While we can’t get into Jeff Bezos’ head, and we don’t always know which home in which city he’s inhabiting, we can speculate about where Amazon’s HQ2 will land. We can also do this using the best minds, and best data available to us. If this helps Amazon’s decision-making, it’s all in a day’s work.

Amazon has promised to name a location this year for the HQ2 project, which it claims will ultimately employ 50,000 people. Amazon refuses to comment further about the timeline, but there is widespread speculation it could narrow the list of finalists as soon as this month.

The company listed four main criteria for the new location:

· Metropolitan areas with more than 1 million people.

· A stable and business-friendly environment.

· Urban or suburban locations with the potential to attract and retain strong technical talent.

· Communities that think big and creatively when considering locations and real estate options.

We’re using data from SONAR, and also bouncing off what’s already been analyzed (report card style) from other sources. Why? Because for one thing, our SONAR data is telling us one thing from a logistics perspective, but there are certainly other equations to factor in. Plus (most elusive of all) how do you get into Jeff Bezos’ head?

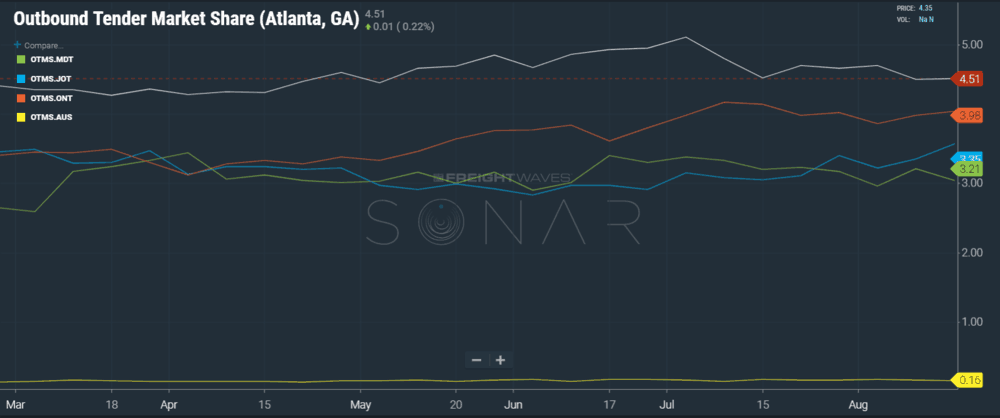

And by the way, SONAR is easy. All you have to do is check out the Outbound Tender Market Share (OTMS). You can look at it as a whole via the map view, and you can also look at it city by city through the chart view.

What does the OTMS tell us? It’s a relative index that measures the number of accepted loads in individual markets in relation to total accepted load volume for the day in the U.S. The sum of all the markets equals 100. Market share percentages tell you what markets have the most impact on truck volumes. A larger market share means the market demands more trucks and has a larger impact on freight market capacity. When market share levels change, network imbalances can show up creating potential spot market activity.

No doubt, Amazon’s location will need to be strategic from a freight perspective. It may well be the single-most overall important factor.

So, here’s the FreightWaves Top 5 most likely places HQ will go to based on our criteria:

5. Los Angeles

SONAR OTMS.ONT says: 3.98% of all U.S. accepted loads that day. That puts them second only to Atlanta in freight movement.

L.A. is great for plenty of reasons, not the least of which are the sheer number of locations (nine submitted locations), a major airport, and (a-hem) the largest port in North America. Nevertheless, no matter how you slice it, that still has Amazon on Pacific Time to anywhere. Historic fires can’t be helping, either.

4. Austin

SONAR OTMS.AUS says: 0.16% of all U.S. accepted loads that day. Yikes.

No state has a better infrastructure, and the state’s business climate is the picture of stability, thanks to the nation’s best all-around state economy, according to CNBC’s assessment. Austin offers not only those attributes but also a legendary tech scene fed by the state’s major university, and a diverse, hip vibe that tech talent can love. For these reasons, and getting a little more central in overall location, we ranked them higher than L.A. But other than being a cool place to live, from a freight perspective, we’re calling it here: Austin ain’t happenin’.

3. Chicago

SONAR OTMS.JOT says: 3.35% of all U.S. accepted loads that day.

Will the Windy City reclaim a part of its heritage by winning Amazon’s HQ2? After all, Sears and Montgomery Ward were the Amazons of their day. Chicago does have some of the world’s most prestigious universities, such as Northwestern and the University of Chicago. It is the transportation hub, which includes O’Hare International Airport, which is set to undergo an $8.5 billion expansion. But Illinois is also the antithesis of stability and business-friendliness.

2. Atlanta

SONAR OTMS.ATL says: 4.51% of all U.S. accepted loads that day.

Atlanta wins from a purely freight perspective. And, don’t forget the Mason Mega Rail Project! The Georgia Rail System is impressive as it is consisting of over 5,000 route miles that run through most of the state’s 159 counties, and it’s about to get a lot bigger. Georgia Ports Authority and other officials last week broke ground on the $127 million Mason Mega Rail Terminal. The project will increase the Port of Savannah’s rail lift capacity to 1 million containers per year, and open new markets that will span an arc of cities from Memphis to St. Louis, and from Chicago to Cincinnati. It doesn’t hurt that the Georgia Ports will soon support 439,000 jobs, according to a UGA study.

1. Northern Virginia

SONAR OTMS.MDT says: 3.21% of all U.S. accepted loads that day.

Just south of the Mason Dixon line, Northern Virginia (just outside of D.C.) could well be the ideal spot for Bezos and company, and ranks as FreightWaves’ top choice. Just look at that population density all around! Yet at the same time, you’re not in the actual population glut. You’re strategically positioned for the megalopolis of D.C., Baltimore, Philadelphia, New York. You also have access to the Pittsburgh, Cleveland, Chicago corridor, and you have the Charlotte and Atlanta corridor as well. Being in Northern Virginia could be a really smart logistics move with access abounding, but not suffering from the effects of actually being in the density. This is important if, for nothing else, the cost of real estate.

Why didn’t we choose other highly-rated contenders, Denver, Miami, Raleigh, Nashville, or Boston?

Denver is an island. Real estate is bad, and warehouse costs will be “high” because of the marijuana boom.

Miami is far away from everything. In short: it’s a terrible place for freight.

Raleigh has been discussed as a dark horse candidate. While it’s true that most of the arguments made for Northern Virginia generally apply to Raleigh (other than being about 3.5 hours south), and it does have loads of talent from the “research triangle” and many institutions of higher learning, it just seems small. Another bottom line: there’s not nearly as much freight.

Nashville’s real estate is expensive, and it’s not geographically ideal. Little freight comes out of neighboring states Alabama or Mississippi or Kentucky. It has a single, highly-congested corridor in I-24/I-65/I-40. That’s about it. Nashville should first consider a professional baseball team.

Boston, especially when compared to Northern Virginia, is more expensive, more congested, and not as accessible to the rest of the country.

So, where in the world is Bezos? Who knows? But you know where his head’s at? We’d say if he’s thinking from a freight perspective it’s probably in Northern Virginia, with a strong chance of Atlanta.

Zach Strickland contributed to this report.