A.P Moller-Maersk, operator of the world’s second-largest container line, announced fourth-quarter results in line with expectations on Wednesday. But its outlook for 2023 came in below consensus, with rates expected to be particularly weak in the second half of the year.

Maersk sees spot rates now stabilizing. It expects contract rates to be negotiated for 2023 at levels close to spot rates, bringing average rates down, particularly after the benefits from contracts negotiated in 2022 expire.

Even though second-half volumes could recover somewhat as retailer inventories normalize, rates will face pressure from higher shipping capacity as a wave of new vessels hit the water in H2 2023 and through 2024.

“It certainly means lower profitability or very low profitability for ocean in the second half of the year,“ said Maersk CFO Patrick Jany on Wednesday’s conference call with analysts.

Maersk Q4 2022 results and 2023 outlook

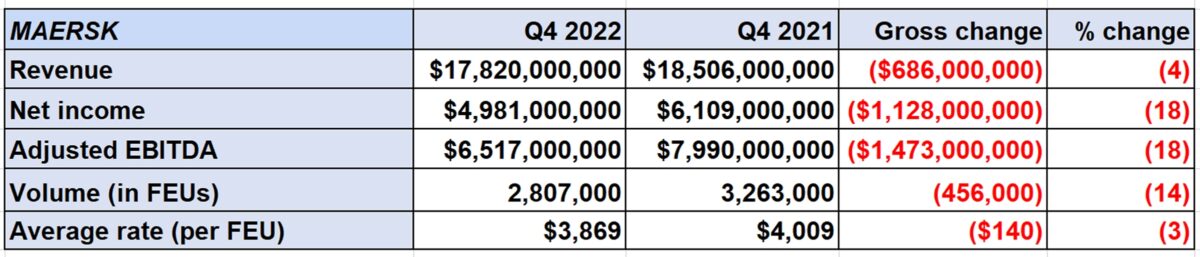

Maersk reported net income of $4.98 billion for Q4 2022, a 44% plunge from the record-setting third quarter and down 18% year on year.

The company had previously forecasted adjusted earnings before interest, taxes, depreciation and amortization of $6.7 billion for the fourth quarter; analysts polled by Bloomberg expected $6.4 billion. Actual adjusted EBITDA came in at $6.54 billion.

Maersk released its initial guidance for this year: for adjusted EBITDA of $8 billion-$11 billion. That would be a massive 70%-78% drop from the $36.8 billion EBITDA in 2022, but still 40%-93% higher than the EBITDA of $5.7 billion in 2019, pre-COVID.

The consensus had been for full-year adjusted EBITDA of $11.6 billion, with Deutsche Bank at $13.6 billion. (After the conference call, Deutsche Bank slashed its outlook to $9.6 billion.)

Steeper-than-expected import drop

Maersk reported an average rate of $3,869 per forty-foot equivalent unit in Q4 2022. That’s down 23% sequentially from the all-time high in the third quarter, and down 3.5% year on year.

Maersk has 70% of its long-haul volumes on annual contracts. Jany noted that the Q4 2022 drop in average rates was “almost entirely due to falling shipment [spot] rates,” implying that Maersk did not reduce annual rates mid-contract.

The company moved 2.8 million FEUs of cargo in the latest period, down 14% year on year and 7% quarter on quarter. Maersk CEO Vincent Clerc acknowledged that the company underperformed the overall industry, which saw volumes drop around 10-11% year on year in the fourth quarter.

“That was because of the exposure we had to the east-west trades, specifically to the verticals in retail, lifestyle and technology, the ones where we had grown a lot and the ones that felt the inventory correction the most,” he said.

Clerc explained, “While we had anticipated a steep normalization in ocean freight rates in the second half of 2022, this was accompanied by a steeper-than-expected decline in volumes, with import volumes into North America and Europe from Asia falling by the mid-20 percentages due to inventory corrections at large retailer and lifestyle brands.

“Import volumes in North America and Europe are now trending below pre-pandemic averages, which appears to be caused by an inventory correction,” said Clerc, adding that this correction should unwind as 2023 progresses.

“Different companies are at different stages. The pace of sales is still more sustained than the pace of [import] shipments because that’s how they work it down.

“We expect that in the second half — assuming the level of consumption holds — that we will see the volumes that move through the supply chain converge back up to the trend of where consumption actually is, rather than be lower because of the inventory correction.”

‘Profound effect’ on contract negotiations

The inventory correction and fall in import volumes caused a collapse in spot rates, and that effect is now spilling over heavily into the contract-rate market.

“Naturally, the effect of the drop in the spot rates is having a profound effect across the industry during the annual contract negotiations,” said Clerc. “We expect our average 2023 contract rates to eventually move toward prevailing spot rates.”

Most Asia-Europe annual contracts run from Jan. 1 and most Asia-U.S. contracts run from May 1. Jany said contracts signed last year “should have some continued benefit in the first part of this year, particularly in the first quarter, but over the course of the year the advantage will disappear.”

Clerc said that Maersk will continue to carry 70% of its long-haul volumes on annual or multiyear contracts in 2023. Agreements have already been signed for about half of this year’s contract volume, he said, mainly the Asia-Europe customers, with trans-Pacific deals to be signed in March and April.

Assessing the 2M Alliance breakup

Commenting on the recently announced decision for Maersk to end the 2M Alliance with MSC in 2025, Clerc said, “When we created 2M back in 2015, there was significant value in pooling networks, as we had to phase in a new generation of 20,000-TEU [twenty-foot equivalent unit]-plus tonnage and we needed to maintain flexibility on capacity management.

“Since then, we have grown volumes significantly and gained scale and gotten better at capacity management — so much, in fact, that the synergies from the pooling have decreased significantly at the same time the ‘dis-synergies’ from having divergent strategies have increased.

“We are convinced that this is the time to move beyond the traditional ocean service model and make ocean an integrated part of the end-to-end value proposition. To do this, we need to regain and retain strong control of the service levels we provide. That cannot be achieved in an alliance structure.”

The 2M Alliance is one of three global agreements, along with the Ocean Alliance and THE Alliance.

Asked about the future of alliances, Clerc said, “The situation with 2M is quite unique, because it’s an alliance of the two largest carriers and both of us had reached a size where we could actually stand alone if we wanted to. I don’t think any of the other carriers today would be able to have the comprehensiveness of coverage that is required to be competitive or the cost base to stand alone.

“Therefore, the way to think about it is that there are three major networks on the east-west [trades] today and in the future there will be four. The Ocean Alliance [runs through] 2027, so that’s at least the next four years of stability. And it’s hard to see how THE Alliance would make a significant change given that both MSC and Maersk intend to have a mostly standalone network.

“So, I would expect to simply see a transition from three to four networks. I don’t think it’s as much of a change as it’s being made out to be. I don’t expect the ‘musical chairs’ that have been talked about with everybody trying to find new partners.”

Click for more articles by Greg Miller

Related articles:

- Lag effect: Why liner profits stay high much longer than spot rates

- Just how big are the global container shipping alliances?

- How will Maersk-MSC split redraw container shipping landscape?

- Here’s how container shipping lines can escape a crash in 2023

- ‘Surge finally over,’ US imports back near pre-pandemic levels

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- End of an era: Profits finally peak for shipping giant Maersk