This week national freight volumes (OTVI.USA) gained about two percent, and despite a minor mid-week dip in tender rejections (OTRI.USA), turndowns essentially stayed flat at 6.73 percent.

The distribution of freight across the country’s markets is growing wider, a continuation of last week’s trend. The largest freight markets, such as Ontario, Atlanta, Los Angeles, Harrisburg, Joliet, Houston, and Dallas all lost market share. Mid-sized markets like Allentown, Charlotte, Cleveland, Philadelphia, Detroit, and Stockton gained market share.

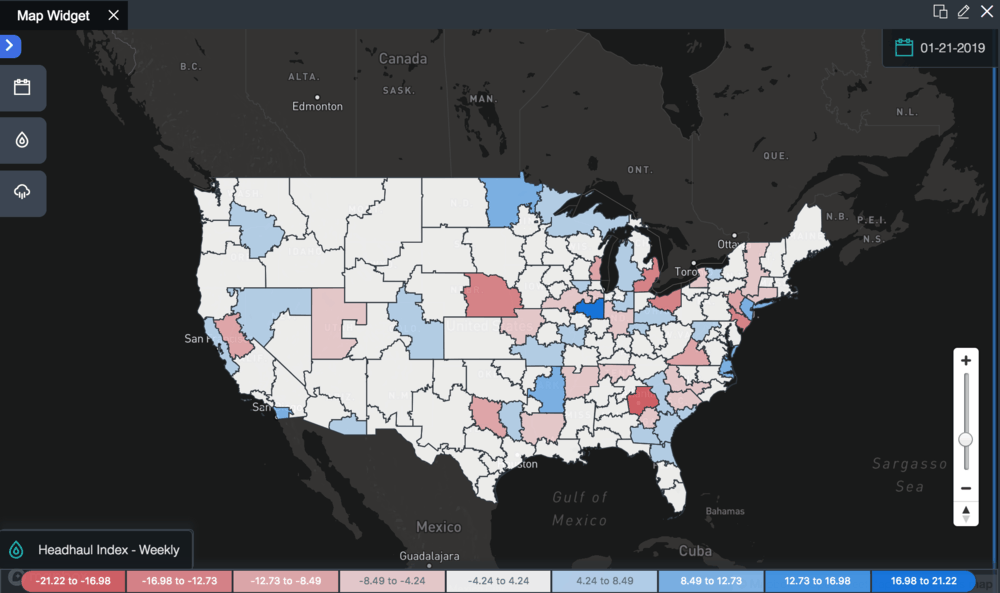

As freight flows rebalance, new markets are breaking into positive territory on our Headhaul Index. The Headhaul Index is calculated by subtracting inbound volumes to a given market from the outbound volumes leaving that market. A positive score indicates that more freight is being shipped out of a market than into it (think Los Angles), making it a favorable destination for carriers who want a backhaul out of the market. A negative score indicates that more freight is being shipped into the market than out of it (think Miami), making it an unfavorable destination for carriers who will get stuck or be forced to deadhead out.

This week, markets like Little Rock, Bloomington, Savannah, Norfolk, and Jacksonville moved further into positive territory, tilting toward a carrier-friendly headhaul bias. On the other hand, Atlanta, Detroit, and Cleveland saw negative movement in their headhaul scores and became less favorable markets for carriers to enter.

Reefer capacity finally loosened in Midwest markets like Joplin, Kansas City, Jefferson City, St. Louis, and Quincy, where tender rejections fell by as much as 12 percent this week. Capacity seems to have shifted to relieve some of the extraordinary tightness shippers felt earlier, and warmer weather also reduced the demand for freeze-protection equipment.

Some of the major freight lanes saw slight deterioration in dry van spot rates over the course of this week: Chicago to Atlanta dropped to $1.84/mile exclusive of fuel, while Los Angeles to Dallas is starting to stabilize at the very low rate of $1.27/mile exclusive of fuel. In the past five years, spot rates have generally bottomed out at some point in February, but a continued slowing of industrial activity in the larger economy may mean that trucking rates have lower to go before recovering in May. On Wednesday, Federal Reserve Chairman Jay Powell lowered forecasts for gross domestic product growth to 2.1 percent for 2019.