Less-than-truckload carriers are hoping an end to a two-year industrial recession will provide a needed volume uptick and bring about a more favorable freight mix. A positive inflection will also allow carriers to fill terminals acquired following Yellow Corp.’s exit.

Yellow’s (OTC: YELLQ) July 2023 shutdown put roughly 8% market share up for grabs, providing the industry with a respite to an ongoing freight recession. However, the newfound volume was quickly absorbed, and the industry is again experiencing pronounced declines.

Many publicly traded carriers will report volume and pricing metrics for November (and final numbers for October) this week. However, the start to the fourth quarter was tough, and November manufacturing data was only less-bad.

October 2024 compared poorly to October 2023, a month when many in the industry benefited from a cyberattack at private carrier Estes. ArcBest (NASDAQ: ARCB), Old Dominion Freight Line (NASDAQ: ODFL) and XPO (NYSE: XPO) all reported high-single-digit year-over-year declines in tonnage during the month.

October 2024 also included the fallout from two major hurricanes.

Saia (NASDAQ: SAIA) was an outlier in the month, reporting a 6.5% y/y tonnage increase. The carrier has been active, taking on retail-related freight as well as shipments from large, national accounts to keep its growing network full. The less favorable freight mix, however, has been a modest headwind to margins.

Yellow’s freight mix skewed toward retail customers with lighter shipment weights versus denser, industrial loads.

Most carriers said on third-quarter calls in late October that the y/y tonnage comps are expected to ease throughout the fourth quarter.

Manufacturing activity, which accounts for nearly two-thirds of freight in some LTL networks, contracted again in November, according to the Institute for Supply Management’s Manufacturing Purchasing Managers’ Index released Monday. A 48.4 reading (50 is considered neutral) marked the eighth straight decline for the dataset. The index has been in contraction territory for 24 of the past 25 months.

The overall index did improve 1.9 percentage points from October to the highest reading since June. The new orders subindex, which is indicative of future demand, moved into growth mode at 50.4 after seven months of decline. Historically, it takes a 52.3 reading, or higher, to move Census Bureau data on manufacturing orders higher.

The PMI dataset leads LTL carrier tonnage by roughly four months.

During the third quarter, publicly traded carriers referred to the pricing environment as “rational,” noting that contractual rate renewals were again up by mid- to high-single digits. Carriers have recently been implementing annual general rate increases, showing an ability to capture price in a soft demand environment. However, It will likely take a few months to determine how sticky those rate hikes will be.

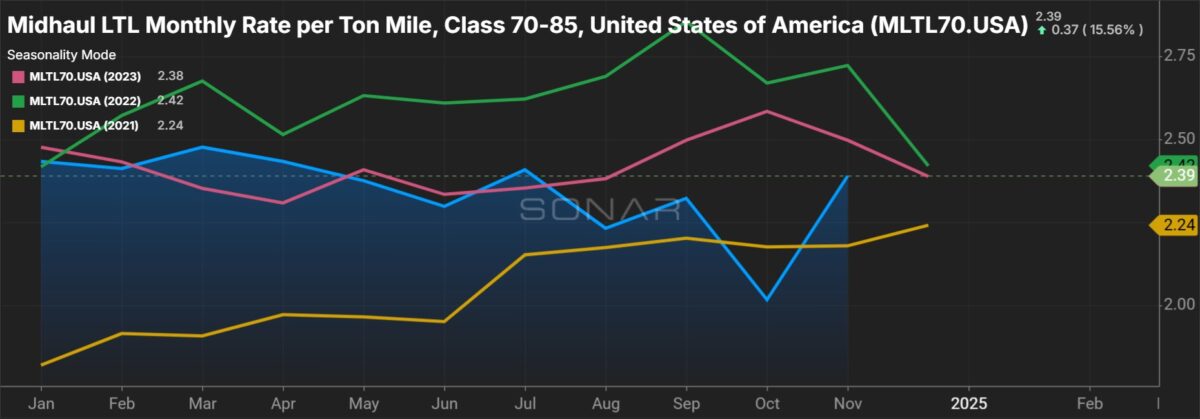

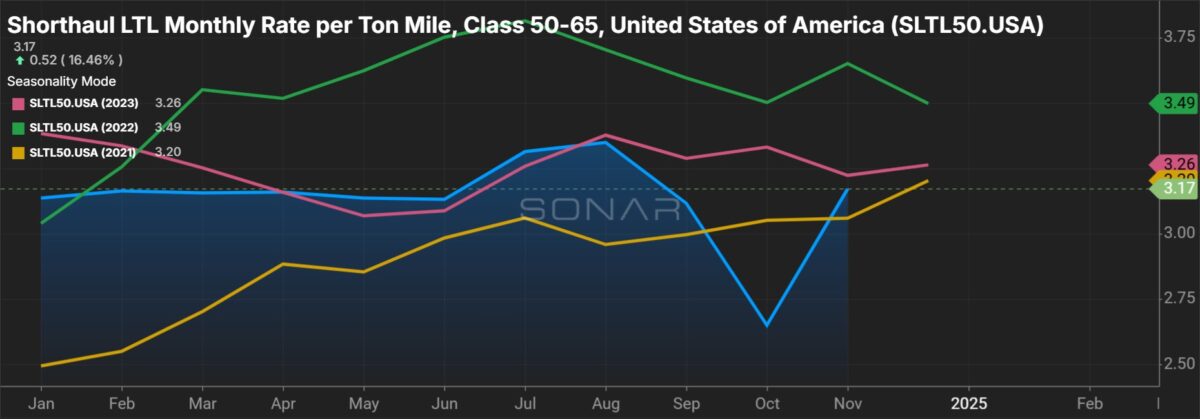

FreightWaves’ data on rate per ton-mile shows the price inflection when Yellow closed. The shipper data is aggregated from transportation management systems and grouped by LTL classes and lengths of haul. Not surprisingly, the ton-mile pricing data has stepped lower since the Yellow bump and shows the industry is in need of a volume influx.

Third-quarter reports showed operating ratio (inverse of operating margin) deterioration at most publicly traded carriers. ArcBest, Old Dominion and Saia reported roughly 200 basis points of y/y degradation. (XPO bucked the trend, reporting 200 bps of improvement.)

Guidance provided by carriers for the fourth quarter was mixed.

Operating ratios normally deteriorate 200 to 250 bps from the third to the fourth quarter. (ArcBest normally sees 100 to 200 bps of deterioration.) ArcBest said it expects to be at the high end of its normal sequential change rate this year while Old Dominion expects to exceed its high end by 100 bps, resulting in roughly 500 and 400 bps of y/y deterioration, respectively.

Saia and XPO previously said they expect to outperform normal sequential change rates.

Stay tuned to FreightWaves for coverage of fourth-quarter updates from LTL carriers.