Leading up to and following the demise of Yellow Corp., shippers and brokers were quick to redistribute freight to other carriers. However, some of the newly formed shipper-carrier relationships may not be long-lived, according to a survey from investment firm Morgan Stanley.

A Monday report showed that of the more than 300 shippers and 3PLs queried, all of which had recently worked with Yellow, 35% are still looking for another carrier for their less-than-truckload shipments, indicating their first choice post-Yellow is not a permanent fit. Pricing, service and network fit are some of the reasons for another, albeit more modest, shake-up in the LTL landscape.

Yellow historically held a roughly 9% share of the LTL market but that number likely dwindled a couple of hundred basis points ahead of its late-July shutdown.

Most large, growth-oriented carriers run their networks with 15% to 20% excess capacity in efforts to stay ahead of a longer-term demand curve. That means the remaining top-5 carriers had the ability to absorb Yellow’s share. That’s not how Yellow’s freight was redistributed across the industry as many smaller and regional players were winners from the fallout. But the unwinding of Yellow on the downside of the demand cycle with many competitors carrying ample door space explains why the redistribution was accomplished with minimal disruption.

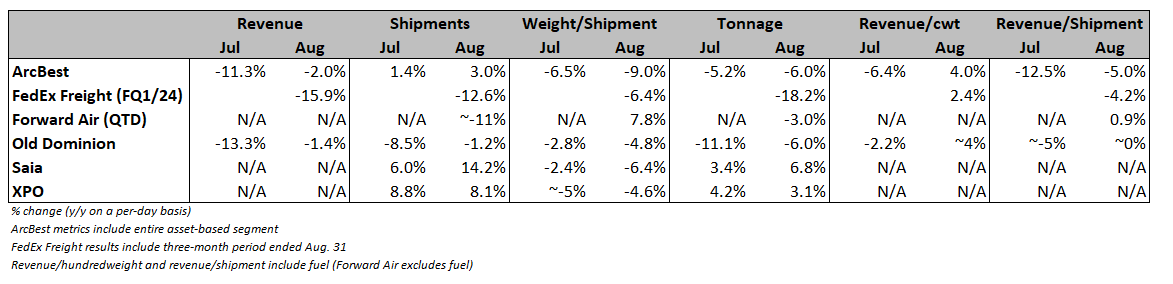

The recent reshape of the LTL pie was apparent in third-quarter updates provided by large public carriers.

All of the public carriers noted some type of inflection in shipments in July and August with Saia (NASDAQ: SAIA) recording the largest increases. Shipments for the carrier were up 14% year over year in August. XPO (NYSE: XPO) has seen high-single-digit increases and ArcBest (NASDAQ: ARCB) called out a 20% jump in volumes at its core accounts, most of which also relied on Yellow.

Morgan Stanley’s (NYSE: MS) report said carriers “appear to be happier with the current status quo than shippers,” which could “lead to a surprise in the magnitude of Phase 2” of the freight reshuffle.

Only 7% of the carriers polled said the Yellow customers onboarded aren’t a good fit for their networks, although 46% acknowledged the pricing and freight mix was worse than that of its base business.

Due to its inability to generate a consistent profit, Yellow lacked the capital to consistently replace equipment, make terminal upgrades and invest in technology. The dynamic dragged down the carrier’s service metrics and often forced it to take freight with unfavorable pricing.

Service provided by new partners is not really an issue for shippers and brokers as 39% said they were very happy with their new carriers, with 60% indicating they were at least somewhat happy. Not surprising, pricing was more of an issue as 22% said they were very happy with their new rates. Sixty-five percent said they were somewhat happy with the new pricing while 13% said “not at all.”

Of the 35% of shippers and brokers saying they are going to find a new carrier, half said they would do it this year, with the bulk of the remainder saying it would be done in the first half of next year. Sixty-nine percent of brokers said a change would be made this year while 60% of shippers said they would wait until the first half of next year.

Eighty-percent of carriers said they have stopped receiving inbound requests from Yellow’s former customers.

“The lack of incoming requests to carriers with 35% of shippers/brokers still planning to move carriers means that there could be significant movement of LTL freight, which may come as a surprise to Carriers who think that their new customers are happy,” the report said.

More FreightWaves articles by Todd Maiden

- Forward Air’s bid for Omni temporarily blocked by court

- 3PL, warehousing provider WSI acquires El Paso carrier

- FLS Transportation acquires cross-border Mexico specialist

Freight Zippy

LTL Carriers need to follow the Southwest Airlines strategy. They do not offer their services to Third Party sites, if you want to utilize Southwest Airlines capacity you can only purchase seats via Southwest Airlines and nowhere else..

That will end these parasites from killing any more LTL Carriers

Maxwell Smart

When O When will the carrier quit his or her crying and realize that the 3PL’s job is to put the carrier at a disadvantage, if not out of business? Hate the game, not the player. And if you’re stuck in a truck that doesn’t turn a significant profit, get a brokers license and you’ll finally understand!

Ex yellow driver

I agree with Paulo

3pls destroyed freight, trucking market.

Government needed intervene

Shop Around

Paulo, you make it sound like 3PL is the only option. Do people not know you can shop for rates?

Third Party Logistics

Wow Paulo show me on this doll where the 3pl hurt you….

Patric Bogie

I have not missed yellows slow trucks on the highways.

Jose

Por causa de esta clase de expertos esta la economy tan mal quieren engañar a quien se deja engañar

Paulo Martin

3 PL COMPANIES ARE THIEVES THAT TELL THE TRUCK OWNERS AND TRUCKING COMPANIES THE RATES ARE LOW. SO THEY CAN PAD THIER PROFITS AT THE SAME TIME THEY TELL SHIPPERS THAT THE TRUCK OWNERS AND TRUCKING COMPANIES ARE DEMANDING THESE HIGH RATES. AS I SAID. CRIMINALS , THIEVES AND LIARS. MAKE 3PL. ILLEGAL. THEY DONT TRANSPORT ANYTHING. THEY DONT PRODUCE ANYTHING. THEY ARE THE SCUM OF TRANSPORTATION.