Freight markets continued to show signs of weakening as the outbound tender volume index (OTVI) for the U.S. fell another 3.3% over the past seven days. It’s typical to see a drop in volume after a quarter end, but there are other signs the market may be softening outside of a normal seasonal cycle. Tender rejections have also dropped over the past 7 days, falling from 17% to 15.27%, as carriers have been more willing to stay true to their contracted rates and offer capacity.

The most recent value, however, is a new annual low. Rejection rates fell from summer highs close to 26% in late June to 17.31% in early August where values hovered until the end of September. Since October 1st, tender rejection rates have fallen daily.

Tender rejection rates are a measurement of carrier sentiment, which is a combination of available capacity and attitude toward their contracted rates. Pairing tender rejections with volume gives a more complete picture of capacity both physical and managed.

A similar scenario played out in early spring when volume and rejection rates fell significantly, though not as low as they currently are now. Volume is roughly 1% lower and rejection rates are about 7% lower than they were on April 10th, a similar time due to the beginning of a quarter.

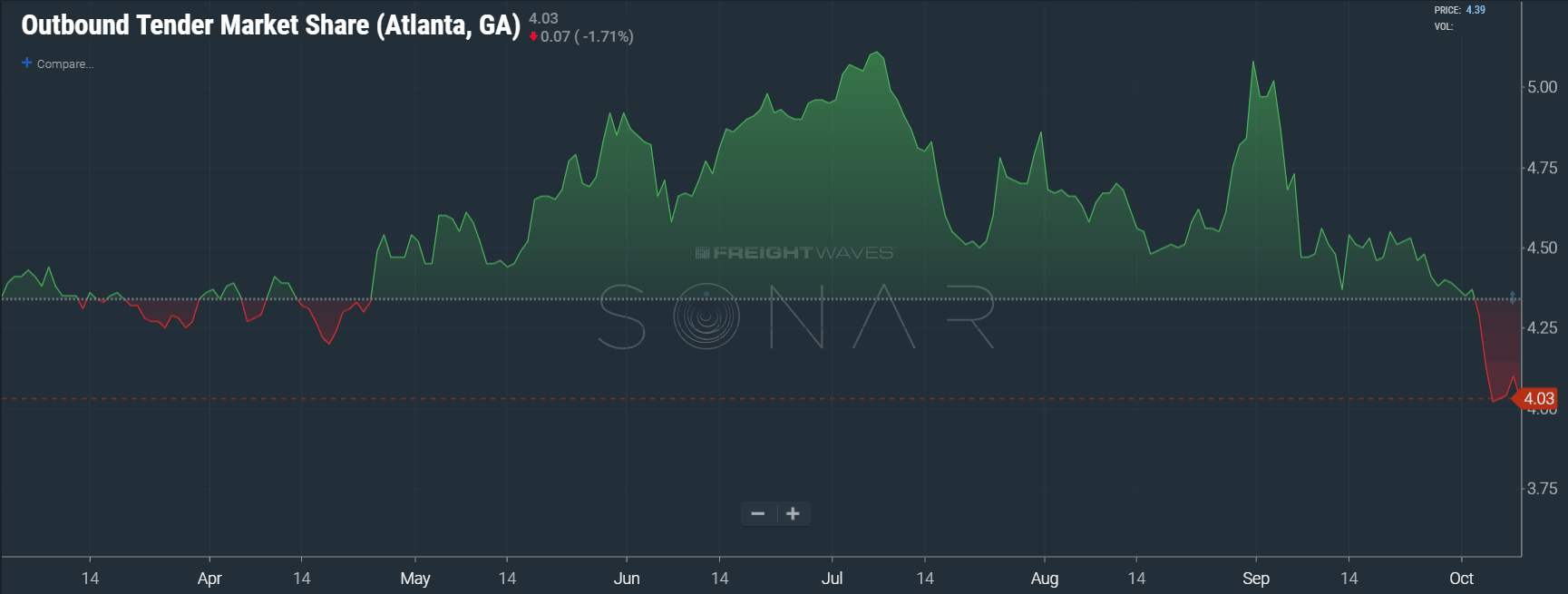

The Atlanta market appears to be one of the biggest drivers of the market drop as volume has dropped 14% since the beginning of the month out of the area. Atlanta averaged 4.61% of the total U.S. outbound market share from March 1st to the end of September. That value now sits at 4.03%, an annual low.

The Atlanta drop is disproportionate to the rest of the country. The next question to ask is where did that volume go? From this information we can figure out where the freight is moving.

One of the biggest gainers in outbound market share has been the Los Angeles market. Over the past 3 months L.A. has gone from having a 2% market share to 2.63% with the biggest increase coming towards the end of September. The significance of this is the fact the L.A. has been pulling trucks west, and now there is a potential black swan event in the form of Michael, a major hurricane, hitting the Florida Panhandle.

The potential disruption to freight markets with a hurricane come from the initial emergency relief efforts normally lead by FEMA and the subsequent rebuilding of the infrastructure. Items such as water, temporary shelters, blankets, and medical supplies are positioned in the area to help those affected as the recovery effort begins. The second part of the equation, the rebuilding, has the longer running impact, but the impact is not as immediately felt in freight markets as emergency relief efforts.

There has been little noticeable effect in the market from Michael so far. Elevated rejections in the Tallahassee market are to be expected, but the Florida Panhandle is not densely populated nor is it a large freight market with much industry outside of tourism. Michael also sprung up relatively quickly, becoming a category 4 hurricane (winds exceeding 130mph) in less than 4 days after initial recognition as a system of interest.

Unlike Florence, whose impact to the Carolinas was forecast over a week in advance, Michael’s arrival gave less notice. The speed of development and movement has taken many, including meteorologists, by surprise as original forecasts put it around a high-end category 1 at landfall, leaving little time for preparation. Also, unlike Florence, Michael will have much more wind related damage to inland areas as the system is much stronger in that regard.