Truckload carrier Marten Transport brought in a lot more revenue in the fourth quarter of 2022 compared to a year earlier but posted a much smaller gain in net income.

Net of fuel, operating revenue at Marten (NASDAQ: MRTN) rose 15.8%, though total operating revenue, which included fuel, climbed 20.9%, to $322.6 million from $266.9 million in the fourth quarter of 2021. Operating income rose to $32.78 million from $30.67 million, and after taxes and other charges last quarter of about $500,000, net income came in at $25.5 million compared to $24.73 million in the fourth quarter of 2021, a gain of 3.2%.

That small level of improvement in net income stood out in a table provided by Marten on its financial performance during the pandemic.

Operating revenue year on year has grown every quarter since the first three months of 2020, with even the crazy second quarter of 2020 posting a gain of 0.1%. The year-on-year gains in 2022 sequentially were 28.8%, 41.8%, 29.1% and 20.9%.

But the fourth-quarter net income increase of 3.2% was easily the lowest in the series since the pandemic began. In only one other quarter since then did net income growth in terms of percentage fail to crack double digits.

One notable cost line: Salaries, wages and benefits rose 18.2% to $104.7 million from $88.6 million a year ago. Part of that likely is because the company’s fleet of drivers rose 425, according to a provided statement from Executive Chairman Randall Marten. Marten does not hold an earnings call with analysts.

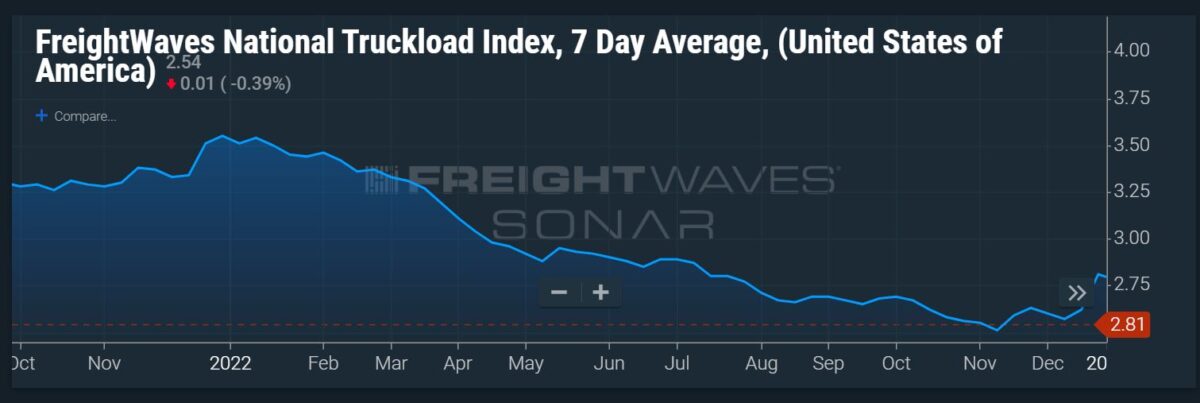

Purchased transportation rose 11%, to $60.6 million from $54.6 million, even as freight rates as measured by the National Transportation Index in SONAR declined over the course of the year, from a range of about $3.30 to $3.50 per mile to $2.60 to $2.80.

Net of fuel, the operating ratio for Marten as a whole deteriorated 100 basis points, to 87.8% from 86.8%. The comparison suffered because Marten’s truckload segment posted a decline in its OR net of fuel to 87.6% from 83.9%, as operating income in truckload dropped to $13.41 million from $14.75, a 9.1% decline. Truckload revenue net of fuel rose $16.7 million, to $108.5 million, a gain of 18.2%.

The company’s intermodal segment was hammered in the quarter, seeing its operating income drop 78.1% to $728,000 from $3.32 million in the fourth quarter of 2021. That led to an OR of 97.% for the group. Revenue net of fuel in intermodal declined slightly, to $22.8 million from $23.3 million.

The operating ratio in dedicated net of fuel climbed to 85.4% from 88.7%. Brokerage recorded a similar improvement, rising to 88.5% from 90.2%.

For the full year, operating ratios at Marten did not change much between 2021 and 2022. Truckload deteriorated slightly to 85.6% from 85.3%. Dedicated improved to 85% from 86.9%. Intermodal was slightly worse at 89.4% compared to 89.2%. Brokerage improved to 88.9% from 89.8%, leading to a consolidated OR of 86.4%, better by 400 basis points from 87% in 2021.

Marten ended the year with $80.6 million in cash on its balance sheet, up from just under $57 million at the end of 2021.

Todd Fowler, chief transportation analyst at KeyBanc, said the results at Marten show that “consistent execution is increasingly a hallmark of results, and in our view, a culmination of efforts to diversify freight offerings (dedicated, brokerage, intermodal) and a disciplined approach to rates.”

Fowler also said that on a follow-up call with Marten executives, the discussion “highlighted seasonal trends January-to-date (we interpret as soft) and as usual, the quarter will be determined by March trends,” Fowler wrote. “Despite weaker volumes, commentary suggests initial contract renewals are closer to flat vs. meaningfully lower, with driver pay expected to stabilize at recent levels.”

Investors have reacted positively to Marten’s earnings. The stock shot up from about $20.60 when the earnings were released late Tuesday, climbing as high as $22.22 Wednesday before falling back to $21.72 at about 12:50 p.m. Thursday.

According to Seeking Alpha, Marten’s net income was in line with consensus estimates and revenue came in slightly higher than forecast.

More articles by John Kingston

Marten’s Q3 compared to year ago but slows from Q2