Borderlands is a weekly rundown of developments in the world of United States-Mexico cross-border trucking and trade. This week: Mexican fishing vessels will be barred from US Gulf ports; Mexico drops to third place among U.S. trade partners; Canada joins Mexico in a USMCA automotive dispute; and FedEx will open a distribution center in central Texas.

US to close Gulf of Mexico ports to Mexican fishing vessels

Mexican fishing vessels will not be able to enter U.S. ports in the Gulf of Mexico starting Feb. 7 due to the alleged illegal capture of red snapper in American waters, according to the National Oceanic and Atmospheric Administration (NOAA).

NOAA is the federal agency that deals with unauthorized fishing fleets in U.S. waters and has cited Mexico for “its continued failure to combat unauthorized fishing activities by small hulled vessels (called lanchas) in U.S. waters.”

“NOAA fisheries has announced port restrictions on all Mexican fishing vessels that fish in the Gulf of Mexico. These vessels are prohibited from entering U.S. ports and will be denied port access and services,” NOAA wrote in a report released Wednesday.

The announcement caps a yearslong investigation by U.S. officials aimed at protecting red snapper stocks along territorial waters in the Gulf of Mexico.

“[NOAA] has made a negative certification for Mexico until such time that there is sufficient evidence to support a positive certification, which will require a decrease in the number of Mexican lancha incursions into the U.S.,” NOAA said.

The U.S. has imported more than $100 million worth of fresh and frozen red snapper (15 tons) from Mexico since 2018, raising concerns that these imports may have included fish harvested illegally in U.S. waters, according to the NOAA.

During fiscal year 2021, the U.S. Coast Guard apprehended 78 lanchas, seized 15,484 pounds of catch and detained 208 fishermen from Mexico in the Gulf.

Mexican authorities have told U.S. officials that they are making efforts to address the illegal fishing activities in the Gulf.

Mexico was not the only country cited for violations in the NOAA report. China, Costa Rica, Guyana, Russia, Senegal and Taiwan were cited for using vessels that violated conservation measures adopted by various global fishing agreements.

Watch: Salvatore Mercogliano discusses the White House Supply Chain Disruptions Task Force’s response to the shipping crisis on FreightWaves What the Truck?!?

Mexico drops to 3rd place among US trade partners

For the third month in a row, China was the primary trading partner of the U.S., followed by Canada in second place and Mexico in third.

China recorded $64.5 billion in two-way trade with the U.S. in November, according to WorldCity’s analysis of the latest U.S. Census Bureau data.

Canada totaled $61.4 billion in trade with the U.S. during November, a change of 31% compared to the same month a year ago.

Mexico had $58.7 billion in two-way trade with the U.S. in November. Mexico was the second-ranked U.S. trade partner in October but was slowed by exports, which fell 1.6% from October to November.

Port Laredo in Texas remained No. 3 among the nation’s 450 airports, seaports and border crossings in November. The port’s total trade for the month was $21.63 billion.

Chicago O’Hare International Airport ranked No. 1 among U.S. gateways at $31.5 billion in November, followed by the Port of Los Angeles at $24 billion.

Laredo’s top trading partner country for the month was Mexico, which accounted for 98% of total trade, or $21 billion, followed by China at $141 million and Japan at $62.3 million.

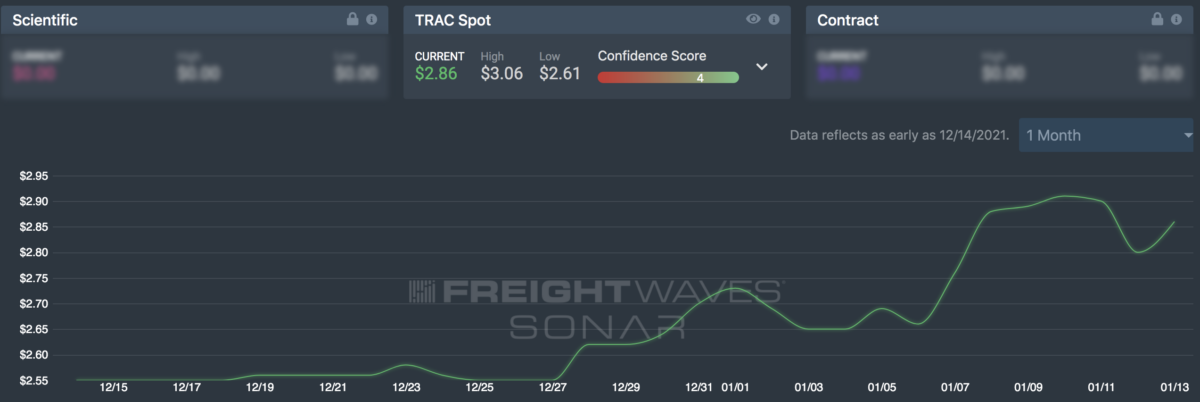

FreightWaves’ Trusted Rate Assessment Consortium (TRAC) spot rate from Laredo to Detroit fell slightly over the past week. The lane between the two cities is an important freight corridor for auto parts. The FreightWaves TRAC rate in this dense lane decreased by 2 cents per mile to $2.86.

The fluctuation in spot rates are likely the result of capacity cooling following the holidays and produce imports from Mexico beginning to pick up. Laredo’s load balance is neutral, with capacity loosening due to downward pressure on spot rates.

Canada joins Mexico in USMCA automotive dispute

Canada is joining Mexico to challenge how the United States is interpreting North American trade rules that govern duty-free cars and trucks.

Trade Minister Mary Ng said Canada would join Mexico’s request for a dispute resolution panel under the terms of the U.S.-Mexico-Canada Agreement (USMCA) trade pact to challenge the way the U.S. is assessing regional content in vehicles built in North American factories.

In Canada the agreement is referred to as the Canada-United States-Mexico Agreement (CUSMA). Mexico formally made the request for a dispute resolution panel last week.

USMCA auto rules of origin requirements establish how much of a vehicle must originate in North America in order to qualify for tariff-free status — 75% under USMCA, compared with 62% under the now replaced North American Free Trade Agreement.

If vehicles qualify for the rules of origin auto content, the exemption from tariffs amounts to 2.5%.

Mexico and Canada’s disagreement with the U.S. centers on how the regional content of vehicles is calculated. Both Mexico and Canada believe the trade deal stipulates that more regionally produced parts should count toward duty-free shipping than the U.S. wants to allow.

“The interpretation that the United States adopted in July 2020 is inconsistent with CUSMA and the understanding shared by the parties and stakeholders throughout the negotiations,” Ng said in a statement. “Canada, Mexico and the United States would all benefit from certainty that CUSMA is being implemented as negotiated, and Canada is optimistic that a dispute settlement panel will help ensure a timely resolution of this issue.”

A dispute panel will take about 30 days to form under the USMCA’s dispute settlement system and could file a final report within 180 days.

FedEx to open distribution center in central Texas

FedEx Ground will open a 25,000-square-foot distribution center in Temple, Texas, by the end of the year.

The facility will be located on 52 acres in the Temple Industrial Park. Located along Interstate 35, Temple is 65 miles north of Austin and 34 miles south of Waco.

“Temple offers quality access to key North American markets and has a strong workforce to support e-commerce growth,” Adrian Cannady, president and CEO of Temple Economic Development Corp., said in a statement. “FedEx’s distribution center will serve broader markets conveniently accessible from central Texas.”

FedEx did not specify how many jobs the facility will create.

Temple is home to several other logistics operations, including distribution centers for Walmart, the H-E-B supermarket chain, Performance Food Group and McLane Co.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

New truckload carrier aims to serve e-commerce and the middle mile

Mexican cucumber and squash imports costing US growers, trade agency says