportation market flip is coming (FreightWaves)

Joann Ray

Thanks, I have just been looking for information about this subject for a long time and yours is the best I’ve discovered till now. However, what in regards to the bottom line? Are you certain in regards to the supply?