Shareholders of a blank check company vote Oct. 22 on completing a reverse merger that would provide startup Lordstown Motors Corp. (LMC) twice as much money as it needs to retool a former General Motors plant to build a commercial fleet-focused electric pickup truck.

Diamond Peak Holdings Corp. (NASDAQ: DPHC) raised $780 million in an initial public offering (IPO) and through the sale of discounted shares. The full amount will transfer to LMC if the vote passes as expected.

Since the proposed deal was announced in August, shares in the special purpose acquisition company (SPAC) the share price has more than doubled. But the stock experiences volatility common to many SPACs favored by retail investors who cannot participate in traditional IPOs

Stalled fundraising

Renovating portions of the 6.2 million-square-foot assembly complex that GM opened in northeast Ohio in 1966 stalled while LMC CEO Steve Burns tried to raise money. In what has become the year of the SPAC, Diamond Peak Holdings chose LMC over “hundreds” of companies it investigated.

According to a September DPHC investor presentation deck, LMC needs $135 million to retool the former car plant and launch the Endurance pickup by the end of 2021. It will spend $90 million on research and development, including validating the trucks. It plans to spend $130 million to hire workers and build the trucks.

The remaining $320 million in cash will be used for “contingencies and additional growth opportunities,” according to the investor deck.

Workhorse Group leadership and technology

LMC’s leadership is loaded with veteran talent from major automakers including Tesla, GM, Toyota and Volkswagen.

But the most common name in the experience section of resumes is Workhorse Group Inc. (NASDAQ: WKHS), which Burns founded in 2007 and led until February 2019. A license of Workhorse technology for its W-15 electric pickup underpins the Endurance.

The W-15 platform also would be used for the next-generation delivery vehicle for the United States Postal Service if Workhorse wins some or all of the $6 billion contract. Three companies remain in the competition. Speculation on the winner has driven retail investor interest in Workhorse for months, pushing its share price higher.

The Postal Service contract is expected to be awarded before the end of the year. Workhorse, which owns 10% of LMC, would contract with its practical carveout to build the postal vehicles.

Endurance uniqueness

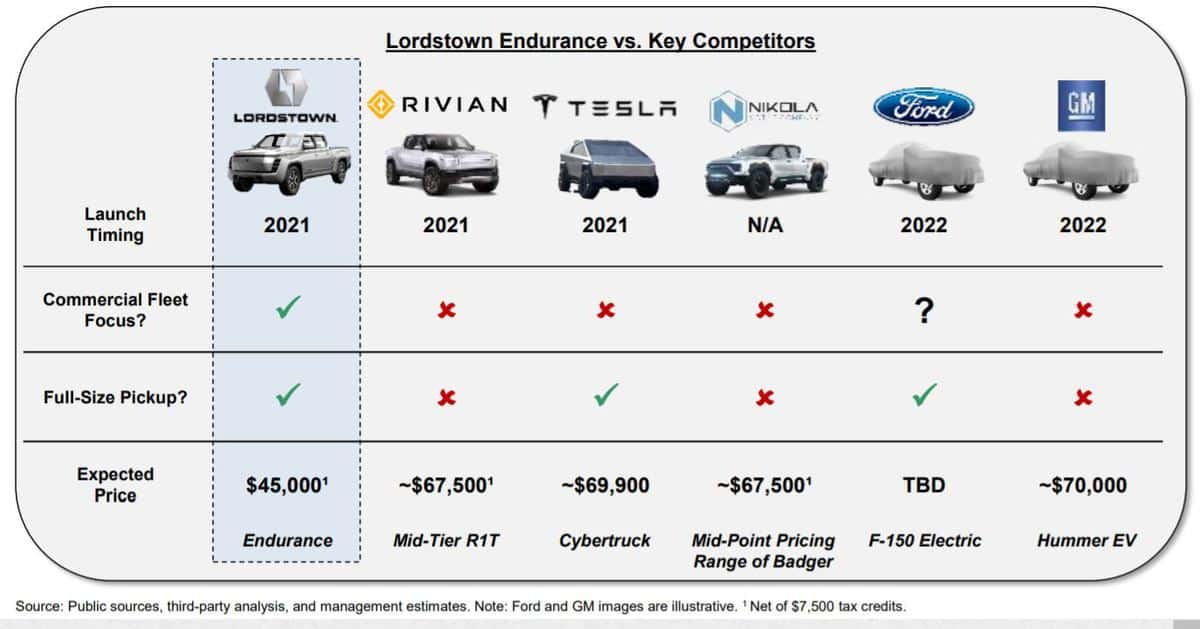

The full-size Endurance pickup is a light-duty vehicle capable of hauling 7,500 pounds. Its target market includes construction and utilities. It could be the first or second electric pickup on the road in a crowded field where Amazon (NASDAQ: AMZN) backed startup Rivian entered its first R1T prototype electric pickup in a road rally this week.

The Endurance is the only electric pickup in a group that includes legacy automakers GM (NYSE: GM) and Ford Motor Co. (NYSE: F) focused on commercial buyers. LMC claims it has 40,000 nonbinding orders for the Endurance worth a potential $2 billion in revenue.

With four hub motors, one on each wheel, the Endurance differs from competing electric trucks that use an electric driveline. LMC says the Endurance can travel 250 miles between charges and capture energy via regenerative braking at every wheel. Gasoline-equivalent fuel economy is 75 miles per gallon – as much as five times a typical gasoline-powered pickup.

Its $45,000 price, assuming a $7,500 federal tax credit, makes it the least expensive electric pickup coming to market,

A political football

From the time GM announced in November 2018 that it would stop making the Chevrolet Cruze compact sedan in Lordstown, the automaker incurred the tweeting wrath of President Donald Trump. He won Ohio in the 2016 election with strong support from blue-collar workers in the Mahoning Valley.

Burns’ approach to GM to buy the idled plant survived initial opposition from the United Auto Workers. The union wanted GM to assign another product to the plant. After a long national strike in September and October 2019, it agreed to let GM idle the plant as part of a contract settlement. GM then mortgaged the property to LMC and loaned it money to get it started.

GM put in $75 million of the $500 million private investment in public equity (PIPE) that Diamond Peak raised. Two-thirds of GM’s buy-in is in-kind, including the plant, permits and operating costs, including a $10 million loan to LMC.

Trump ultimately calmed down about GM. On Sept. 28, he hosted a northeast Ohio delegation including LMC executives and a prototype of the Endurance on the South Lawn of the White House. Vice President Mike Pence was Burns’ passenger during the reveal of the truck at the Lordstown plant in June.

GM’s approach is similar to CNH Industrial N.V.’s (NYSE: CNHI) investment in Nikola Corp. (NASDAQ: NKLA). As part of a $150 million in-kind investment, CNHI is providing use of its Iveco subsidiary’s plant in Ulm, Germany, for production of the battery-electric Nikola Tre. It is based on the Iveco S-Way platform for heavy-duty trucks.

Long list of risks

Despite the mostly positive attention, LMC faces a long list of risks to meet its goal of producing 2,200 trucks by the fourth quarter of 2021. The DPHC preliminary proxy filing with the U.S. Securities and Exchange Commission (SEC) lists 12 pages of things that could go wrong. Some of the risks are standard to any business. A few are unique.

For example, LMC plans to sell its trucks directly to fleets, eschewing a dealer network and franchise laws in states that set requirements on how vehicles are sold. Tesla flouted these rules in its early days and was prevented from selling in several states where dealers wielded influence over franchise laws.

LMC also could have problems if:

- Its acquisition of the Lordstown complex from GM leaves LMC holding the bag for environmental remediation beyond what GM conducted.

- Workhorse licenses the W-15 technology to another company, especially one with more resourcespitting LMC against better-heeled competition.

- The challenges of hiring a workforce in the COVID pandemic delay production.

Related articles:

Lordstown Motors going public in reverse merger

Lordstown Motors says first-year electric pickup is sold out