Maersk, the world’s second-largest ocean carrier, revealed Friday that it is “intensifying” job cuts in light of the “worsening market conditions” in ocean shipping.

“Given the challenging times ahead, we accelerated several cost and cash containment measures,” said Vincent Clerc, CEO of A.P. Moller-Maersk (Copenhagen: MAERSK-B).

“We are in a very uncertain trading environment with significant further downside risk potential — one that could stay with us for quite a while,” Clerc said on the call with analysts.

Maersk began the year with 110,000 global employees. Year to date, it has cut 6,500 jobs, which it has not previously disclosed. It has now decided to cut a further 3,500 jobs, including 2,500 by year-end and 1,000 in 2024. The total reduction — 10,000 layoffs — will reduce global headcount by 9%.

“This is not a diet. This is a reset of the baseline,” said Clerc.

Job cuts will lead to restructuring charges of $350 million this year (up from the $150 million guidance announced in February) followed by $600 million in cost savings from lower compensation next year.

It’s not just job cuts. Maersk said it is “considering all options to preserve cash.” Capital expenditures (capex) will be slashed both this year and next year, and share buybacks could be halted next year.

Maersk now expects 2023 capex of $8 billion, down from previous guidance of $9 billion-$10 billion, and 2024 capex of $8 billion-$9 billion, down from previous guidance of $10 billion-$11 billion. Based on the range midpoints, that equates to total 2023-2024 capex cuts of $3.5 billion or 17.5%.

Maersk executives said on Friday’s call that capex reductions will largely come from delaying investments in the ocean shipping division. Both Clerc and CFO Patrick Jany cited high yard costs, implying that Maersk has pushed back orders for some methanol-powered newbuildings that it would have otherwise ordered.

Extreme uncertainty for 2024 and beyond

Maersk’s Copenhagen-listed shares plunged 17% to a new 52-week low in over five times the average trading volume in the hours after it disclosed cost cuts and the potential halt to stock buybacks.

The shipping giant is not cutting costs because it’s running short of cash: Liquidity was $26.8 billion at the end of Q3, on par with $26.9 billion at the end of Q2. Rather, it is cutting costs because the outlook is so uncertain. It is preemptively battening down the hatches.

“We have a strong balance sheet but we also have a high uncertainty ahead,” said Jany. “There are quite a wide range of scenarios for 2024 … so we are preparing to weather any type of scenario that might happen.

“We do see scenarios where we start to be cash negative, as we guide for in Q4 already. In the direst path of the scenarios, you do have a cash burn that you need to prepare for,” Jany said.

What happens in the fourth quarter will be key to how 2024 turns out, explained Clerc. Maersk is heavily reliant on contract rates, which largely reset on a calendar-year basis in the Asia-Europe market and in May in the Asia-U.S. market. European contracts are about to reset, with those contract rates contingent on what happens in the spot market over the coming months.

According to Clerc, “What happens with spot rates during the next three months is going to determine how much of an impact there will be from contract renegotiations. One of the reasons we are taking these [cost-cutting] measures is that we don’t have the visibility yet on where [contracts] will reset — on where spot rates will be and what type of premium we can achieve [versus spot rates] on our contracts.

“With the [spot rate] decrease we have seen in the third quarter and with what we’re guiding in the fourth quarter, if contract rates were to come down to what the prevailing [spot] rates are today, that is not an insignificant gap,” he said. In other words, what Maersk is worried about is that 2024 contract rates could reset to current spot levels.

The biggest driver of rates is overcapacity as a result of newbuilding deliveries, said Clerc, who expects supply side pressure to extend into the medium term.

“We expect market conditions in ocean to worsen further due to the additional capacity coming into the market and due to the fact that mitigating measures such as ship idling and ship recycling have not been effective.

“If you simply look at the amount of tonnage that is in the process of being built at the yards and the phasing in of that capacity, these difficult market conditions are likely to stay with us, not only for 2024, but also for longer.”

Q3 volume better than expected, rates worse

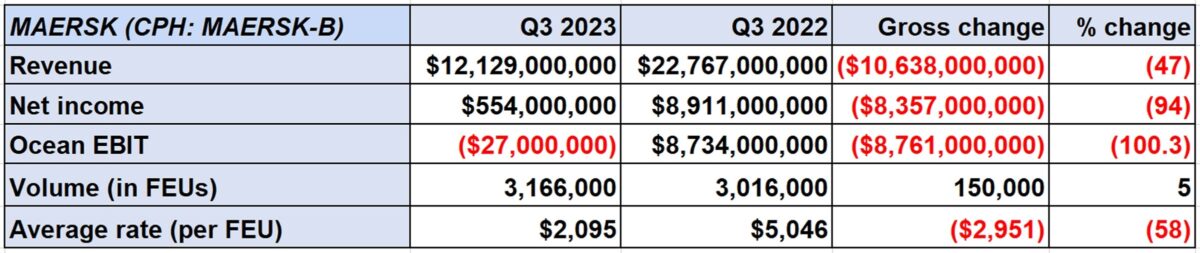

Maersk reported net income of $554 million for the third quarter of 2023, in line with expectations and down from the record-setting $8.9 billion of net income in Q3 2022.

Maersk’s ocean division reported a modest operating loss in the latest period. Ocean shipping earnings before interest and taxes (EBIT) were minus-$27 million.

Third-quarter volumes came in better than expected. Maersk carried 3,166,000 forty-foot equivalent units, up 9% from 2,906,000 FEUs in the second quarter. As a result of the volume uptick, it now expects full-year 2023 demand to decline in the range of 0.5% to 2%, compared to prior expectations for a drop of 1% to 4%.

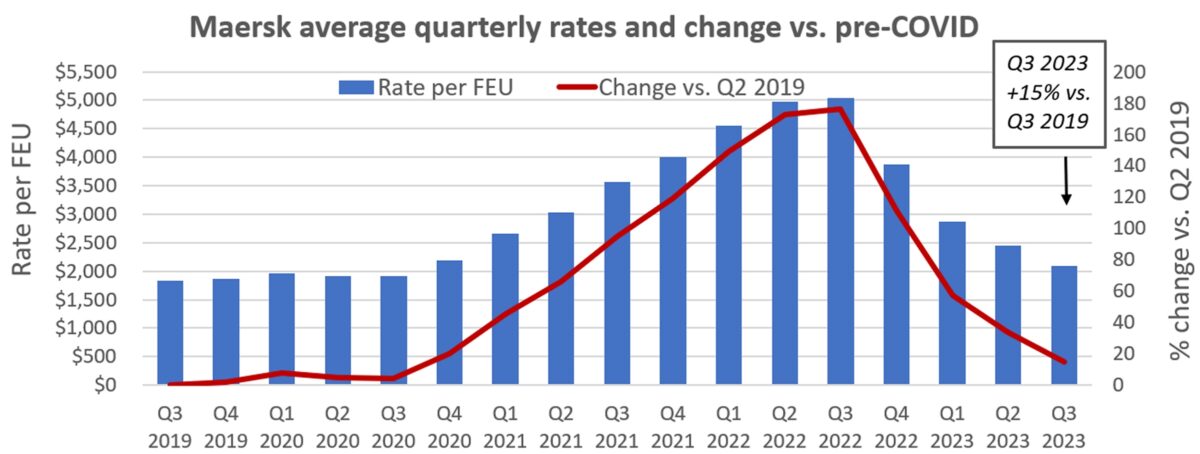

Average rates (68% on contract, 32% on spot) came in at $2,095 per FEU in the third quarter, down 14% sequentially from $2,444 per FEU in the second quarter of this year. “Prices declined at an accelerated pace, overshadowing the positive impact of higher volumes,” said Clerc.

Even so, Q3 2023 rates were still 15% above the average in Q3 2019, pre-pandemic.

Maersk did not reduce its full-year guidance but now expects results to come in toward the bottom end of the range. Guidance is for adjusted full-year EBIT of $3.5 billion-$5 billion.

That implies a very rough fourth quarter. Maersk’s EBIT over the first nine months totaled $4.47 billion. Full-year EBIT of $3.5 billion equates to Q4 EBIT of minus-$970 million.

Click for more articles by Greg Miller

Related articles:

- Shipping braces for impact as Panama Canal slashes capacity

- Some shipping lines are still posting 9-figure profits amid downturn

- East Coast vs. West Coast: More imports shift back to Pacific ports

- Shipping line earnings preview: A mix of black, red and very red ink

- US container imports still rising, topping pre-COVID levels

- Container shipping has a Europe problem and it’s getting worse

- Trouble ahead: Container shipping rates sinking further into the red

- US container imports rise in line with pre-COVID peak season pattern

- Rebound in trans-Pacific container shipping rates has stalled