Morgan Stanley’s Truckload Freight Index has decreased over the last two weeks and has now underperformed seasonality two updates in a row. This seasonal deceleration is not unusual, as July and August tend to be weaker.

The Morgan Stanley TFLI is a broad-based measure of incremental truckload demand versus incremental truckload supply. It is seen as an indicator of truckload capacity.

Morgan Stanley’s August 8 update noted DAT spot rates for the first week of August came down slightly from July. Rates are now up about 23 percent year-over-year, as opposed to about 25 percent year-over-year in July.

The update predicts the next round of tightening will come in the week leading up to Labor Day, potentially lasting through peak season.

“The dry van index trended down sequentially and underperformed seasonality, driven by both weaker demand and stronger capacity expansion,” the update reads. “Our straight-line forecast projects 2018 trending above 2014 but below 2017 for the rest of the year.”

Falling demand, rising supply

The demand component of Morgan Stanley’s index decreased sequentially, directionally consistent and underperformed seasonality two updates in a row. Demand decreased about 1,550 bps sequentially compared to its average decrease of about 570 bps, according to the update

The supply component of the index increased sequentially, directionally consistent and underperformed seasonality. Supply increased about 1,830 bps sequentially compared to its average decrease of about 970 bps, according to the update.

Morgan Stanley’s reefer and flatbed indices also decreased sequentially, directionally consistent and underperformed seasonality. The update notes both indices are at their highest levels since 2014.

While last month’s J.D. Power Valuation Services used truck report, the most current available, continued to report subdued supply in June, it did note a small increase in volume at auction.

J.D. Power Senior Analyst Chris Visser predicted an increase in supply over the second half of the year due to June’s increasing auction volume, historical patterns and an extremely high volume of new truck orders when FreightWaves spoke with him last month.

Survey results

Morgan Stanley’s biweekly Truckload Sentiment Survey includes the opinions of “hundreds of shippers, carriers and other truck industry contacts with a view of on the ground trends,” according to the company’s methodology.

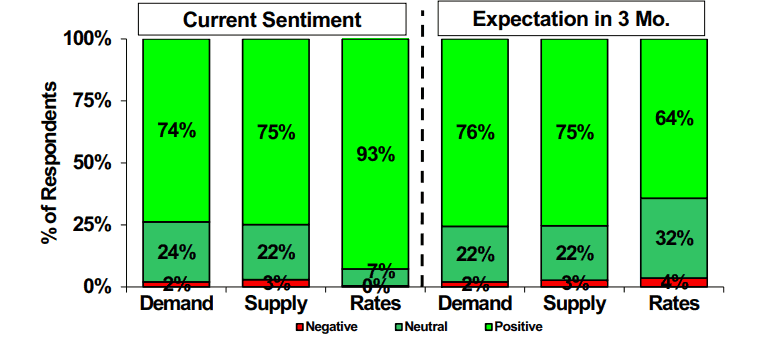

In the most recent survey, 74 percent of respondents expressed a positive sentiment toward current demand, 24 percent expressed a neutral sentiment and 2 percent expressed a negative sentiment.

“Demand must be softening a little,” one shipper who responded the the survey said. “We have had 10 days of more truck offers than loads to ship. We have not seen that for about a year.”

Survey respondents reported similar feelings about supply, with 75 percent expressing a positive sentiment, 22 percent expressing a neutral sentiment and 3 percent expressing a negative sentiment.

“Spot market softening, although still well above any past levels. Still overbooked by a factor daily and well in advance,” one carrier who responded to the survey wrote. “Brokerage capacity still very tight, but not as tight as it was a month ago. Reefer market still very tight.”

A full 93 percent of survey respondents expressed a positive sentiment toward current rates, and 7 percent reported a neutral sentiment. Zero percent reported a negative sentiment toward rates.

“We are experiencing the normal seasonal loosening in capacity, but expect the market to tighten again in early Autumn,” one broker who responded to the survey said. “Any disruption in freight flow such as a hurricane will quickly accelerate the market for the remainder of the calendar year.”

When asked about their expectations of demand in the next three months, 76 percent respondents expressed a positive sentiment, while 22 percent expressed a neutral sentiment and 2 percent stayed negative.

Sentiments toward supply over the next three months stayed exactly the same as current sentiments toward supply.

The largest difference between current sentiment and expectations over the next three months was seen in rates. Only 64 percent of respondents expressed positive expectations, 32 percent reported neutral expectations and 4 percent reported negative expectations.