A new survey of over 1,000 online grocery shoppers found that 72% has purchased groceries online in the past 90 days. While the base for online grocery shoppers is estimated to be 150 million, according to data from Statista, the new report from Chicory, the third such report in the past three years, shows a steady trend upward in online shoppers.

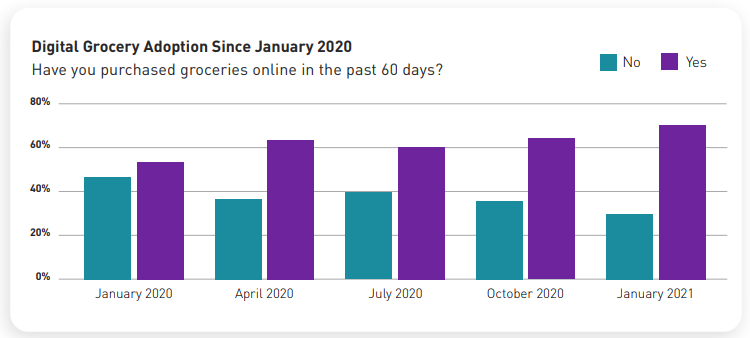

The first report, issued in January 2020, found just over 50% of people said they have ordered groceries online in the previous 60 days. That jumped to 70.27% in January 2021 during the height of COVID-19 restrictions, but it has remained strong even as in-person shopping has returned.

“Online grocery usership has the potential to grow stronger this year as brands and retailers prioritize digital solutions. The 2022 online grocery shopper is willing to spend more money, more frequently, which will likely yield higher returns for those investing in digital advertising solutions — as long as those solutions are catering to high-intent shoppers in a context that makes sense,” Chicory wrote in the Online Grocery Usership report.

Chicory is a digital shopper online marketing platform. It began surveying online grocery shoppers between the ages of 18 and 85 in January 2020. The most recent survey was conducted on Dec. 27, 2021.

Statista estimates the online grocery market will reach $135.2 billion this year, up from $112.9 billion in 2021, and grow to $187.7 billion by 2024.

Chicory found that online shoppers were not generally driven by health or safety concerns — less than 10% cited these as their motivation — but rather by the convenience online ordering provides, with 46% of respondents citing that reason. Product availability or accessibility was the second-most popular reason at 19.3%.

Over 52% of survey respondents said they placed an online order at least once a week. Special occasions, though, were not a popular reason for placing an online order, with just 14% saying they went online to order for a special event or holiday.

Brands that can get consumers to add items to their carts regularly were more likely to increase sales, the survey found.

“Based on the data we collected, more frequent add-to-cart cadences (45.5% more than once a week) are gaining in popularity, with the majority of shoppers adding items weekly or a few times a week,” Chicory wrote. “Meanwhile, every few weeks, the lowest add-to-cart cadence is declining in popularity. This suggests that shoppers are spending more time browsing online and may be more likely to use online carts to build their shopping lists, regardless of where they complete their purchases.”

Interestingly, the survey did not find wide disparities in age groups, with 11% of 18-29-year-olds and 9% of 60-plus-year-olds adding items to their online cart more than once a week.

Watch: The ever-changing grocery store supply chain

More than one-third of shoppers spend more than $100 and 50% spend between $50 and $100.

“For 33% of shoppers, it’s pantry staples and supplies that are driving the majority of their spend,” Chicory said. “This suggests that shoppers are relying on online ordering for essentials, not just spur-of-the-moment wants, like snacks. These items also hold up during transport well, making them a no-brainer to add to the cart.”

Dairy or meat products were the second-most bought item at 18%, followed closely by snacks at 17.6% and produce at 16.6%.

For the third year in a row, Walmart topped the online grocery shopping market at approximately 35%. Amazon was second at roughly 23% followed by Instacart at 10%. Younger generations were more likely to choose Instacart while 45-60-year-olds preferred Walmart.

For brands looking to reach customers, Chicory said they should look to digital tools. In the survey, 40% of respondents reported using digital recipes monthly to help build their in-store shopping trips, and 27% said they do this weekly.

“Shoppable ads, which allow consumers to purchase items by engaging with the ad, are an effective means of driving items to cart,” Chicory said. “However, for CPG and grocery brands especially, it matters where those shoppable ads are placed. Digital recipes are the third-most popular place where shoppers would buy grocery products from a shoppable ad, after coupon and retailer sites. Social media channels are the least popular. This is because context matters. Brands are most likely to reach high-intent shoppers in places where the shopper is meal planning or building their grocery list already: retailer, coupon and recipe/food sites.”

Click for more articles by Brian Straight.

You may also like:

Drones are flying into weather data deserts. Can they be stopped?

Navigating COVID-19 shipping chaos: Finding capacity and servicing the customer