With the second quarter of 2018 coming to an end this past Saturday, we saw tender rejections spike to their highest level since January at almost 27%. Major markets like Atlanta and Dallas hit highs for the year topping out around 31% and 26% respectively. Both are southern tier markets that have been increasing since early May.

The Los Angeles market, which had been on the climb since early May, has stalled out for the moment on rejections. The rejection rates exiting LA market are still elevated, but not increasing at the torrid pace they were on. The last week saw only a 1.5% increase versus the almost 24% increase it has experienced since mid-June.

In terms of rates, DAT showed some impressive rate expansions with lanes like LA to Phoenix jumping to new highs at $3.37/mile in June. Atlanta to Dallas pushed through the $2/mile range for the first time and landed at $2.08, a 16% increase for the month. National dry van rates show a 9% jump from May.

We would expect a moderation to occur as we enter the first week of July, as many shippers have pushed volumes off their docks. Carriers were also attempting to deliver as much as they could to claim the revenue in the quarter. Also, the occurrence of the 4th of July has an impact on order rejections, as many drivers take vacation or attempt to get home time this week.

With the holiday being on a Wednesday the impact may not be as much as when it falls closer to the beginning or end of a week. Long weekends are simply not as much of an option. Tender Lead times corroborate the lessened impact of the holiday on shipper behavior as they remain 4.5% below Memorial Day levels.

With all that being said, the freight market is still very heated. A period of contraction as compared to historical expansion does not mean we will enter a transportation recession. Rates probably wont climb as quickly as they have been over the past month is all.

Something we will be looking at very closely, will be how the market behaves in the second week of July. Container spot prices are falling from China indicating volumes may also be on the decline after spiking in May. Reefer rejections are stabilizing as well, moving down over 5% in the last week after peaking at 42.5% the week prior. Reefer use and import volume spike are 2 big reasons for June destabilization as production cycles ramp up in China and warmer weather brings produce and the need for climate-controlled trailers.

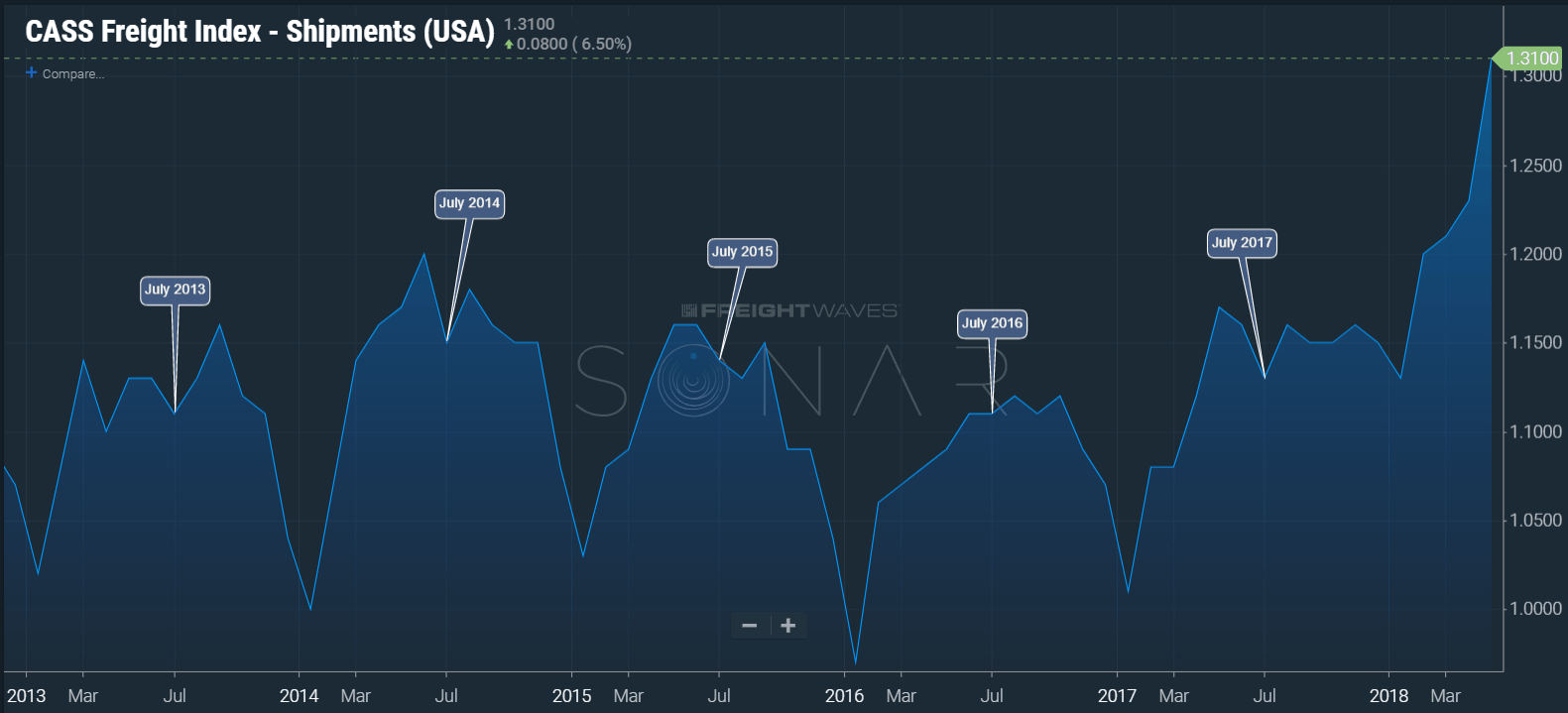

July traditionally sees a reduction in shipment volumes sequentially compared to June so we should see some relief in the freight markets this month. One thing we really cant count on however is the past predicting the future. Looking at the Cass Shipment Volume Index you can see the previous July pattern of declining, but also one glaringly obvious point, we are in an entirely new pattern compared to the previous 10 years, or at least on another scale. “Relief” is relative in this instance, so don’t expect those carriers who gave you a rate increase in March to reverse course this month.

Check out this week’s weekly market update video for a quick look at the overall market.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.