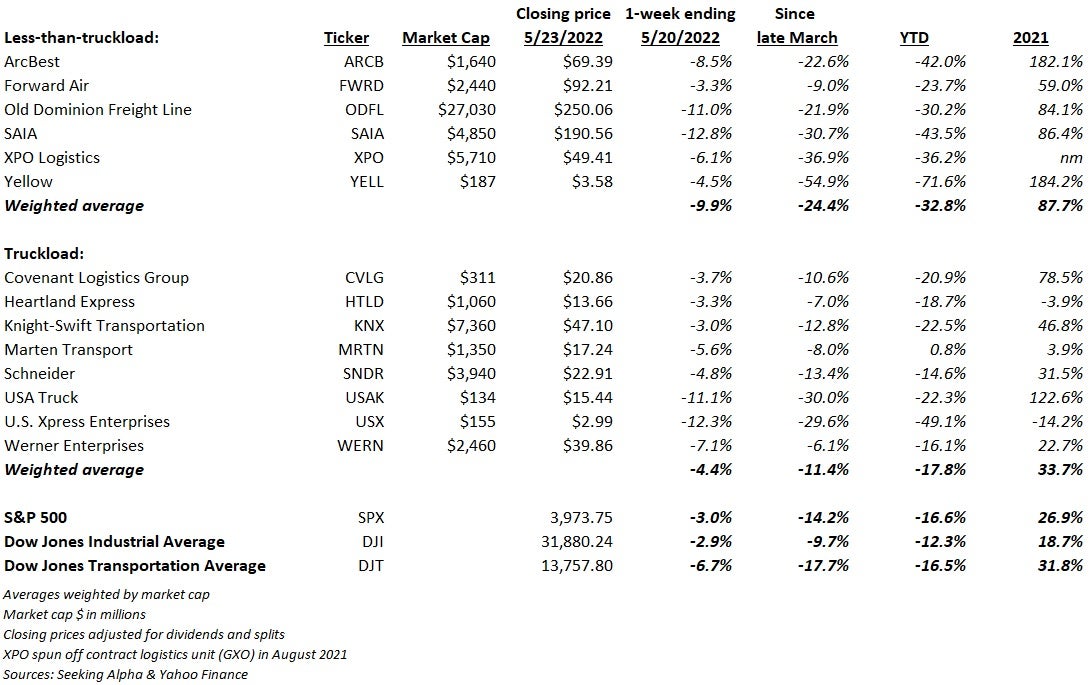

Trucking stocks have received a fair amount of attention over the past several weeks for the wrong reasons. With spot truckload fundamentals eroding, several analysts have downgraded the space and cut earnings expectations. While TL stocks have sold off from recent highs, it’s the less-than-truckload sector that’s underperforming the broader market and transports.

Less-than-truckload stocks were the high fliers last year, up 88% on a weighted average, handily outpacing the broader transports (+32%) and the S&P 500 (+27%). The exuberance around favorable competitive dynamics, pricing gains and expanding margins had investors paying well north of 20 times forward earnings and as much as mid-30s multiples for best-in-class operator Old Dominion Freight Line (NASDAQ: ODFL). The nosebleed multiples paid last year were double 10-year historical averages that are in the high teens.

2021 was the year of the LTL, with TL carriers also trying to gain a valuation bump by buying into the space through M&A. TFI International (NYSE: TFII) leaned further into LTL during the year and Knight-Swift (NYSE: KNX) bought not one, but two LTL carriers.

Whether it’s TL contagion, mean reversion or the realization that LTLs are now much more correlated with the retail space and e-commerce post-pandemic, the sell-off has been pronounced in a year where the market as a whole is down 17% so far. Last year’s favorites among analysts — Old Dominion and Saia (NASDAQ: SAIA) — are back to trading at multiples under 20x and 14x, respectively.

Historically the slowest period of the year, first-quarter delivered record results for many carriers. Tonnage was ample in the period, with many carriers continuing to swap out lower-margined shipments for better-priced, more network-friendly freight. Double-digit percentage hikes in yield pushed margins and earnings to all-time highs for some. Most management teams were adamant that customer demand was not rolling over and announced that April had remained strong.

Some even softly guided to new highs.

Old Dominion said it’s now eyeing a sub-70% operating ratio as early as the second quarter of this year. That’s where the Class I rail oligopoly (monopoly on some lanes) operated just a few years ago. Asset-light provider Forward Air (NASDAQ: FWRD) was less demure, saying it now expects to hit at least the low end of its 2023 financial targets a full year ahead of schedule.

So, what gives with the stocks?

The LTL industry is highly consolidated, with 10 carriers accounting for 75% of the $40 billion-plus market. By comparison, the roughly $800 billion TL industry has 50,000 fleets, 90% of which have five trucks or less.

Less-than-truckload networks are capital intensive: a closely woven map of terminals, multiple truck and trailer types, and the technology to operate it all. A typical freight shipment sees multiple stops on different trucks to different terminals. The high barriers to entry make it so only a few carriers are actually bidding on the same freight. Thus, the group exhibits a high degree of price discipline.

However, that is a double-edged sword. The high-fixed-cost setup makes the stocks more susceptible to cyclical changes and a perceived loosening in capacity. This was seen last week when the space sold off sharply after Target (NYSE: TGT), Walmart (NYSE: WMT) and other retailers missed fiscal-first-quarter expectations, warned on supply chain costs and acknowledged they are likely holding too much inventory.

Historically, LTL earnings are highly correlated with moves in industrial data sets like the Manufacturing Purchasing Managers’ Index and industrial production. However, after taking on a significant amount of e-commerce-related freight during the pandemic, the stocks appear to also be tethered to retail.

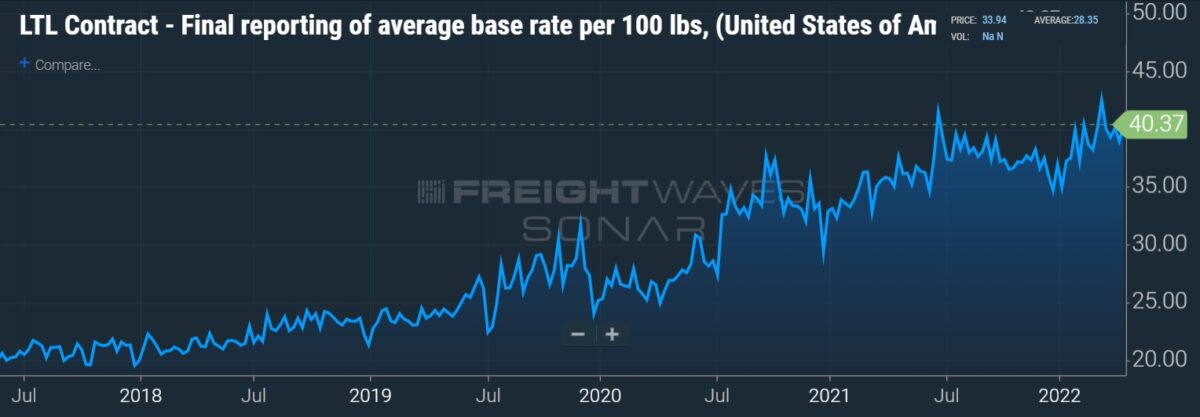

The linchpin will continue to be pricing

Morgan Stanley (NYSE: MS) analyst Ravi Shanker said in a note to clients last week, “the big debate from here is how much of the EPS gains for the LTLs in 2020-22 were permanent/sticky vs. cyclical/will mean revert.” He said the “bulls see the sell-off from the peak as a good opportunity to revisit the LTL names, while bears still see plenty of room for the stocks to mean-revert back to pre-pandemic levels.”

Less-than-truckload carriers have remained rational through the past few freight cycles, holding ground on price negotiations. This has allowed the industry to push yields higher in a stairstep fashion for more than a decade now. The last time the industry saw any type of notable price war was in 2009 when debt-burdened YRC Worldwide, now Yellow Corp. (NASDAQ: YELL), was teetering on failure. It was widely circulated at the time that several carriers were underbidding the company in hopes of forcing it to exit the industry.

In a Friday email to investors, Deutsche Bank (NYSE: DB) analyst Amit Mehrotra also called attention to the “LTL pricing debate.” He said investor concerns regarding a “hyper fragmented TL market,” which traditionally lacks pricing power, have spilled over into the LTL space.

“We think otherwise,” Mehrotra said. “We believe the consolidated nature of the LTL market, coupled with the importance shippers put on service above price, allows the very best LTL operators (i.e. ODFL and SAIA) to preserve the pricing gains achieved in recent years.”

His comments pointed to Old Dominion’s ability to increase revenue per shipment by 5.1% on average in each of the past 15 years compared to a cost-per-shipment increase of only 3.5% annually over the same time (160-basis-point spread).

“And this is not simply explained by COVID-related benefits, with the average annual spread +100bps from 2006 to 2019,” Mehrotra said. “This has equated to a +502% increase in ODFL’s operating profit per shipment since 2006 (+13% CAGR), which we believe speaks to the potential within the LTL industry for high quality companies to see sustainable pricing above inflation.”

The question for the LTL stocks is whether the pricing gains, and outsized margins, hold through the downside of the freight cycle.

“Management teams seem confident in their ability to maintain pricing through a downturn and many LTLs now see themselves as supply-chain partners valued for quality of service as opposed to just a commodity, which they believe should help to buoy them through the cycle’s end,” Shanker said.

His call is “that the cycle is on track to turn and that 2H22 will likely be softer either way.” He favors ArcBest (NASDAQ: ARCB) on valuation as it trades at less than 6x 2023 estimates. He has an “equal-weight” rating on the more expensive shares of Old Dominion and an “underweight” recommendation on Saia’s stock.

Mehrotra has a “buy” rating on Saia, as he believes it has a lengthy runway to improve pricing, and a “hold” rating on Old Dominion.

The picture may get a little clearer in early June when several public carriers provide tonnage and yield updates for the first two months of the second quarter.

More FreightWaves articles by Todd Maiden

- How widespread is API connectivity in the LTL industry?

- Large carriers still seeing strong demand midway through Q2

- Fox Logistics expands offering with freight automation platform Boxton