Less-than-truckload carriers use general rate increases (GRIs) to make adjustments to base rates. The increases are applied to general tariff codes and vary by lane and weight tier. Some LTL pricing agreements with shippers work off a base rate schedule and utilize account-specific negotiated discounts. The base rate will increase when a GRI is taken but shippers continue to apply their discounts to the new rates. The headline percentage change announced by the carriers is the expected average increase the rate adjustments will have across all of the impacted accounts.

The increases are used to address cost inflation throughout a carrier’s network. Recently, carriers have incurred incremental costs associated with hiring and retaining drivers and dockworkers, and fuel prices have increased by more than 40% year-over-year over the last six months. Also, a surge in demand has many carriers making additional investments in real estate, equipment and technology.

“LTL GRIs are essentially a rebalancing of that carrier’s lane index based on demands in the market, their linehaul network and rising costs they’ve incurred,” said Curtis Garrett, VP of pricing and carrier relations at Recon Logistics. “It allows them to bump rates higher if they have elevated costs to cover and also ratchet them down lower to capture more freight if they are in lanes with excess capacity.”

The average increases to base rates are typically announced in the third or fourth quarter with implementation usually occurring in the first quarter the following year. Large carriers are normally the first to announce increases with smaller carriers issuing similar rate bumps shortly after. Small and midsize businesses are often the most impacted by the changes, but not exclusively.

“Shippers that are impacted by the GRI every year aren’t necessarily smaller and without contracts. The contract sits outside of this. The base rates agreed upon for use within the pricing program are what dictate whether a shipper will be subject to the GRI or not,” Garrett continued.

Garrett explained there are three types of base rates normally used. Current carrier rates (subject to a GRI), frozen carrier rates (not subject to GRIs) and a neutralized or standardized base rate like a Czar, or benchmark rate, from data provider SMC3 that is not subject to a GRI. He noted that when a GRI is issued, frozen base rates will see a “teeter-totter effect” as discounts are adjusted “to maintain a tariff revenue amount that is somewhat parallel to the current carrier base rates.”

The impact from GRIs only touches a portion of a carrier’s overall customer book. Only 25% of ArcBest’s (NASDAQ: ARCB) asset-based business is subject to a GRI. The rest of its shipments are under contract or on an individual pricing arrangement. Roughly 20% to 25% of Saia’s (NASDAQ: SAIA) revenue falls under a GRI.

In looser markets where supply is ample, carriers either don’t issue GRIs or the increases fade away as shippers are able to walk to other providers that have favorably priced capacity. The opposite occurs in an environment in which capacity is tight. If the the market is strong enough, carriers can take multiple GRIs in the same calendar year.

Most carriers installed a 5% to 6% GRI during the first quarter of 2021. However, many have already implemented a second increase for 2021, in some cases at higher levels, given robust freight volumes and a lack of capacity.

Yellow (NASDAQ: YELL) implemented a 5.9% increase on Nov. 1, ArcBest (NASDAQ: ARCB) implemented a 6.9% GRI on Nov. 15 and Estes put a 5.9% increase in place on Nov. 29.

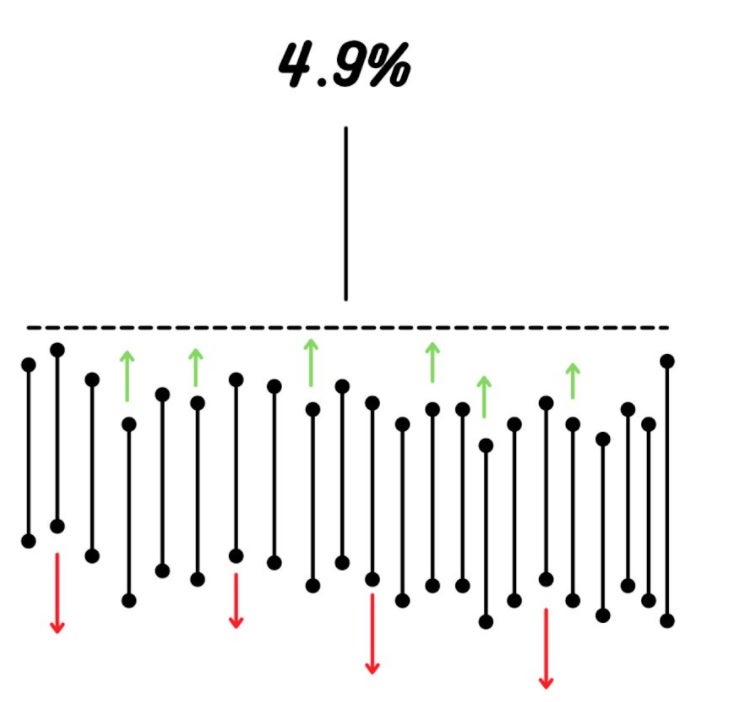

FedEx Freight’s (NYSE: FDX) 5.9% GRI across most zones begins Monday. The same day, Old Dominion’s (NASDAQ: ODFL) 4.9% increase takes effect. While the average increase is expected to be unchanged from 2021, Old Dominion’s GRI will be installed only 10 months after its most recent increase.

Forward Air (NASDAQ: FWRD) announced a 7.9% GRI but it won’t take effect until Feb. 1.

The GRI isn’t the only lever a carrier has for yield improvement. Most carriers are focused on overall account profitability and capture the desired rates through regular negotiations. Also, many are using a strong freight backdrop to replace lower-margined accounts with customers and freight that better fit the network.

Click for more FreightWaves articles by Todd Maiden.

- 2021’s most transformational deals in trucking

- Cold chain 3PL RLS Logistics sees big expansion in 2022

- Why is transportation M&A so hot?