Lufthansa Cargo has begun offering qualified commercial customers and partners greater digital connectivity to its reservation system, giving logistics providers a fast, no-haggle way to book space for shipments.

Automating the booking process is a new trend among airlines keen on attracting more business by simplifying the experience and is a requirement to play on new multi-airline platforms, such as cargo.one, that offer dynamic pricing and instant transactions.

Lufthansa’s [DAX: LHA] cargo division said last week it has developed an application programming interface, or API, that provides customers and distribution partners with a binding offer that can be booked online with a single click. It contains the available routings, capacities and prices and makes sure the shipment complies with relevant rules.

An API is a piece of middleware for system-to-system communications that allows forwarders to directly connect their transportation management system to a carrier’s reservation and revenue management systems. The result is a real-time quote for spot market or contract rates that can be instantly booked and confirmed.

When people go to a restaurant’s homepage or a review site such as Yelp, for example, and see available directions via Google Maps, the connectivity is enabled by APIs.

Lufthansa’s process stands out from most air cargo websites where manual booking requests are tentative, requiring a period of time before the airline accepts them with its final price. The direct connection also enables forwarders to attach the airway bill to the transaction.

In fact, most logistics providers still manually make reservations after scouting prices online. And online aggregators simply centralize more static views of airlines’ estimated capacity and retail rates that don’t reflect actual prices they will take.

“It used to be a longer process to negotiate the rate, make phone calls. People don’t have time, they want to cut out costs,” said Jesse Cohen, FreightWaves air cargo market expert and a former managing director for cargo pricing and revenue management at United Airlines. “It’s about speeding up the process, getting the best rate up front, not trying to get an additional 10 cents a kilo, but really saying, ‘Here’s the price on this airplane. You want a better rate, there’s one three hours later that might be better, or three hours earlier,’ just like on the passenger side. You put it all up front, your best deal.”

Lufthansa Cargo customers can now electronically book shipments through the website, by phone and email with Lufthansa’s sales center or with its smartBooking interface.

Using smartBooking requires a partner to register, follow certain procedures and be able to work with APIs, said Boris Hueske, vice president of digital transformation, in an interview.

Automated, real-time booking through API links is not common for the air cargo industry yet, but more airlines are preparing to make the move as the latest integration software becomes available, according to industry experts. The technology is expected to bring more efficiency to the market by giving airlines greater ability to maximize revenue through yield management and shippers more price transparency.

“If you want to win those incremental opportunities, you better be in front of your customer” by integrating into their systems, said an executive at a U.S.-based forwarder who asked not to be named because of ongoing discussions with airlines and related parties.

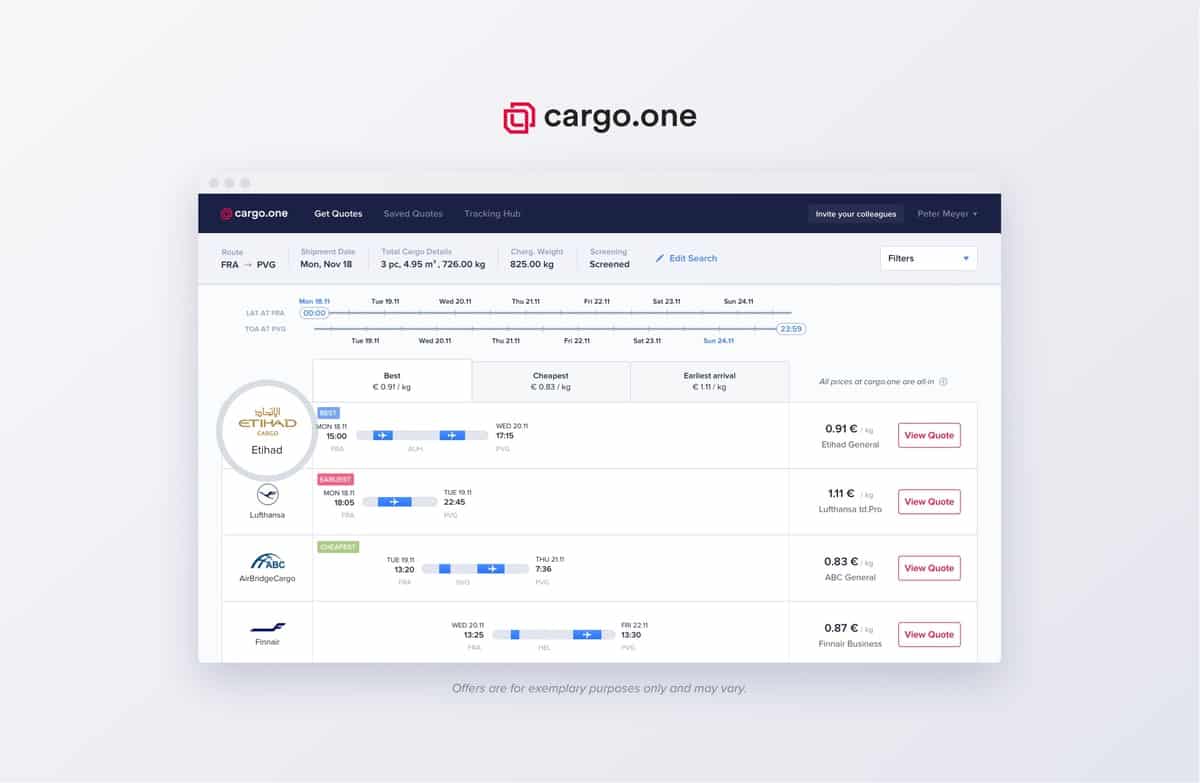

cargo.one

Meanwhile, Etihad Cargo is the latest airline to join the Cargo One GmbH (cargo.one) e-booking platform.

As a distribution platform that displays all the offerings of participating carriers, cargo.one uses APIs to connect to airlines’ back-office systems and integrate with freight forwarders’ systems.

Cargo.one, a 2-year-old startup in Berlin backed by venture capital, serves more than 300 forwarders in Europe and says it is adding many more each month.

Etihad Cargo said that using the cargo.one channel would make its available cargo capacity accessible to a wider pool of European customers that can access new markets across the Middle East, Indian subcontinent, Asia, Africa, Australia/New Zealand and the U.S.

The cargo arm of Abu Dhabi-based Etihad Airways has accelerated investments in the past year to digitize cargo transactions and says its own online platform now represents 38% of its bookings. Last week, a Delta Air Lines cargo official said that a third of all cargo bookings come through its website after a series of technology upgrades were made.

“Our digital investment enabled us to rapidly build the required API connectivity to seamlessly link to the cargo.one platform,” Abdulla Mohamed Shadid, Etihad Aviation Group’s managing director of cargo and logistics services, said in a Nov. 18 news release.

Lufthansa Cargo, with gross sales of €2.7 billion ($3 billion), is a minority shareholder in cargo.one. The booking platform also offers capacity from seven other airlines, including Nippon Cargo Airlines, El Al Cargo, AirBridgeCargo, CargoLogicAir and Finnair.

Lufthansa and Etihad both operate freighters in addition to carrying cargo in the lower deck of passenger aircraft.