World’s largest shipping company outlines new surcharge stemming from switch to low-sulfur fuel.

Maersk (Denmark OMX: MAERSKB) unveiled new fuel surcharges in response to rules requiring a seven-fold decrease in global sulfur emissions rules for the shipping industry by 2020.

The world’s largest shipping company is introducing customers to the new “bunker adjustment factor” 14 months ahead of the mandate from the International Maritime Organisation that ship’s sulfur emissions go from a 3.5% down to 0.5% globally.

There has been much hand-wringing in the industry about the cost of implementing the rules, which take effect 1 January, 2020. Maersk says the new rules will cost the industry $15 billion in higher fuel prices, with Maersk alone taking a $2 billion hit.

Its peer companies are also readying for higher fuel bills. Hapag-Lloyd (Frankfurt: HLAG) chief executive Rolf Habben Jensen said in public comments recently that the German company faces $1 billion in higher costs due to the fuel rules.

The path forward to 2020 remains highly uncertain. Most of the industry is expected to use a lower-sulfur marine fuel to meet the rules.

But the supply of such fuel remains unclear as only a few major refineries have committed to producing the fuel. Futures markets show the cost of low-sulphur fuel is currently about $364 per metric ton higher than standard high-sulfur marine fuel by the start of the IMO rule.

Shipowners also have the option of installing sulphur scrubbers on their vessels, which will allow them to burn lower cost high-sulfur fuel. But the payback on such systems, which can cost $2 million or more, is also uncertain. Maersk itself is cautiously trying out scrubbers on a few ships.

In addition, many of the current scrubber systems in use put the cleansed sulfur directly into the ocean water. That opens a new set of risks should governments decide to regulate ocean disposal of sulfur.

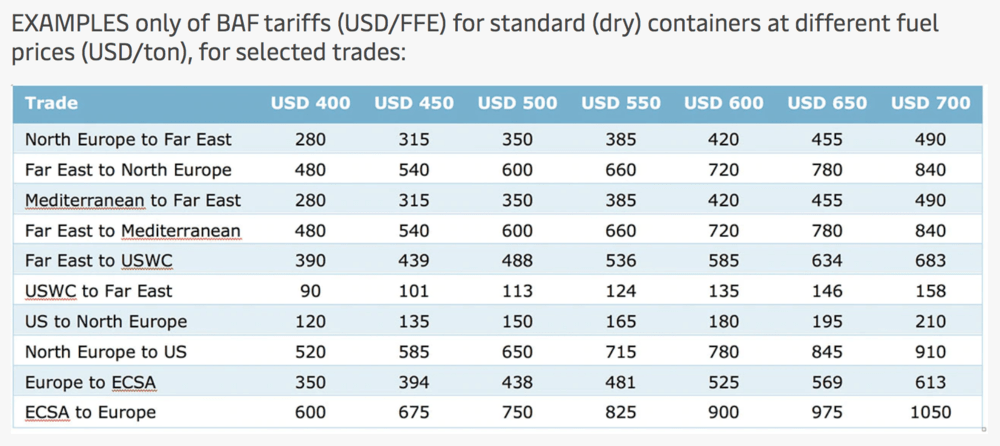

Maersk says the new bunker adjustment factor will replace its existing standard bunker factor “to allow customers to predict, plan and track how changes in fuel price will impact total shipping freight rate(s).” The adjustment factor will be charged separately from the regular ocean freight rate.

The adjustment factor, which will go into effect starting next year, is comprised of two things: the average fuel price in key ports around the world; and a trade factor which accounts for vessel sailing time, fuel efficiency, and the level of headhaul and backhaul cargo.

Contracts with start dates before 2019 will use the existing bunker surcharge formula, with all contracts expected to switch to new factor by 2020. Refrigerated containers will be subject to a slightly higher rate due to higher energy consumption.