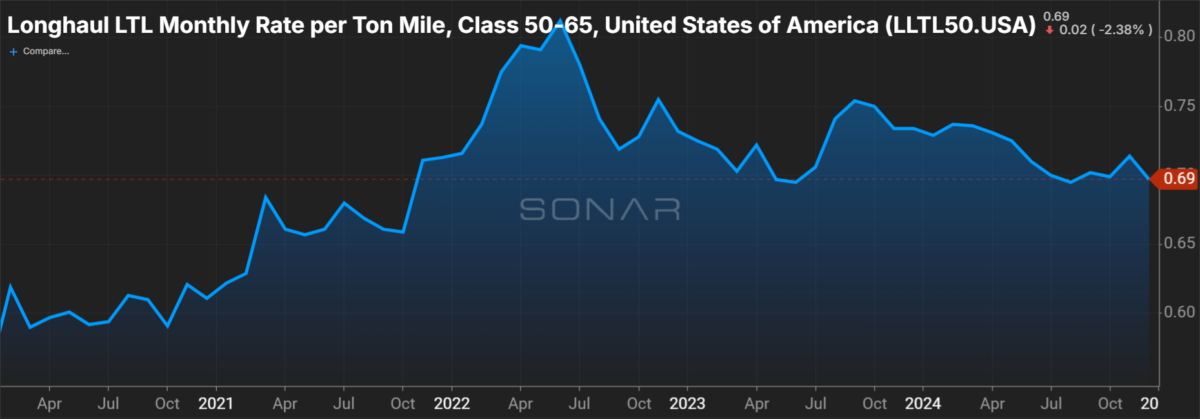

Less-than-truckload pricing appears in need of the next catalyst, according to a report from 3PL AFS Logistics and financial services firm TD Cowen. The update classified LTL rates as steady but noted “some indication carrier pricing discipline may start to crack” as demand remains tepid.

The industry got a reprieve from the freight recession in the summer of 2023 when the nation’s third-largest LTL carrier, Yellow Corp. (OTC: YELLQ), shut down. With the industrial economy in its third year of a downturn and no major carrier on the brink of closure, the LTL industry will likely need a more meaningful demand catalyst to continue to push rates higher.

The TD Cowen/AFS Freight Index shows the LTL-rate-per-pound dataset was 62.7% higher in the fourth quarter than its January 2018 baseline. That was 140 basis points higher year over year but 140 bps lower than the third quarter. The index is expected to record a fifth consecutive y/y increase in the first quarter (to 62.4% from 61% a year ago) but will be down slightly sequentially – typical for the seasonally slowest quarter of the year.

“LTL pricing has been resilient, and a major factor is the increased sophistication of carriers and their ability to price freight in a way that is closely tied to the true cost to move it,” said Aaron LaGanke, vice president of freight services at AFS, in the report. “But there are opportunities for shippers, especially as low demand persists and carriers seek out ‘attractive’ freight they can move efficiently.”

With a finite number of carriers in most regions, the LTL industry is much more disciplined on pricing than the highly fragmented truckload space, which has an abundance of carriers willing to take noncompensatory rates during downturns. However, volume is needed at some point to keep LTL pricing momentum going.

Fourth-quarter updates from publicly traded LTL carriers showed gross yields (revenue per hundredweight inclusive of fuel surcharges) were slightly negative on a y/y comparison but up by low-single-digit percentages excluding fuel surcharges. LTL carrier margins traditionally benefit from higher fuel prices because fuel surcharge mechanisms move higher as the per-gallon price increases.

The TD Cowen/AFS Freight Index showed LTL cost per shipment was off 1.3% sequentially in the fourth quarter and down 6.6% y/y. Several factors dragged costs down.

Diesel fuel prices were down 4% sequentially and 16% y/y. The report said the average fuel surcharge at major carriers was down 3.4% from the third to the fourth quarter. (Net fuel surcharge per shipment was down 5.5%.)

Weight per shipment and length of haul were down sequentially in the quarter by 0.3% and 1.4%, respectively.

The report also said FedEx’s (NYSE: FDX) planned spinoff of its LTL business, the largest in the nation, could change the competitive landscape. FedEx Freight expects to add 300 LTL sales reps in the coming weeks.

“FedEx spinning off its freight business could also shake things up, as shippers who have historically benefitted from bundling parcel and LTL spend to qualify for higher discounts may entertain other options,” LaGanke said.

There’s also some concern that pricing fundamentals could weaken as carriers continue to redeploy the nearly 200 terminals acquired from Yellow’s estate, and potentially eye the remaining 100 sites that head to auction next month. While some of the remaining locations are unlikely to see another LTL shipment, carriers are eager to begin generating returns on their real estate investments totaling roughly $2.2 billion.

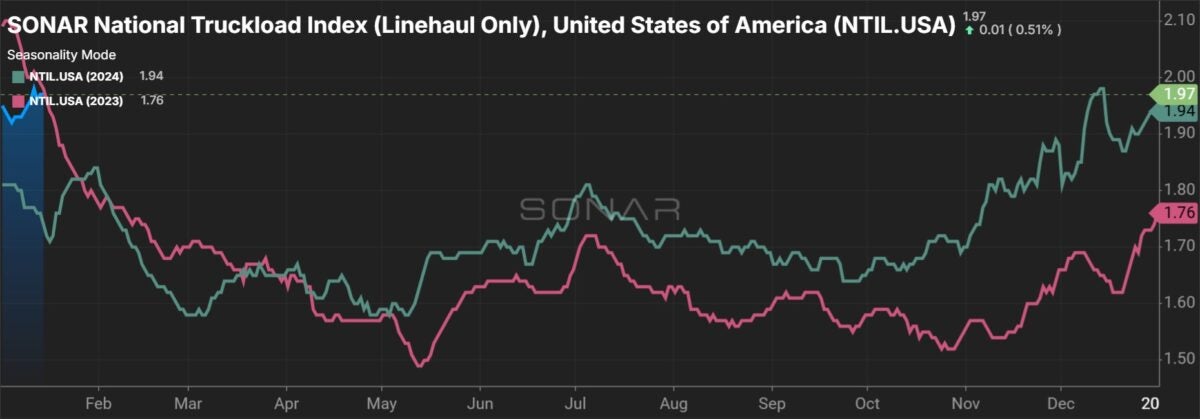

The report also showed that TL linehaul cost per shipment was down 3.3% sequentially in the fourth quarter as miles per shipment fell 3.6%. Cost per shipment was down y/y for an eighth consecutive quarter and reached a cycle low, just 11.6% higher than before the pandemic.

The TL-rate-per-mile freight index is expected to be 5.1% higher than the January 2018 baseline in the first quarter and 20 bps higher y/y.

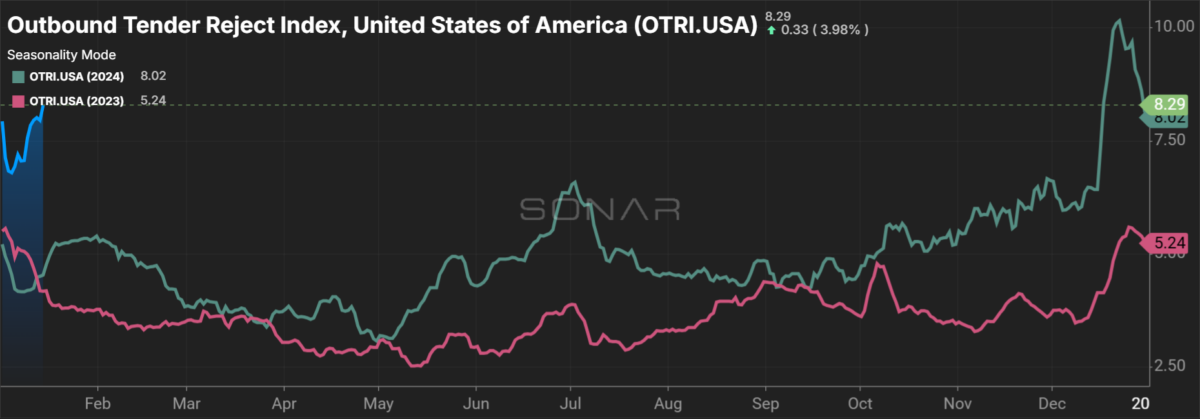

“Truckload demand remains flat, but some positive cues are emerging, including rising spot rates and higher tender rejection rates, indicating that carriers are being more selective about what loads they accept,” the report said. “But the upward momentum in the spot market has not made its way to contract rates, and the market remains in a state of overcapacity.”

Tender rejections are higher to start 2025 than they were in the prior two years and signal the market is roughly at equilibrium. Spot rates have been on a steady ascent since November, and the market will get a firsthand update on contractual bid season on Thursday when J.B. Hunt Transport Services (NASDAQ: JBHT) reports fourth-quarter results.

AFS Logistics is a non-asset-based 3PL providing audit and cost management services, managed transportation, and freight brokerage. It has visibility into more than $39 billion in annual freight spend.