National freight volumes remain elevated after increasing rapidly at the end of February. After increasing almost seven percent last week, the Outbound Tender Volume Index for the U.S. receded only slightly as it hovered over the 10,000 threshold this past week. The index is based on March 1, 2018 volumes with its base value being 10,000 on that date. A value of 10,076, its value as of Wednesday, indicates there is 0.76% more load volume in the nation than on March 1 of last year. That volume number could be counter-intuitive to many because rates are quite subdued compared to this time last year, with DAT reporting average national rates 11% lower than March’s average last year.

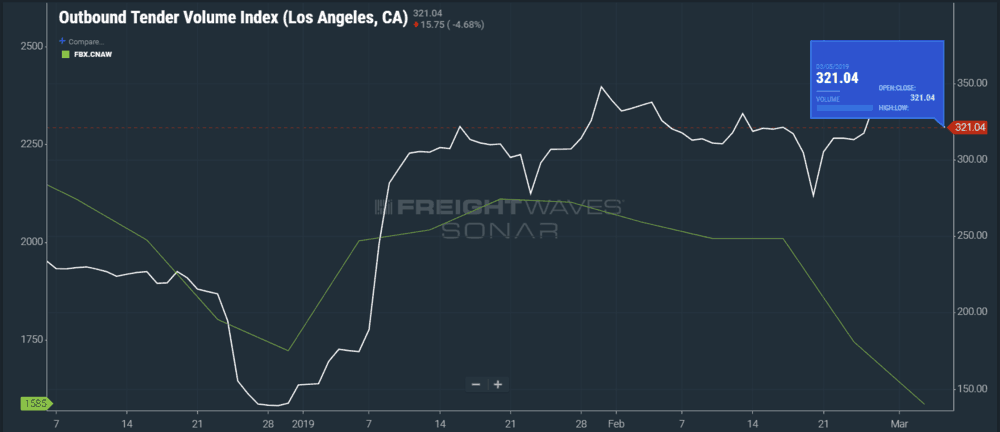

Over the past several months many of the loads originated on the West coast as Los Angeles and Ontario in southern California grew from 5.4% of the total market volume in April of last year to over 8% currently, according to FreightWaves Outbound Tender Market Share Indices. This past week the coastal market of L.A. associated with the ports had volumes decline significantly, falling roughly 4% week-over-week. Volumes remain relatively strong from the region, averaging 58% higher from a year-over-year perspective, but this is coming off values that were almost double that of a year ago last week.

The Freightos Baltic index measuring the average spot rate for 40-foot containers moving from China to the North American West Coast has dropped 21% to $1,585 in the past two weeks after being over $2,000 for the first seven weeks of 2019. The rapid decline in rate is expected coming out of Chinese New Year, but this also means the port is getting a break, which should lead to lowered volumes in the L.A. market in the near term.

Capacity has not been an issue with rejection rates dropping below 2% in the past week. The past few days, however, the outbound tender rejection rate from L.A. has pushed back to 2.08%, jumping 27 bps in 2 days. This value is still historically low, and the long-term trend is still declining with little room to fall much more.

National rejection rates have remained depressed entering what tends to be a more volatile month seasonally, remaining below 7.4% as of Wednesday, but they have started to tick up over the past few days after bottoming on March 3rd at 7.23%. The increase is still not enough to think the general capacity situation has changed. Carriers are still accepting most of their freight as options are limited for continued truck utilization.

Looking forward, March has a seasonality component where volumes increase and, subsequently, capacity becomes tighter. The former has already occurred, but capacity remains very loose. Volumes have begun to increase out of several markets with 75 of the 135 markets showing week over week increases in volume. This is a significant occurrence due to the fact last week was elevated already due to month end. If the volume persists out of other areas of the U.S., capacity will tighten in earnest.