Mexico ranked as the United States’ top trading partner for the second consecutive month in September, according to the most recent data from the U.S. Census Bureau.

Mexico’s total trade with the U.S. increased 23% year over year (y/y) to $67.4 billion in September, compared to the same period in 2021, with imports from Mexico accounting for $39.5 billion.

Computers ($3.6 billion), passenger vehicles ($3.3 billion) and auto parts ($2.8 billion) were the top three imports from Mexico to the U.S., according to Census Bureau data analyzed by World City. The top exports from the U.S. to Mexico were gasoline ($3.5 billion), auto parts ($1.51 billion) and liquified natural gas ($1.49 billion).

Canada was No. 2, as its total trade with the U.S. increased 22% y/y to $66.5 billion in September, compared to the same year-ago period. China rated third with $61.1 billion.

The U.S.-Mexico port of entry in Laredo, Texas, rated No. 2 among the nation’s 450 airports, seaports and border crossings in September. It is the second consecutive month Port Laredo finished second, having previously ranked third for the first eight months of 2022.

Port Laredo’s total trade with the world increased 25% y/y to $26.1 billion in September.

Chicago O’Hare International Airport rated No. 1 among U.S. gateways in September, accounting for $30.8 billion in trade. The Port of Los Angeles fell to No. 3 for the month with $25.1 billion in cross-border commerce.

In August, the Port of Los Angeles ranked No. 1 and O’Hare came in at No. 3.

Port Laredo’s top three imports in September included motor vehicle parts ($1.99 billion), passenger vehicles ($1.36 billion) and heavy-duty trucks ($999 million). Motor vehicle parts ($1.1 billion), diesel engines ($403 million) and gasoline ($400 million) represented the port’s top three exports.

Commercial truck crossings in Laredo increased 10% to 237,896 vehicles in September and 9.4% in October to 242,619 vehicles. For the first nine months of 2022, Laredo has processed 2.1 million truck crossings, an 11% increase compared to the same year-go period.

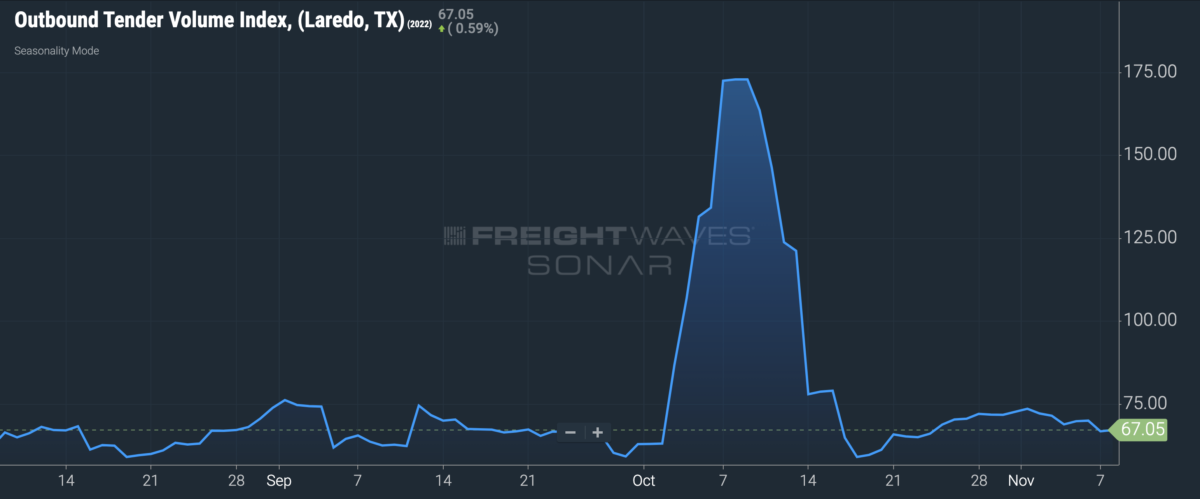

As of Tuesday, the freight market in Laredo was down 4.8% in outbound load volume week-over-week after a huge spike in trade in October, according to FreightWaves Sonar platform.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Cyberattack disrupts Mexico’s transportation system

Experts discuss how truckers can survive freight recession

Push to reshore US manufacturing motivated by global supply chain issues