The freight market is remarkably stable far this March. Volumes remain decent as the National Outbound Tender Volume Index hovers above the benchmark 10,000 line, but capacity is readily available in just about all corners of the country, with very few isolated pockets of instability. The national tender rejection rates have stalled around 6.4%–down 17 bps since last week–as we approach the end of the month, meaning spot rates should remain relatively flat until some unforeseen change occurs.

Outbound L.A. volume remains the driving force in the market as the massive inbound container market fueled the region with plenty of freight to keep trucks busy on the West Coast. Volumes have started to recede from the coastal market after peak volume was attained at the end of February when the L.A. Outbound Tender Volume Index hit 362, an all time high since the index for the market was created in October of 2017 when the value was around 198. The index is currently sitting art 316, which is still historically high. The average value for the entirety of 2018 was 215, which means volumes are 46% higher currently than last year’s average.

The freight-producing engine does appear to be running out of gas as total West Coast container volumes have fallen 9.6% below last year’s February levels after having a record January. Spot rates for shipping 40-foot containers from China to North America’s West Coast fell another $97 this week, continuing a five consecutive week decline.

It is unclear how much potential energy this volume has pumped into warehouses in the West Coast but the data suggests the regional movements account for anywhere from 9 – 12% of the total freight market volume over the past month.

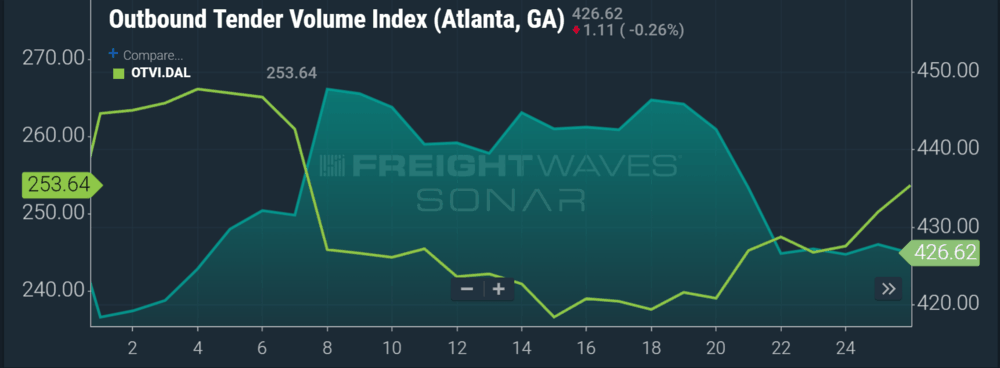

Earlier in the month some of the larger markets such as Atlanta and Dallas showed signs of life before retreating. The two markets, representing roughly 6.75% of total outbound freight volume in the U.S., have had an inverse relationship: where Dallas volumes fell on March 8th, Atlanta volumes surged. In the last week Atlanta volumes fell 4.3% while Dallas volume jumped 5.77%. As with most markets in the U.S. currently the volume has not had a significant impact on capacity or rates with tender rejection rates out of Atlanta dropping below January levels at 3.36%. Dallas turndowns hit a bottom in early March at 3.10%, before starting a slow ascent to their current position at 3.64%.

The market appears to be oversupplied, as carriers are accepting over 93% of their contracted freight tenders, meaning they do not have as many options to use their trucks in any other manner but with their contracted shippers. It should be noted the market is not extremely soft in terms of volume as it is averaging 5% higher than January and February levels. The combination of gradual increases in volume with no large emerging markets or shifting dynamics from the West Coast to other areas of the country have made this March the softest in two whole years.

National spot rates in March of 2017 averaged $1.25 not including fuel or assessorial charges. The current average is $1.35. The market is still decent, but we’re in a very different place from 2018.