Ocean carrier reports unaudited full-year results including its acquisition of UASC, but volume gains have yet to add to profit.

Hapag-Lloyd (FSE: HLAG): squeezed out a slightly better operating profit after a full-year of results including its acquisition of United Arab Shipping Company. But the ocean carrier still faces headwinds from fuel prices.

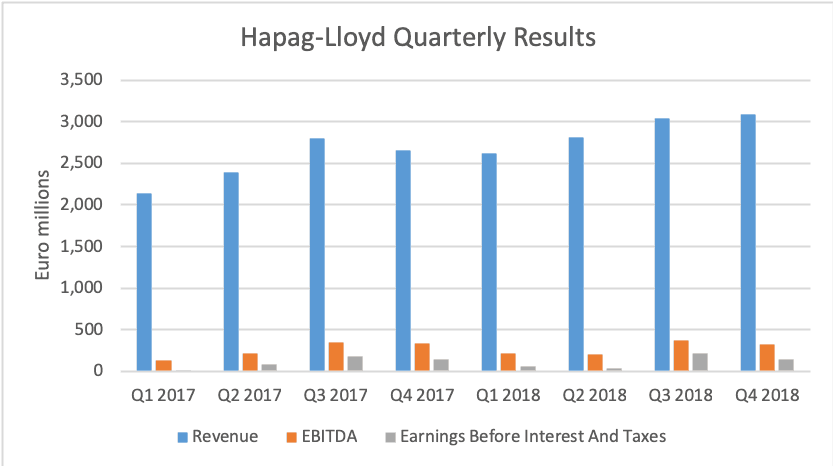

The fifth largest ocean carrier reported revenue growth of 15 percent for last year reaching €11.5 billion ($13.6 billion) for the year, with total volumes rising 21 percent to 11.8 million twenty-foot equivalent (teu) for the year. The gains come thanks to the full year of reporting results from the UASC buyout, which closed in mid-2017. If the two had been combined for all of 2017, volumes would have been up 6 percent for the year.

Operating profit for the company came in at €1.138 billion for the year, an 8 percent gain and near the upper end of guidance Hapag-Lloyd gave for 2018 results. This despite freight rates dropping 1.5 percent over the year to $1,040 per teu. But fuel prices remain a wildcard for the industry with transport expenses up 18 percent to €9.4 billion amid marine fuel prices rising from $318 per metric ton to $421 per metric ton. Operating margin was also weaker, dropping to 9.9 percent for the year.

U.N. body aims to finalize details about IMO 2020 switchover

International Maritime Organization rules aim for global consistency. (Maritime Executive)

U.S.-China trade detente could help energy commodities

Growing trade in oil and liquefied natural gas set for boost with trade truce. (Bunkerworld)

Port of Oakland gets good marks for credit rating agency

Fitch says port’s capital spending plan is manageable in light of uncertain trade. (Maritime Professional)

Cold storage industry sees $1 billion deal

Second largest U.S. cold storage firm Lineage Logistics buys peer firm. (Wall Street Journal)

LNG bunker may get boost from FERC decision

As the ocean shipping heads to a 2020 reckoning on lowering its sulfur emissions, one choice for meeting that goal is using liquefied natural gas (LNG). But it’s at best a distant third to the other alternatives, including low-sulfur marine fuel and installing sulfur scrubbers on board ships. Ship classification society DNV estimates that roughly 500 ships will use LNG by the 2020 deadline. This compares with over 2,000 sulfur scrubbers expected to be installed on ships, with the other roughly 50,000 commercial vessels largely aiming to use low-sulfur marine fuel.

The big issues blocking LNG are natural gas reserves and the cost of the infrastructure. On the first score, the U.S. is in a pole position to supply the world with LNG since it has the fourth largest natural gas reserves behind Russia, Iran and Qatar. It’s the infrastructure that’s the bigger challenge due to costs of building specialized LNG fuelling terminals and the regulatory hurdles involved in siting and construction. But FreightWaves John Gallagher reports that the federal agency in charge of LNG facilities plans to start fast-tracking permits.

The Federal Energy Regulatory Commission said it it will increase the number of engineers reviewing LNG projects and will take over decision-making steps handled by other federal agencies. FERC chairman Neil Chatterjee said the new process has “strategic significance” for cutting through the red tape now facing U.S. LNG projects. An LNG lobbying group says “this streamlined review process will allow for a more robust discussion on LNG bunkering in the U.S.”