More shippers avoiding long contracts amid abundant truckload capacity

A recent article by Furniture Today on domestic trucking is highlighting a growing trend of domestic trucking undergoing pricing and market changes between carriers and shippers. Powell Slaughter wrote, “Domestic trucking has started to share traits with its maritime counterpart, namely a shift to more transactional relationships between many shippers and their carrier partners and increased consolidation.”

Bluewater Logistics CEO Tiffany Bowman told Furniture Today, “From a domestic market standpoint, there’s no longer a true contract season or bidding season that we previously saw. We’re seeing customers who are transactional, that are bidding on a daily basis, even weekly ‘mini-bids.’ Previously, especially in furniture and textiles, you were seeing those contracts locked in for a year, two years, three years, at their pricing per region. Now, it seems shippers reach out daily for rates.

Bowman also saw some shippers call for earlier bids, adding, “Where we normally see those take place in May and June, we’re seeing them now in February.” This strategy can be beneficial for shippers who want to lock in the lowest rate possible before a potential upswing in the freight market, with current consensus being the second half of 2024. Rachel Shames, director of pricing and procurement at CV International, sees freight rates remaining mostly stable for most of 2024. Shames told Furniture Today, “In general, there’s plenty of capacity, rates are low. Unless there’s a major change in volume forecast, I don’t see trucking changing this year.”

Serial arsonist of Swift trailers found guilty

A jury found Viorel Pricop, 66, of Allen Park, Michigan, guilty on Tuesday of six counts of arson of vehicle or property in interstate commerce. He had been in custody since October 2022. The arson involved Swift-owned trailers parked at or near truck stops in California, with the fires mainly occurring on or near the trailer tires. A news release from the U.S. attorney’s office, Central District of California, said, “Pricop set on fire at least 18 additional Swift Transportation semi-trailers in other states from June 2020 to March 2022, according to an affidavit previously filed in this case. These incidents occurred at locations spanning from Barstow, California, to McCalla, Alabama, with most incidents occurring along Interstate 10 and Interstate 40.”

A pattern began to emerge after Swift hired fire investigation consultants to examine the scenes and found multiple reports that showed similar methods used to light the trailers. The location of the fires and time of day each fire occurred led to an investigation of cell towers near the fires. A Department of Justice press release said the cell records “revealed that a specific GPS navigation device installed in a commercial truck was present at the fires. Law enforcement determined that this device was installed on a vehicle owned and operated by Pricop, the affidavit states. Law enforcement then identified the cellphone subscribed to Pricop and, through historical cellular data analysis and ping warrants, learned that the phone was present in the general area of 24 of the 25 fires, the affidavit alleges.”

This was not Pricop’s first conviction. The press release adds, “Further record checks for Pricop revealed that he was convicted in 2018 in the Eastern District of Michigan for transportation of stolen goods.” Pricop was sentenced to time served — about two years’ imprisonment — in the 2018 conviction, and his supervised release ended in June 2019, one year before the nationwide arsons began, per the affidavit.

U.S. District Judge Sunshine S. Sykes set sentencing in the current case for June 7. Pricop faces five to 20 years in federal prison on each count.

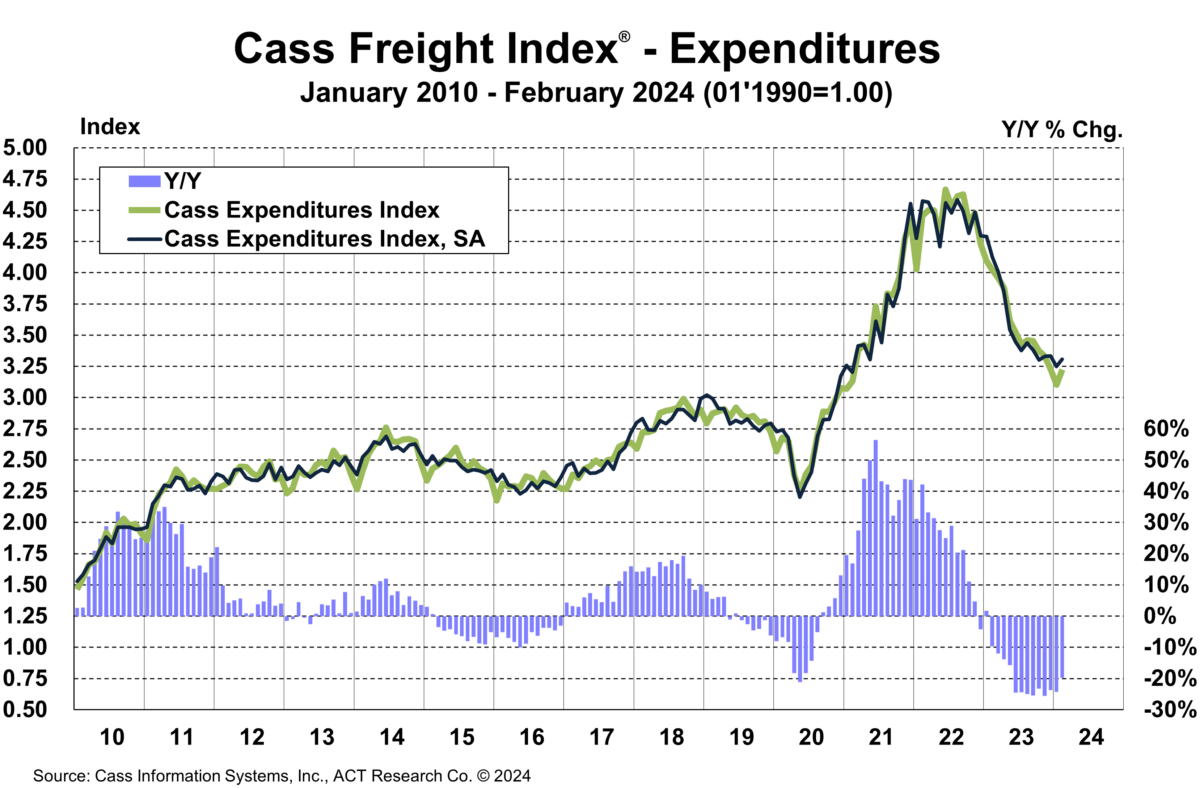

Market update: Cass February data shows ongoing freight market bottom

On Monday, freight audit and payment provider Cass Information Systems released its Cass Index for February which saw small improvements in freight rates and shipments but remained lower year over year. FreightWaves’ Todd Maiden writes, “Shipments increased 7.3% from January, up 2% when adjusted for normal seasonal trends, and were just 4.5% lower year over year (y/y). The y/y decline was the smallest in 10 months and 3.1 percentage points lower than January’s decline.” The report notes that ongoing destocking and a rise in goods consumption are encouraging signs of a nascent freight market recovery.

The Freight Expenditures Index, a measure of total freight spend, rose 4% m/m but is down 20% y/y. The report notes that expenditures “fell 19% in 2023, after a record 38% surge in 2021 and another 23% increase in 2022. It is set to decline about another 14% in 1H’24, assuming normal seasonal patterns from here.”

For fleet equipment demand, upcoming rulemaking and changes to emissions requirements are viewed as a potential demand boon. The report adds, “While the freight cycle is certainly stabilizing with rates below sustainable levels in many cases and little room for further savings, we’re also seeing surprisingly strong new equipment orders for this point in the cycle. In our view, planning for upcoming emissions regulations is likely a key factor. These capacity additions suggest the long bottom in the freight cycle may lengthen even further.”

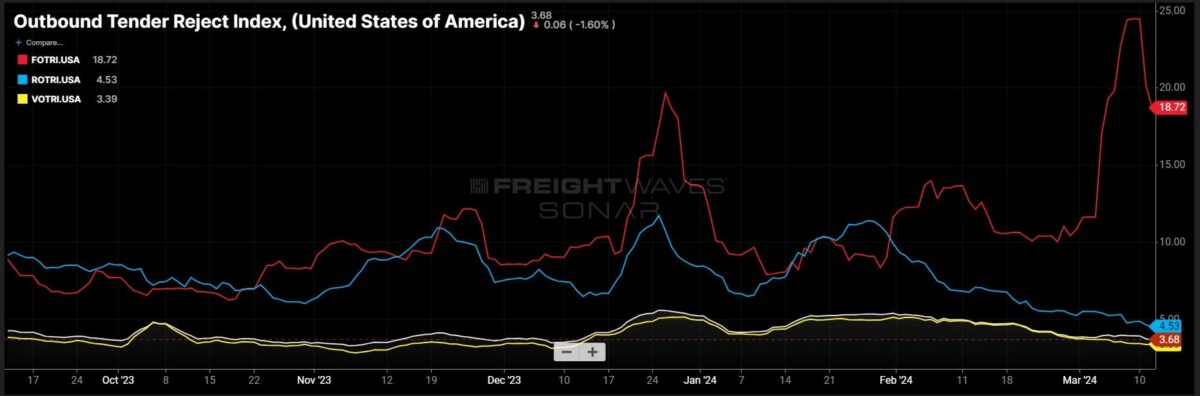

FreightWaves SONAR spotlight: For rejection rates, flatbed remains king

Summary: Ongoing declines in outbound tender rejection rates for dry van and reefer carriers continue, but for the flatbed truckload segment, the first two weeks of March bring optimism, with flatbed outbound tender rejection rates at 20.12%. Flatbed tender rejection rates rose 303 basis points week over week from 17.09% on March 4 to 20.12%. For reefer and dry van segments, the past week saw continued declines in tender rejection rates in spite of outbound tender volumes remaining relatively flat. Dry van outbound tender rejection rates declined 33 bps w/w from 3.7% on March 4 to 3.37%. Reefer rejection rates fell 78 bps w/w from 5.42% on March 4 to 4.64%.

The development to watch for reefer tender compliance will be at the beginning of produce season, which brings higher reefer demand with both 2019 and 2020 seeing reefer tender rejection rates rise in the middle of March. A contrarian take would be that there remains excess reefer truckload capacity as 2022 through 2023 saw declines in rejection rates and current spot market rates for reefer (RTI) are down 14 cents per mile from $2.65 all-in to $2.51 w/w.

Dry van and flatbed spot rates saw some improvement in the past week. The FreightWaves National Truckload Index 7-Day Average rose 3 cents per mile all-in from $2.21 per mile on March 4 to $2.24 per mile. The Flatbed Truckload Index rose 10 cents per mile all-in from $2.55 on March 4 to $2.65. Spot rate volatility paired with outbound tender declines for contracted freight continues to suggest that while the freight market is nearing an end to its current down cycle, there remains a lack of sustained and persistent spot rate and contracted tender rejection rate improvement to warrant celebration for truckload carriers. For shippers, improving tender compliance and lower rates keep them in a favorable position, but there are risks once enough capacity leaves the market and the freight cycle begins its upswing in full.

The Routing Guide: Links from around the web

NHTSA safety committee eyes trailer underride retrofit requirement (Commercial Carrier Journal)

Bill gives states new power to waive truck weight limits (FreightWaves)

TA 2024 growth plans includes adding 1,600 new truck parking spaces (Trucking Dive)

U.S. Department of Labor’s worker classification rule takes effect (Land Line)

Biden administration rolls out power grid plan for electric trucks (FreightWaves)

US reviewing security of connected vehicles, including trucks (Trucking Dive)