The CEO of Canada’s largest trucking company didn’t mince words about COVID-19 when he discussed first-quarter financial results on April 22. TFI International’s Alain Bedard likened the pandemic’s impact to a tsunami.

But TFI will almost certainly survive COVID-19 and likely come out stronger. It has millions of dollars in cash, hundreds of millions more in untapped credit, and ruthless operating efficiency in its core Canadian and U.S. truckload businesses.

“We’re not going to lose money in the second quarter, that’s for sure,” he said.

Other Canadian carriers may not survive the quarter. TFI represents an exception in Canada, where only eight trucking companies employ more than 500 people. TFI has more than 16,000 employees across North America, and nearly 10,000 owner-operators in North America.

Despite the billions of dollars federal aid that will flow to Canadian businesses – much of it through a 75% wage subsidy program – carriers say they need more immediate help. A Canadian Trucking Alliance (CTA) survey released this week found that 55% carriers polled have already laid off personnel and 37% have concerns about their ability to continue operating.

Simply put, they need cash. In March, the CTA quietly floated a proposal to the federal government to allow carriers to temporarily defer payroll tax withholdings to hold onto valuable cash.

“Every business relies on cash flow. It’s becoming a bigger issue for trucking as more shippers are closing,” CTA president Steve Laskowski told FreightWaves.

The plunge in freight volumes and rates along with increasing delays of shipper payments has created a perfect storm for Canadian carriers. Carriers in a recent CTA survey reported a 27% drop in revenue from COVID-19.

Payroll tax deferral ‘an elegant solution’

The proposal would buy carriers time, particularly those that don’t meet the criteria for the wage subsidy. The federal Department of Finance declined to comment on the proposal.

“It’s an elegant solution. In effect, the government would be indirectly loaning businesses money so that they can continue their day-to-day operations,” Scott Tilley, president of Ontario-based trucking and logistics firm Tandet told FreightWaves.

“Without some sort of support, carriers that are down 5% to 25% will continue to struggle,” Tilley added.

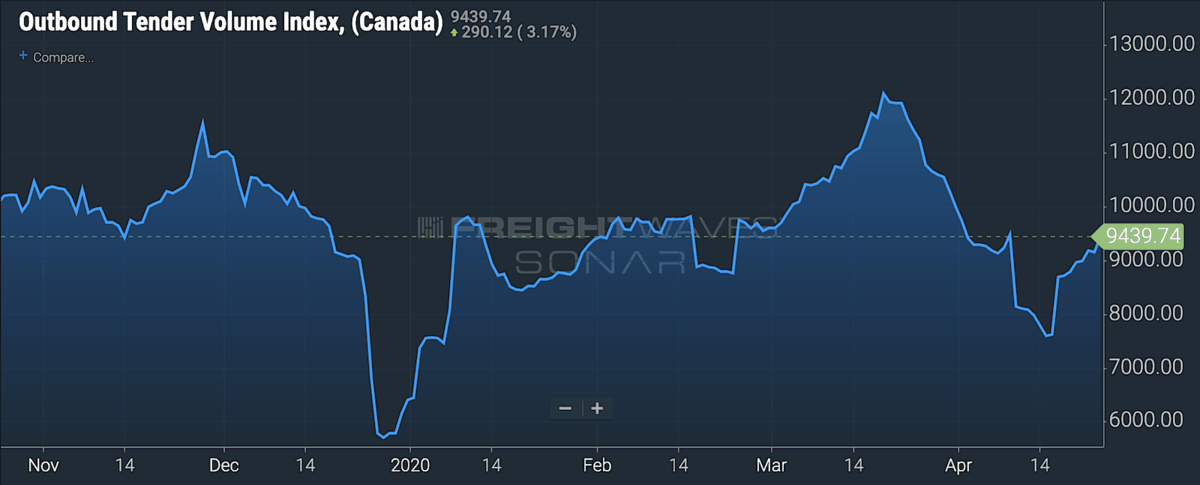

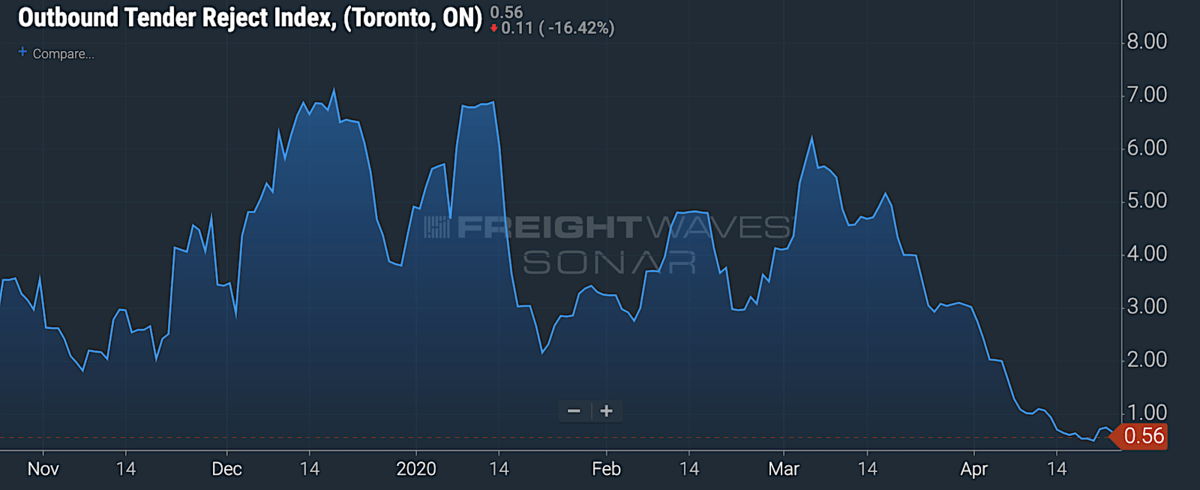

While Canadian freight volumes appear to have bottomed out – at least for now – conditions for carriers continue to worsen. The supply of trucks has far outstripped the freight available in key markets. In Toronto, Canada’s largest freight market, the Outbound Tender Reject Index (OTRI.YYZ) hit a historic low on FreightWaves’ SONAR platform – 0.5 on April 20 – meaning that almost no one is saying no to hauling a load.

“With the lack of volumes, some carriers are getting desperate. They don’t understand their operating costs, and are excited to just get rolling,” Mark Bylsma, president of Ontario-based cross-border less-than-truckload carrier Spring Creek.

With a fleet of about 40 trucks, Spring Creek is among the thousands of small carriers that form the backbone of Canada’s trucking industry.

“We’re all trying to help move the economy rolling,” Bylsma said. “But opportunistic brokers are hurting us.”

The rate plunge happened quickly, he said. “The third-party rates we were seeing two or three weeks ago were fairly responsible. All of a sudden it got ridiculous.”

“In some cases, we’ve chosen to come home empty rather than move it at sub-par level.”

— Craig Germain, chief operating officer, XTL Transport

Even Canadian carriers that otherwise avoid the spot market have increasingly had to do so because so many large shippers are idle during the pandemic. While some carriers have begun pushing back and refusing to haul freight below cost, many don’t have that luxury, particularly for backhauls from U.S. markets and peripheral Canadian ones.

“In some cases, we’ve chosen to come home empty rather than move it at sub-par level,” Craig Germain, chief operating officer of Ontario-based cross-border carrier XTL Transport, told FreightWaves.

XTL is better positioned than many carriers, with extensive exposure to essential goods, particularly food, and warehousing business. Germain estimates XTL is operating at 80% to 85% capacity.

“We’re holding our own,” he said. “But if you have a weak balance sheet and your cash position is light, then you may need help.”

Stephen Webster

The government still needs to bring in money a short term of ( up to 12 weeks) in no payroll taxes would be fair. A much better plan is minimum and maximum freight rates for domestic freight. Assistance with insurance and the Canadian portion of plate costs for up to 20 weeks. Any company getting assistance not be allowed to bring in any overseas truck drivers for 3 years and a review of all drivers wage and injuries complaints for the last 7 years if the aid from the taxpayers is over $25,000 in any 12 months period including assistance with the cost of bringing in ( training) new truck drivers.