Despite its takeover by ocean carrier, Swiss freight forwarder keeping it multi-modal with introduction of rail service from China to Europe.

As if ocean shipping did not have enough to deal with, including low freight rates, bigger ships arriving, and a major fuel change next year, now rail wants to take its boxes.

Thanks to China’s “Belt and Road” initiative, more rail services are now linking the Far East with Europe. While ocean shipping still remains the number one source of goods trade between the two continents, Eurasia’s rail service does appear to be on an uptick.

This month, Swiss freight forwarder Ceva Logistics (SIX: CEVA) introduced a block train service linking the Chinese port city of Xiamen with western Germany. The block trains can carry up to fifty, 40-foot marine containers on the twice weekly service.

Ceva, which is in the process of being folded into CMA CGM, said containers from other Asian countries can be trans-shipped to Xiamen, the 14th-largest port in the world, to take advantage of the new service, which offers a transit time of 16 to 17 days.

That compares to a transit time of 23 to 27 days via ocean freight to Europe’s largest port.

Shippers do pay about 30 percent more for the block train service versus an all-water route, said Kelvin Tang, Director of road and rail at Ceva Logistics. Yet for shippers involved in automotive, high-tech and even fashion, the speed advantage outweighs the cost.

“The multi-modal service is a valuable alternative for all shippers in the need of saving time because, in comparison to all-ocean, door-to-door lead time is about 10 days shorter,” Tang said.

“For the coming years we are expecting a growing demand for this service,” he added.

Rail service between China and Europe predates the Belt and Road initiative. In 2011, rail service started between the southwestern city of Chongqing, China to western Germany. That encouraged manufacturers such as Hewlett-Packard, Foxconn and Volkswagen to set up manufacturing sites in China.

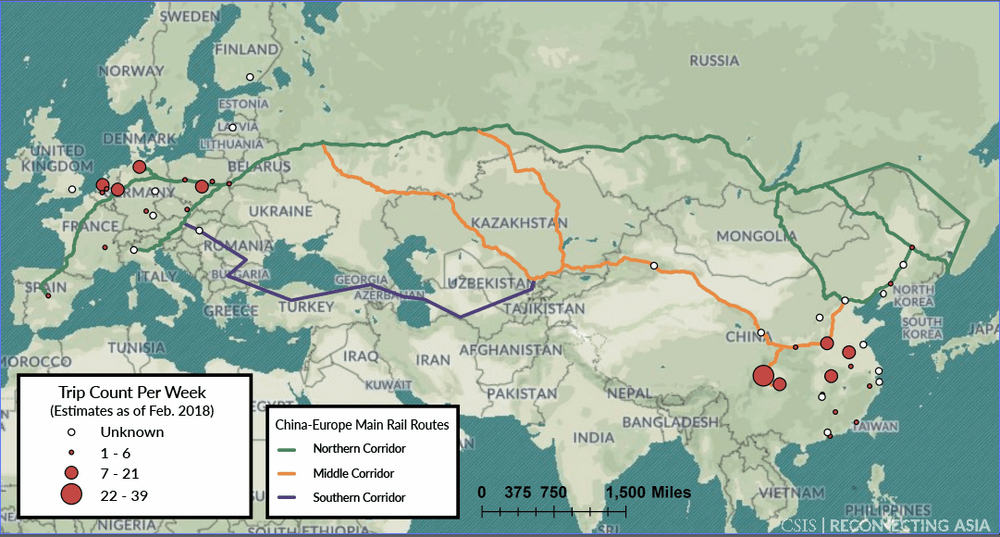

Including that initial service, there are now some nine different routes totaling 61,400 miles of track that link China and Europe, according to Richard Pomfret, an economics professor at the University of Adelaide.

Pomfret said there’s been a “trial-and-error” process for finding which route is commercially viable for shippers. But the German Federal Railway said carrying containers on the service from China is its most profitable route.

To be fair, ocean shipping is still the predominant way to move freight from Asia to Europe with some 23 million twenty-foot equivalent (TEU) containers moving between the two continents.

But according to United Transport and Logistics Company, a Moscow-based joint stock company that promotes rail service through former Soviet republics, about 10 percent of the seaborne volume “could be delivered by the railways of Eurasia very efficiently.”

It said China-Europe-China rail volumes reached 350,000 TEUs last year. It was not immediately clear how much of the backhaul volume is comprised of empty containers.

Of course, not everyone believes Eurasian rail service is really commercially viable. Critics cite higher energy consumption of rail shipping versus ocean shipping, the delay in handing off containers at borders due to different railway gauges and the major subsidies that China may be using to help keep the cost of service more competitive with ocean shipping.

But Ceva’s Tang said China’s plan to expand its market reach through the Belt and Road initiative “will most probably trigger an increase of transportation demands between China and Europe and we are especially developing our ground products and service.”

ONE deploys super efficient ship on Asia-U.S. East Coast trade

Hull design and fuel efficient diesel engine are features of 14,000-TEU ship. (Marine Insight)

ExxonMobil makes IMO 2020 fuel pledge for U.K. refinery

Oil major plans $1 billion investment in U.K. refinery to boost low-sulfur fuel production. (Ship & Bunker)

Hapag-Lloyd says it’s cool with IM0 2020 targets

Liner reduces fuel use in addition to meeting emissions targets. (Shipping and Freight Resource)

Now can we talk about IMO 2050?

Engineering firm says carbon-reduction technology is ready for shipping. (Ship & Bunker)