Fuller: spot rates in “free fall conditions”

On Thursday afternoon, FreightWaves CEO Craig Fuller and Chief Economist Ibrahiim Bayaan hosted their Monthly Market Update webinar discussing the state of the macro- and freight economies. FreightWaves presented our findings in partnership with Convoy, which provided proprietary data and slides.

Fuller opened the webinar with three announcements. FreightWaves is launching a Shipper of Choice Award to highlight the shippers that operate with best-in-class service for carriers; FreightWaves Radio, a weekly radio show on SiriusXM, will begin broadcasting on February 23; and our futures exchange allowing shippers, carriers, and 3PLs to hedge against spot market volatility will open trading on March 29.

After that bit of housekeeping, Bayaan turned to macroeconomics.

The long and short of is that while overall economic indicators like gross domestic product (GDP) growth and unemployment look relatively healthy—with growth decelerating to trend—the particular metrics most relevant to the movement of freight are flashing red.

Industrial activity, exports, oil production, and housing are all markedly weak.

“It’s pretty clear that the economy is slowing down from where it was in the middle of last year,” Bayaan said. “I don’t think it’s gone so far as to contract, necessarily, but the pace of growth has calmed down quite a bit. And the things in the economy that help drive freight movements are doing worse than the overall economy.”

Bayaan said that GDP growth in the first quarter of 2019 would probably come in under 2 percent, partially due to an approximately twenty basis point hit from the government shutdown, which also led to the cancellation of a number of government data releases.

“The beginning part of this year is getting off on a pretty weak footing,” Bayaan said.

The Institute for Supply Management’s (ISM) Manufacturing Index, fortunately, is not gathered by the federal government and therefore did not experience an interruption. Unfortunately, Bayaan said, new orders—which are leading indicators of manufacturing activity—are falling rapidly.

“The new orders suggest [the manufacturing index] won’t see the same level of growth it has in the past,” Bayaan said.

“Some of the government data has not been released, some of it lags already, but it looks stronger than the underlying freight data,” Fuller added. “There’s really no underlying growth in freight activity into this year, and that has us a bit concerned. Throughout the month of January we’ve seen volumes slow down from where we started.”

“Spot market rates are in what I would call free fall conditions,” Fuller said, with the caveat that large enterprise carriers that have been deliberately building up their dedicated business should be insulated from the worst effects of softening demand.

“3PL margins are expanding and shippers are finding really low cost trucking services by being able to play in their routing guide more efficiently. I would expect more freight to hit spot as shippers wake up [to market conditions],” Fuller said.

Fuller displayed two charts built SONAR data on the webcast that directly impacted asset-based carriers. The first showed the spread between diesel rack prices (wholesale) and Department of Energy retail prices (which form the basis for fuel surcharges). Large enterprise carriers buy fuel at rack-plus rates, but their fuel surcharge compensation is calculated from DOE averaged retail prices; when that spread expands, trucking companies capture an unearned windfall, Fuller said.

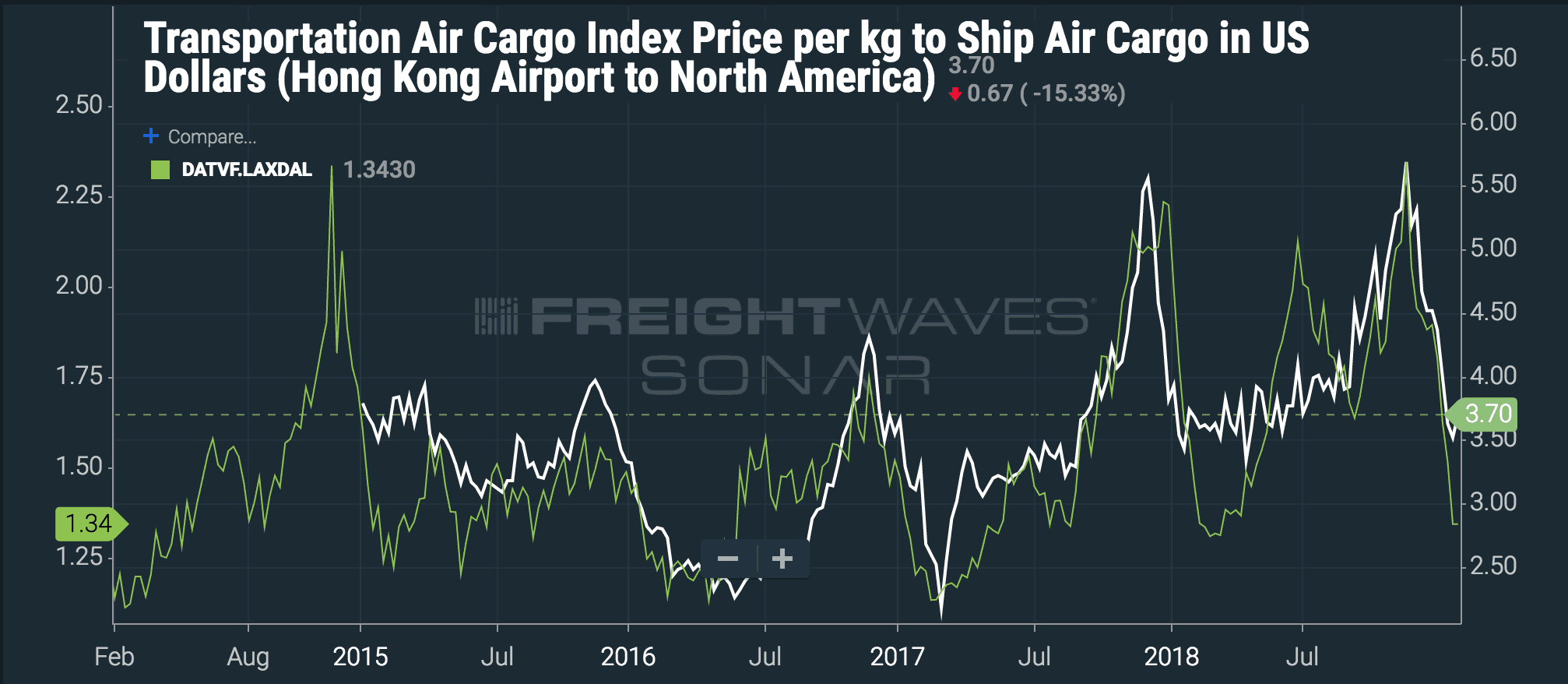

The second chart displayed air cargo rates from Hong Kong to North America against trucking spot rates from Los Angeles to Dallas.

“Air cargo leads the inventory cycle,” Fuller said. “Air cargo is last in and first out of a cycle, and we’re seeing air cargo rates come down.”

The question and answer period at the end of the webinar was fruitful.

“When freight rates eventually slow down, do you see driver pay receding?” one listener asked.

“When the economy goes to hell, people will rive trucks,” Fuller said, “but as long as the employment market stays strong, you’re going to have a problem [finding drivers].”

“Generally speaking,” Bayaan added, “it’s hard to reduce wages. You’ll see layoffs, but it’s hard to just reduce wages.”