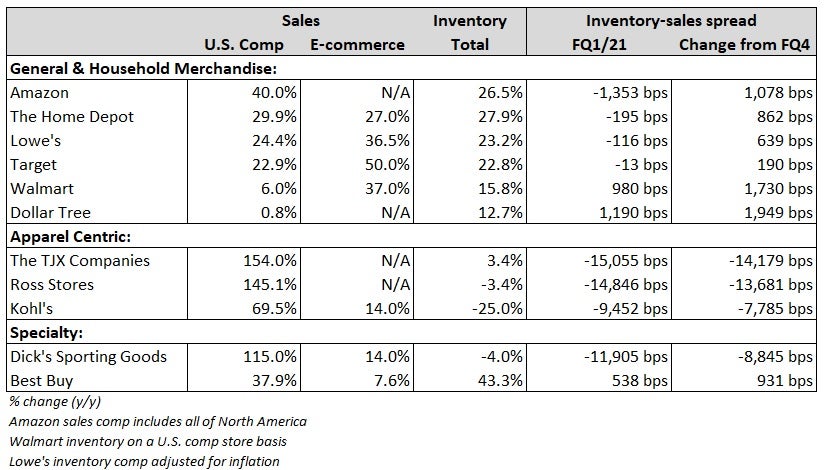

After a few quarters of sales growth significantly outpacing inventory additions, the two were closer to parity at retailers specializing in general merchandise and household goods during the fiscal first quarter, which concluded at the end of April. While stock levels are beginning to improve, it appears it may take retailers a while to rebuild positions to normal historical levels.

FQ1 retail reports show inventory positions improve on absolute basis, but there is some noise

Inventories of household, grocery and other consumable items were largely sold through during the fiscal first quarter of 2020. Retailers were carrying a normal amount of merchandise entering the pandemic but as panic buying and pantry stocking began, stock levels were quickly drawn down. Manufacturers and producers were knocked offline initially due to COVID protocols and have been unable to catch up to demand since resuming operations.

For more than a year now consumers have been buying, at a record-breaking pace at times, to accommodate lifestyles that include more home time. The spending spree has ranged from small basket sizes of household goods to big-ticket items in categories like home improvement, entertainment and exercise, all of which has been fueled by federal stimulus payments.

The combination of factors contributed to depleted inventory positions across the supply chain, a condition that remained evident through the retailers’ fiscal year ended January.

The latest quarterly reports from retailers appear to show progress in rebuilding merchandise levels even as manufacturing has been disrupted, freight is still delayed at the ports and transportation capacity remains historically constrained. The increase also comes as several companies have accelerated inventory turns, the benefit of supply chain initiatives implemented prior to COVID and then greatly advanced after the pandemic began, which presents a headwind to building stock levels.

However, the recent improvement on the inventory front is compared to the period that included the onset of the pandemic and a run on inventory, which was sudden and led to widespread stock-outs on several household merchandise SKUs.

Conversely, retailers with apparel-heavy product lines, like The TJX Companies (NYSE: TJX), Ross Stores (NASDAQ: ROST) and Kohl’s (NYSE: KSS), saw demand fall precipitously in the year-ago quarter. Those chains have been working through excess inventory relative to sales over the last year.

For retailers that benefited from COVID-related buying in the fiscal first quarter of 2020, the inventory comps in the recent quarter were easy and merchandise build should have been materially higher. Further, inventories are reported in absolute dollars and contain inflation, another tailwind for the year-over-year comps.

In fact, Lowe’s (NYSE: LOW) noted that $780 million of a $4.1 billion year-over-year inventory increase was specifically tied to inflation during the quarter. That number included surges in commodity prices for materials like lumber and copper and is not a fair comparison to inflation seen by household, apparel and consumer packaged goods retailers. But it’s probably safe to suggest that at least a few percentage points of inflation were reflected in the recent inventory increases.

A key measure of inflation, the personal consumption expenditures (PCE) index increased 3.6% year-over-year in April, according to recent Commerce Department data. Excluding food and energy, the index was up 3.1%, the highest level since 1992.

While retail inventories improved on an absolute basis, the comparisons are to depleted levels from a year ago and reflect inflationary increases. Also, most companies are still seeing inventory growth lag sales growth, suggesting the restocking is far from over.

What they said

Most management teams said they feel good or very good about current inventories. But the numbers show that many retail companies have continued to see merchandise additions trail sales growth, a dynamic that has been in place for a year now at most chains if not longer.

Retail giant Walmart (NYSE: WMT) noted increased in-stock levels on its fiscal first quarter call with analysts. However, management was quick to point out that the improved inventory position was relative to the year-ago quarter when it had sold through many household categories as consumers stockpiled items.

The company’s inventory-sales spread, or rate of inventory build less the rate of sales growth, increased 980 basis points as merchandise additions (+15.8%) outpaced sales (+6%) for the first time since its July 2019 quarter.

“Inventory increased 16%, reflecting strong sales growth and lapping last year’s COVID-related effects on inventory,” stated Walmart CFO Brett Biggs. “We continue to monitor industry challenges related to transit and port delays, and our merchants have taken steps to mitigate the challenges including adding extra lead time to orders.”

Management added that they were “still chasing” some areas of general merchandise.

However, Walmart competitor Target (NYSE: TGT) reported that sales and inventories grew at the same pace in the quarter. This follows several quarters wherein the company’s inventory growth has lagged sales growth, by wide margins in some instances. Target’s inventory drawdown has been strategic, in part, as it has been rightsizing apparel inventory following several quarters of pandemic-related demand weakness.

CFO Michael Fiddelke said he feels “really good” about stock levels currently but noted that positions “should be [higher], given the growth in sales that we’ve seen and continue to expect.” He said the company will be building inventories to avoid stock-outs going forward.

“We were sold through in a lot of seasons the last year and that’s not optimal for us. We don’t want to look at empty shelves at the end of a seasonal sale. So with our anticipation for growth in the remainder of this year, we’ll be buying appropriately. Hopefully, that means we’ve got fuller shelves at the end of the season.”

Fiddelke said the company was willing to take on the risk of having to mark down prices to move merchandise if demand were to weaken. He prefers that scenario to missing out on sales by not having adequate supply. “I would welcome a little bit of that rate drag so it means that we’re pulling in stock for the guest throughout the season,” he said.

Kohl’s reported a larger decline in its inventory-sales spread in the quarter. However, the company has been working to eliminate out-of-favor brands to decrease its overall apparel inventory. Kohl’s also reported a 10-year high in inventory turnover, a positive for operating performance, but a drag to the spread as stock is on the shelves for a shorter duration.

Management said the company has “never been as well positioned” for the back-to-school and holiday shopping seasons. Kohl’s raised its full-year net sales guidance to a mid- to high-teens percentage range from a mid-teens range, meaning additional inventory additions are likely.

Dick’s Sporting Goods (NYSE: DKS) noted “very clean” inventory and “robust product flow” on its quarterly conference call. The company reported a 115% year-over-year increase in same-store sales, in part due to COVID-related store closures in the year-ago quarter. Net sales were 52% higher than the first quarter of 2019.

The outperformance relative to expectations to start the year led management to raise its same-store sales guidance to a range of 8-11%, from a range of -2% to 2%. More inventory will be required to achieve the new outlook.

“We haven’t rebuilt our inventories yet but we are continuing to be fairly aggressive on our inventory buys for the back half of the year,” said Lee Belitsky, Dick’s CFO.

Adjusted inventories on par with historical comps but not on pace with demand

According to Census Bureau data, the retailers’ inventories-to-sales ratio plummeted to 1.1x in March from 1.23x in February. The latest reading is a record low and well below pre-pandemic levels of 1.45x.

In a report looking at the March data, Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business, said when pulling out motor vehicle and parts dealers’ inventories, which are severely depressed due to materials shortages, retail inventories are back to pre-COVID levels.

However, inventories haven’t kept pace with sales, and spending is now broadening to include apparel, grooming and beauty products as more people are out in public.

Record holiday spending at the end of 2020 carried into the new year. Retail sales surged again in March, following a weather-related sequential decline in February. April sales held March’s strength, basically flat sequentially. On a year-over-year basis, retail sales were up 14% in the first quarter and 27% for the latest three-month period, which included a notably easier comp in April.

The inventories-to-sales ratio for retail, excluding auto, stands at 1.04x, also an all-time low and below the pre-COVID long-term average of 1.22x. At the current rate of sales, Miller suggests $65 billion in inventory will need to be added ahead of the 2021 holiday season to reach the inventories-to-sales ratio held in 2019.

However, retailers only increased inventories by $35 billion in the March 2019 to October 2019 period.

More freight on the way to US ports

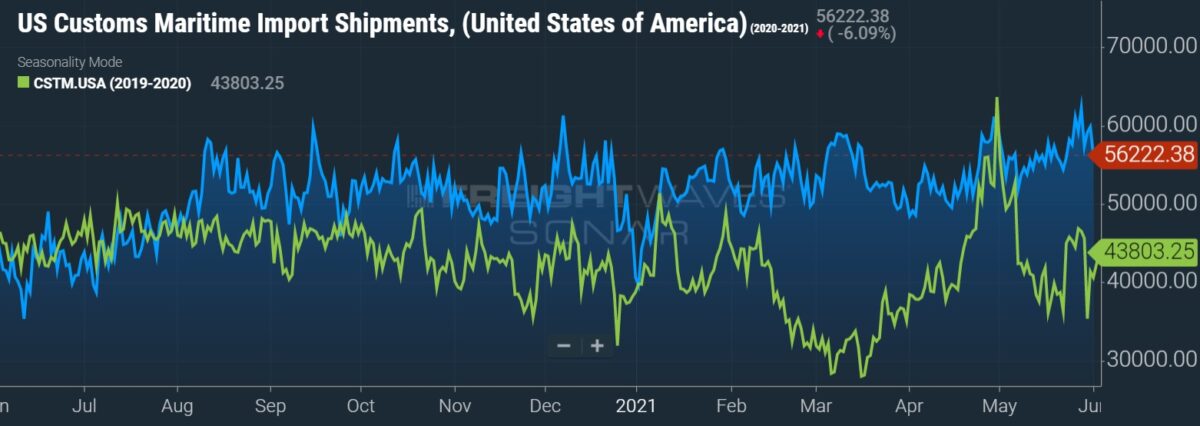

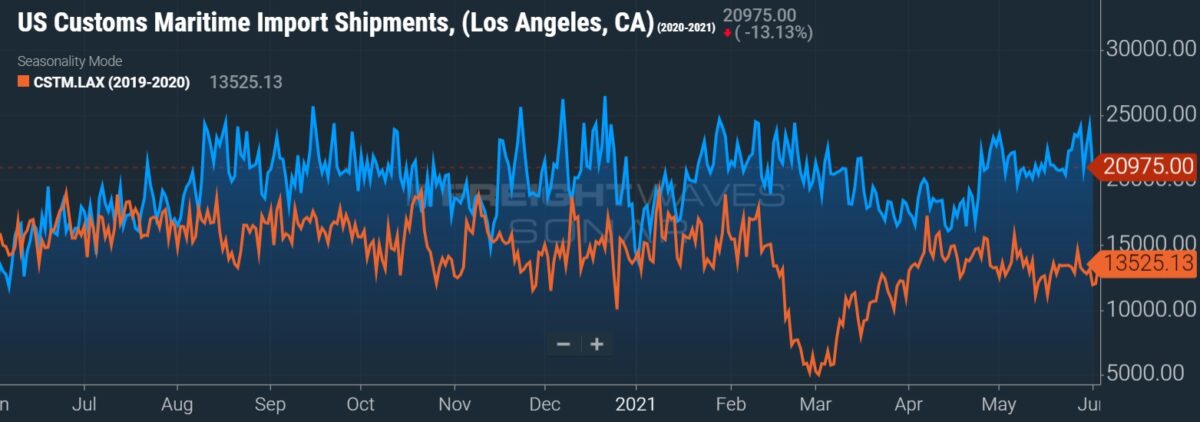

Container imports at the nation’s 10 largest ports were up 33.5% year-over-year in April to 2.05 million twenty-foot equivalent units (TEUs), according to The McCown Report. Total imports in April were only 3% lower than the seasonally strongest month of the year, October. Over the last three months, inbound containers were up 41% year-over-year to almost 6 million TEUs.

Future freight flows are likely to remain robust.

FreightWaves proprietary data shows inbound ocean bookings continue at a record pace. Ocean bookings to the U.S., measured as a 10-day-moving average of volume being tendered with ocean carriers and freight forwarders, are forward-looking and provide insight into volumes before they depart a port of origin.

“We remain confident that [North American] port and broader transportation volumes will continue their strength through 2Q and likely into 3Q,” said Bascome Majors, equity analyst at Susquehanna Financial Group, in his monthly port report to clients.

His forecast is supported by three primary catalysts: “1) a substantial backlog of freight waiting to unload at several large container gateways; 2) the constructive demand indicators from mega-retailers’ inventory and sales figures supported by a 30+ year low retail inventory-to-sales ratio; 3) and high-frequency data suggesting freight demand is still outstripping supply.”