Dry bulk ship operator Malaysian Bulk Carriers (BM: 5077) has reported a weak set of third quarter results. Although revenues are up, the company incurred a loss for the quarter and, barring unexpected positive developments, looks likely to report a loss for the year. If so, that would be the fourth loss in six years. Meanwhile, the company appears to be running down its current assets.

Malaysian Bulk Carriers (MBC) operates a fleet of 17 dry bulk ships and focuses on the carriage of the major and minor dry bulk commodities such as iron ore, coal, grain, sugar, coke and fertilizers.

Third quarter results

MBC reported third quarter revenues of 67.1 million Malaysian ringgit ($16.0 million), a 15.4% year-on-year increase on the 58.2 million ringgit ($14.1 million) of revenues it generated in the third quarter of 2018.

Voyage expenses surged by 24.1% in the three months ending September 2019 compared to the corresponding period in 2018 to stand at 13.3 million ringgit ($3.2 million). However, other operational expenses fell by about 10.7% to 44.9 million ringgit ($10.7 million), which is a difference of about 5.4 million ringgit ($1.3 million).

As ship owners typically fund the acquisition of their fleets through bank debt and lease arrangements, borrowing and leasing costs are particularly important.

MBC’s borrowing expenses were essentially flat year-on-year standing at close to 4.4 million ringgit ($1 million) in the third quarters of both 2019 and 2018. Interest expenses on leases were not recorded in the penultimate quarter of 2018 and stood and 2.3 million ringgit ($551,458) in the third quarter of 2019.

All of this led to a net loss of just under $1.3 million ringgit ($308,912) for the third quarter of 2019. That’s a swing into the red from 23.0 million ringgit ($5.57 million) profit in the third quarter of 2018.

Management did not comment on the third quarter results in their official statement; instead they commented on the nine month results.

Nine month results

In summary, in the nine months to September 30, 2019, MBC generated just under 200 million ringgit ($47.7 million), which is a 17.7% increase on the same period in 2018. In the first nine months of 2018, the company generated 169.9 million ringgit ($41.0 million) of revenues.

Those higher revenues helped reduce losses. The account line “loss at operating level” fell by 73.7%, from 17.0 million ringgit ($4.1 million) to just under 4.5 million ringgit ($1.1 million).

At the end of the nine months ending September 2019, the company reported a loss of 18.1 million ($4.3 million) compared to much greater losses for the same timeframe in the previous year of 142.1 million ringgit ($34.3 million).

MBC noted that average time charter rates per day fell from $10,009 in the nine months ending September 30, 2018 to $9,796 in the same timeframe this year. It also stated that the number of on-hire days rose from 3,840 in the first nine months of September 2018 to 4,115 in the first nine months of September this year.

Commenting on the results, the company noted that losses decreased due to the re-delivery of a loss-making chartered-in vessel and lower operating costs for some of the chartered-in vessels. The company also disposed of a vessel at a loss and its investment account line also reported a loss due to a non-recurring loss reported by an associate company.

Administrative fees decreased this year because of “lower shared services cost” and a reduction in professional fees. Borrowing costs were also reduced because of a loan repayment.

The company also noted that freight rates improved in the third quarter of the year when compared to the first half of the year. It added that it expects the freight rate improvement to continue for the rest of the year. The company cited an expected reduction in the supply of ocean-going shipping in the current fourth quarter “as more vessels are taken off for scrubber retrofitting in preparation for new emission regulations which will come into force from 1st January 2020.”

Balance sheet: total assets and liabilities

A look at the company’s balance sheet as of the end of December 2018 and of the end of September 2019 may reveal a situation in its current assets and liabilities.

Overall, the company has total assets of about 1,026.5 million ringgit ($245.1 million), which is effectively no material change between the two periods. Total liabilities are markedly lower than total assets, at about 644.7 million ringgit ($153.9 million) as of the end of September 2019.

However, total liabilities marginally increased between December 2018 and September 2019 by about 2.6%.

Balance sheet: current assets and liabilities

Looking at current assets, it is clear there has been a marked fall in the value of current assets (i.e. those assets that are cash, or are very cash-like, or can quickly be turned into cash).

As at the end of December 2018, current assets stood at 482.8 million ringgit ($116.6 million) while, as of the end of September 2019, that figure stands at about 177.4 million ringgit ($42.3 million). That’s a 63% decline.

Much of that decline is in short-term deposits, which decreased from 261 million ringgit ($63.1 million) to 15.3 million ringgit ($3.66 million); that’s a decrease of 94.1%. It is also worth noting that, in both the December and September current asset accounts there are large figures described as “non-current assets classified as held for sale.”

An asset for sale is a current asset because the intent is to dispose of it. However, assets for sale are simply not as liquid as cash and cash-like instruments. Just because an asset is held for sale does not necessarily mean that it will be sold quickly. Inventory, for instance, is a current asset but it can take a long time to sell. The same is true of ships and buildings in a down market.

In the September balance sheet, the non-current asset(s) held for sale are valued at 93.45 million ringgit ($22.4 million). With that asset in the current assets account, the total value of the current assets are 177.4 million ringgit ($42.3 million). Without that asset in the current assets account the total value would otherwise be 83.9 million ringgit ($20.0 million).

Looking at current liabilities (those debts that have to be paid within a year), the total value is just over 228 million ringgit ($54.5 million).

Working capital deficiency

Working capital is current assets minus current liabilities. That means MBC has a working capital deficiency, i.e. not enough immediate cash on hand to pay its debts, to the tune of 50.8 million ringgit ($12.1 million) if the “non-current assets held for sale” are included in the current assets total. It has a working capital deficiency of 144.2 million ringgit ($34.4 million) if the non-current assets held for sale are excluded.

The working capital ratio is another measure of liquidity. It is calculated by dividing current assets by current liabilities. A ratio of “1” means that the company has enough cash on hand to pay all its immediately foreseeable debts.

MBC has a working capital ratio of 0.78 if the “non-current assets held for sale” are included in “current assets” and it has a working capital ratio of 0.37 if those “non-current assets held for sale” are excluded.

A further measure of solvency is the “acid test ratio” which excludes from calculation all assets that are not actually cash or very cash-like securities. It adds together cash, marketable securities, and accounts receivable (i.e. money that the customers owe the business for services or goods provided). It excludes assets like inventory.

Excluding MBC’s consumable stores and its non-current assets held for sale gives a highly liquid pool of accounts receivable, short-term deposits and cash worth about 79.8 million ringgit ($19.0 million). Dividing that by a total current liabilities of 228.1 million ringgit ($54.5 million) gives an acid test ratio of 0.35.

About Malaysian Bulk Carriers

Founded in November 1988, MBC listed on the Kuala Lumpur Stock Exchange (now called the Bursa Malaysia) in 2003.

MBC operates a fleet of about 17 ships, six of which are owned vessels and the remaining 11 are chartered in to the fleet.

The company operates four post-panamax bulkers with dimensions of 229 meters long, 36.5 meters wide and each with 87,052 deadweight. Three of those post-panamax ships are owned by the company and the other is chartered.

MBC also operates seven supramax bulkers (grab-fitted) that range in capacity from 55,652 deadweight to 61,500 deadweight. These vessels, four of which are chartered by the company and the other three are owned, are about 32.26 meters wide by 190 meters to 200 meters long. They have draughts ranging from about 12.6 meters to about 13 meters.

The company also operates a small, chartered fleet of handysize bulkers ranging in size from about 29,562 deadweight to 36,320 deadweight. The handysize vessels have a draft of about 9.72 meters, lengths of about 171 meters to about 177 meters and widths of about 27 meters to 28 meters.

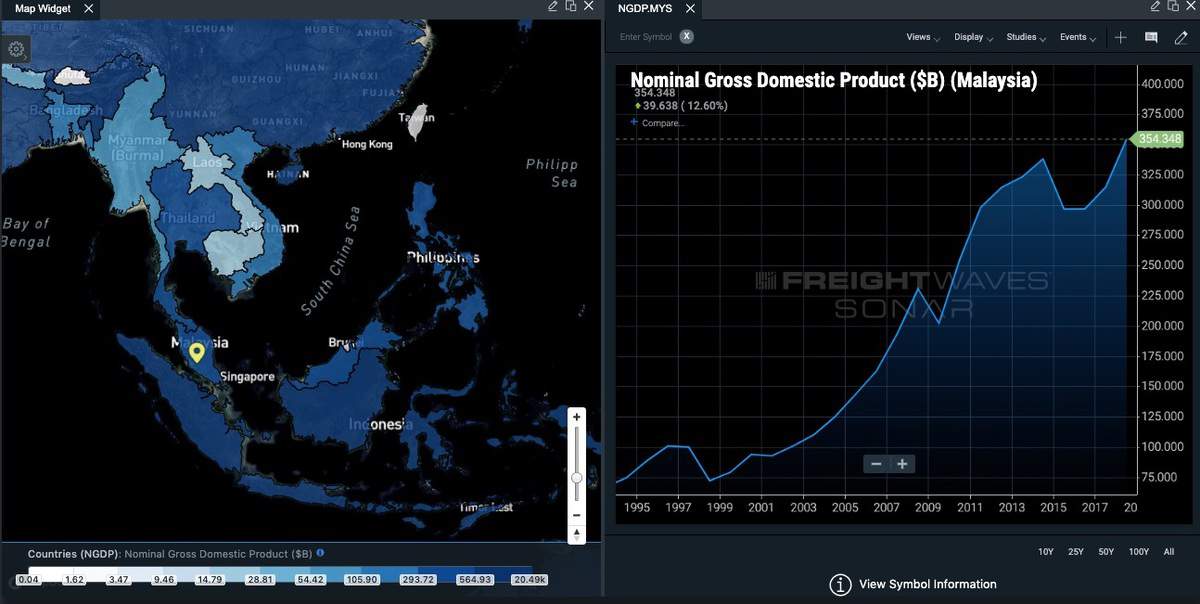

Malaysia’s freight and economy in graphs

Read more stories by Jim Wilson. Jim is based in Australia but he mostly covers Asia’s maritime sectors. He can be reached with comments, suggestions and tips via jwilson@freightwaves.com.