Marten Transport rode a strong first-quarter performance in its Dedicated division to net income slightly higher than the corresponding quarter of 2019, but with the company’s operating revenue and operating income both rising more significantly than net income.

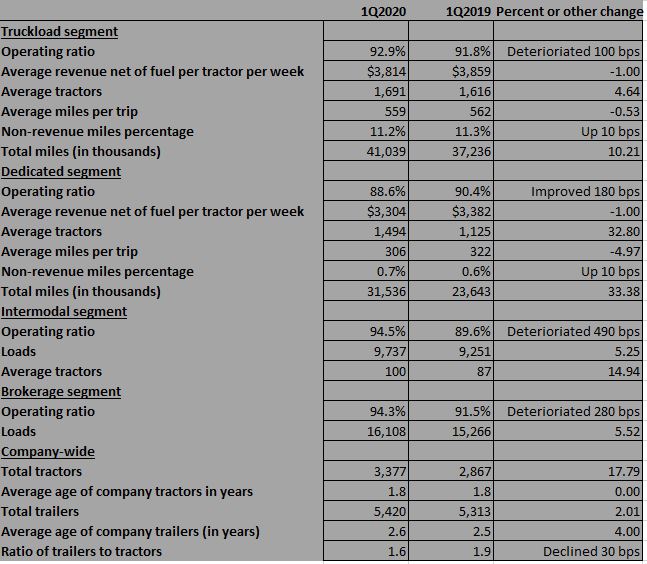

The operating ratio in the company’s Truckload, Brokerage and Intermodal divisions was down in all three segments. But the Dedicated division turned in a strong enough performance to offset those declines.

Net income for Marten (NASDAQ: MRTN) came in at 25 cents per share, flat with last year’s first quarter on a dollar gain of just $172,000. But operating revenue of $218.6 million was up 9.8% from Q1 2009.That revenue total beat estimates by $11.1 million, according to SeekingAlpha. The EPS figure of 25 cents came in 1 cent more than estimates for that metric.

Investors liked the earnings. Post-close, according to Barchart, Marten stock was up 4.37% to $22.20 at approximately 5 p.m. It had risen 3.25% to $21.27 earlier in the day.

In the past month, through trading Thursday, Marten stock was up 25.12% Its high during that period was $23.03.

The Dedicated division had a strong quarter. Revenue net of fuel surcharge was up 31.1% to $64.15 million. Its operating income climbed 54.7% to $8.533 million, an increase of just over $3 million from the first quarter of 2019. Dedicated’s operating ratio strengthened to 88.6% from 90.4% in Q1 2019.

The Dedicated division took care of all the good news coming out of Marten. Operating income in the Truckload division declined 10.2% to $6.785 million. Its operating ratio weakened 110 basis points to 92.9%. But the Truckload division was busy; its revenue was up 4.6% net of fuel surcharge, and total miles rose 10.21% to just over 41 million miles.

The smaller Intermodal and Brokerage divisions also were pointing down. Operating income at Intermodal fell sharply to $1.3 million, a drop of 45.4%. Loads were up to 9,737 from 9,251, but the operating ratio rose significantly, to 94.5% from 89.6%.

Brokerage’s OR climbed to 94.3% from 91.5%. Its operating income plummeted to $1.4 million, a decline of 37.9% on a revenue decline of 6.8%.

Marten does not hold a call with analysts, and a call by FreightWaves to Marten for further comment had not been answered by publication time. But in the company’s press release accompanying the earnings, Marten Chairman and CEO Randolph Marten focused on the company’s drivers and the Dedicated division.

“We added 101 Dedicated and 73 Truckload tractors during the first quarter on top of our growth of 329 Dedicated and 101 Truckload tractors throughout 2019, all while further tightening our stringent hiring standards for experienced drivers,” Marten said in the statement. “We embrace our responsibility to keep our valued employees safe and healthy as they each contribute to our transporting and distributing the food, beverages and other consumer goods essential to millions of people in North America.”

A few other highlights from the earnings:

— Marten grew its cash position significantly during the quarter. It rose to $36.13 million at the end of March, up from $31.46 million at the end of December.

— Accounts payable rose sharply, to $34.8 million from $22.9 million, a jump of almost 52%. The $34.8 million figure is higher than any other quarter in 2019. But it’s not extraordinary; Marten listed accounts payable at $43.87 million at the end of 2018 and $38.1 million at the end of 2017.

— Salary expenses rose significantly, to $65.92 million from $59.38 million, a gain of 11%. Purchased transportation also rose, up 17.8% to $38.67 million.

(Correction: the operating income for the Intermodal division was reported incorrectly in the first publication of this story.)

Mary jo Lindberg

Could you please translate this to English please

Secrets

Newsfilter.io/a/fff4760df434* corporate welfare trucking companies or something