Malaysia-based port, engineering and property giant MMC (BM: 2194) shrugged off the trade war and economic headwinds to report significant increases in revenues and profits. Analysts are enthusiastic about the stock.

MMC reported revenues of 1.2 billion Malaysian ringgit ($297.4 million) and a total comprehensive income of 88.4 million ringgit ($21.1 million) for the three months ending September 30, 2019.

Equities analysts at MIDF Research have issued a note maintaining a “buy” recommendation on the stock. They noted that there was growth in container throughput and argue that seaborne trade will remain “resilient” compared with air freight. The analysts also commented that MMC’s Port of Tanjung Pelepas in southern peninsular Malaysia, adjacent to the city state of Singapore, “would not be directly susceptible to the trade tension between U.S and China as it mainly caters to intra-Asia trade lanes.”

They added that the IMO 2020 low-sulfur regulations “could spur transhipment volumes especially at [the Port of Tanjung Pelepas] as shipping liners will want to mitigate higher operating expenses from more expensive fuel.”

Analysts also foresee synergies from the full acquisition of Penang Ports, “supported by the container terminal business and the cruise terminal operations that will be driven by the growth in tourism in Penang.”

Group numbers

MMC’s revenues surged in the third quarter to 1.2 billion Malaysian ringgit ($297.4 million), a 32% increase on the 944.1 million ringgit ($228 million) generated in the third quarter of 2018.

The conglomerate experienced a generally rising cost environment, too, with the third-quarter cost of sales rising by 42.5% to 798.5 million ringgit ($190.6 million), alongside rising administrative expenses (up 8.4% to 224.0 million ringgit ($53.5 million) and a rise in other operational expenses (up 18.4% to 86.9 million ringgit ($20.7 million).

Profit before zakat and taxation was 120.2 million ringgit ($28.7 million), up by 35.4% in the third quarter of 2019 compared to the corresponding period in 2018. “Zakat” is one of the five fundamental obligations of Islam; it is a religious obligation to pay, subject to certain conditions, charitable donations for the relief of the poor.

Group total comprehensive income in the quarter ending September 30, 2019 quarter was 88.4 million ringgit ($21.1 million), a 41.4% rise on the prior corresponding period.

In the nine months ending September 30, 2019, revenues were 3.6 billion ringgit ($864 million), a 5.7% increase on the corresponding period ending September 30, 2018; gross profits were 2.26 billion ringgit ($538.7 million), which was a decrease of 0.4%; profit before zakat and taxation was 340.6 million ringgit ($81.3 million), a 76.4% increase; while total comprehensive profit was 203.2 million ringgit ($48.5 million), a 64.7% increase.

Port financials

MMC has four main businesses: Ports & Logistics, Industrial Property, Engineering & Construction, and Energy & Utilities.

MMC’s Ports & Logistics division generates the bulk of the group’s revenues. In the nine months to September 30. 2019, the division generated 2.4 billion ringgit ($564.2 million), which was about 65% of the group’s total revenues for the period. And those revenues increased by 8.3% when compared to the corresponding period in 2018.

Management attributed the growth to the effect of the consolidation of revenues from Penang Port, which MMC bought, and higher volumes handled at both the Port of Tanjung Pelepas and Johor Port, both of which are container ports and are located at the southern end of peninsular Malaysia.

Profits were boosted by compensation paid by Rising Star Shipping and its protection and indemnity insurer, The Shipowners’ Mutual, in respect to an overflow of 2,500 metric tonnes (2,756 U.S. tons) of marine fuel oil at the Port of Tanjung Pelepas in July 2017. MMC received 18.3 million ringgit ($4.4 million), which put an end to litigation by the company against the shipowner and its insurer. There was also a higher contribution to profit by the group’s Red Sea Gateway Terminal in Saudi Arabia.

The segment’s 2019 nine-month profit before zakat and taxation stood at 314.7 million ringgit ($75.1 million), an increase of 10% on the corresponding period in 2018.

Looking forward, the company commented that “continuous investments into the ports’ infrastructure, capacities and capabilities along with execution of operational plans are expected to deliver positive results. Operational and cost synergies driven by MMC would further improve the performance of its Ports & Logistics division.”

About MMC

Kuala Lumpur, Malaysia-based MMC is a major ports and terminals operator. It either owns and operates, or has very substantial equity holdings in, a number of ports. These include the Port of Tanjung Pelepas (70%); Johor Port, Northport (nearly complete ownership); Penang Port; Tanjung Bruas Port (70% shareholding and it is the operator); and the Red Sea Gateway Terminal (20% shareholding). It also owns 49% of rail cargo operator KTMB MMC Cargo. MMC is also the owner of Seaport Worldwide, the landowner and developer of the Pelepas Oil Hub.

In addition, MMC owns 99% of Kontena Nasional Berhad, an integrated logistics company. KNB provides trucking, container haulage, contract logistics, project cargo and other truck-related transport along with warehousing services.

MMC is currently suing the former CEO of KNB, Hood bin Osman. It alleges a breach of employment contract, fraud and “various breaches of duty of care under common law and the Companies Act 2016.” MMC is pursuing a claim of 66.6 million ringgit (just under $16 million) against bin Osman. A trial date has been set for early February next year.

MMC owns a variety of power, water, land development and major engineering companies as well.

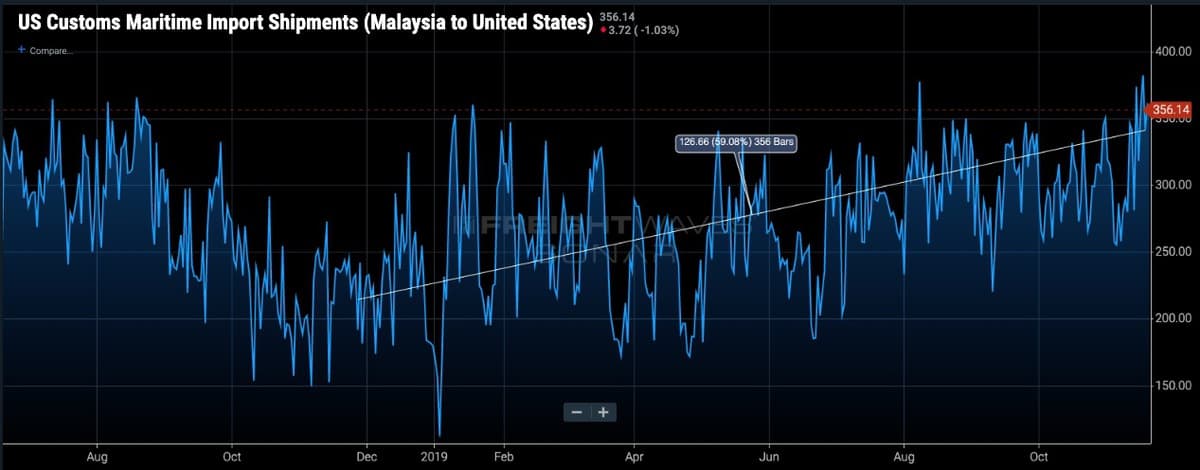

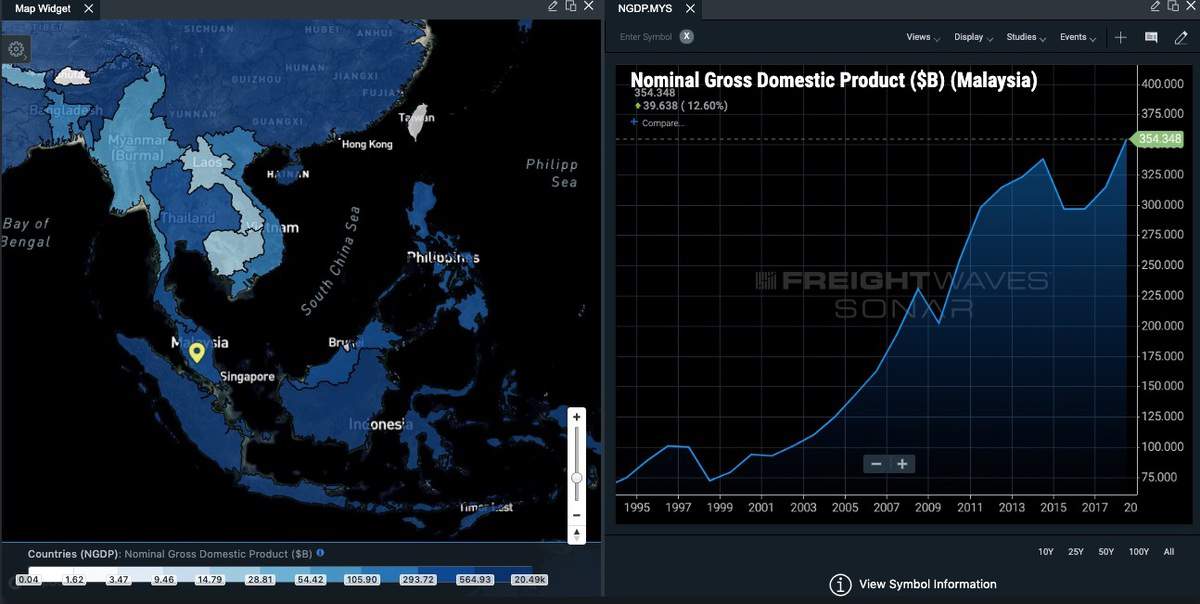

About Malaysian trade

Read more stories by Jim Wilson. Jim is based in Australia but he mostly covers Asia’s maritime sectors. He can be reached with comments, suggestions and tips via jwilson@freightwaves.com.