The Boeing Co. (NYSE: BA) reported a fourth-quarter net loss of $1.01 billion on Wednesday largely because of the 737 MAX grounding. It’s the first annual net loss for the company since 1997.

The Federal Aviation Administration banned the aircraft from the air in March after two fatal accidents in a five-month period, and it is uncertain when the plane will fly again.

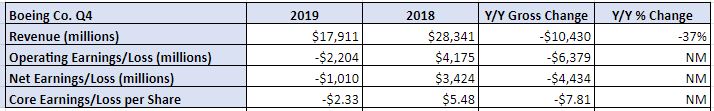

The manufacturer posted a quarterly core loss per share of $2.33 on revenues that dropped 37% from a year ago to $17.91 billion. Analysts had been expecting earnings of around $1.73 per share and revenues of nearly $21.7 billion, according to media reports.

For the full year, Boeing reported a net loss of $636 million and a core loss per share of $3.47 on revenue of just under $76.56 billion. In 2018, Boeing had net earnings of $10.46 billion, or $16.01 per share, on revenues of nearly $101.13 billion.

The company had a negative operating cash flow of $2.22 billion in the quarter and almost $2.45 billion for the year.

“We recognize we have a lot of work to do,” said Boeing CEO David Calhoun.

Boeing Commercial Airplanes (BCA) had fourth-quarter revenues of $7.46 billion, down 55% from a year ago, and an operating loss of $2.84 billion.

BCA fourth-quarter results included $2.6 billion in 737 production costs and an additional $2.6 billion pretax charge related to estimated potential concessions and other considerations for MAX customers. In addition, the suspension of MAX production in January and an eventual gradual return to production at low rates will result in about $4 billion in abnormal production costs, most of which are expected to be incurred this year.

Boeing has taken $18.6 billion in charges related to the MAX grounding so far.

787 production schedule

BCA delivered 79 planes in the fourth quarter, including 45 787s. Boeing previously said it planned to adjust its 787 production rate to 12 planes a month from the current 14 per month in late 2020 and then to keep it there for two years. Now, after the late 2020 reduction to 12 per month, the company plans to dial it back further to 10 per month in early 2021, before returning to a rate of 12 a month in 2023.