FMCSA-sponsored NASEM study disputes ATA driver shortage claims

A recent study looking at the impacts of pay and working conditions on long-distance truck and bus drivers has also called into question claims of a persistent driver shortage. The study, “Pay and Working Conditions in the Long-Distance Truck and Bus Industries: Assessing for Effects on Driver Safety and Retention,” by the National Academies of Sciences, Engineering, and Medicine (NASEM) was conducted on behalf of the Federal Motor Carrier Safety Administration.

Examining the claims of a shortage, the study notes that the American Trucking Associations is one of the few sources available that have reported on turnover. The challenge is that the ATA’s survey, in existence for over 25 years, is a self-selected sample, and it’s uncertain how representative it is. The report adds, “Because the ATA’s studies have been conducted using proprietary techniques and assumptions that are not publicly defined, it is not possible to evaluate the validity of their claims of driver shortages.”

In any case, ATA’s annual turnover reports show that the long-haul segment of trucking does have a persistent, chronic turnover problem. The average annualized turnover rate from Q3 1996 through Q1 2023 was 92.7% for large truckload carriers earning $30 million or more a year. Smaller fleets under $30 million reported a 77.6% turnover rate. This is the opposite of less-than-truckload carriers and private fleets. The ATA notes that LTL carriers reported an average turnover rate of 11.8% from Q4 2000 through Q1 2022. For private fleets, the National Private Truck Council reported annualized turnover rates of only 15% from 2005 through 2022.

The key takeaway from the driver turnover chapter of the NASEM report is that if there were an actual driver shortage, according to traditional economists, two things would need to be demonstrated. One is an increase in earnings for the occupation (long-haul truck drivers) compared to occupations requiring similar levels of human capital and education. The report used the construction industry as a close rival to highlight the difference.

“Significantly, the average wage for all employees in resident construction remained above the prevailing wage in the long distance TL sector over the full period of that study,” the report stated. “These trends are not indicative of the wage premium one would expect for long-distance TL employees if they were indeed working in an occupation experiencing a chronic labor shortage.”

In layman’s terms: If there were a real shortage, trucking wages would at least exceed construction wages (the wage premium) until the shortage was resolved.

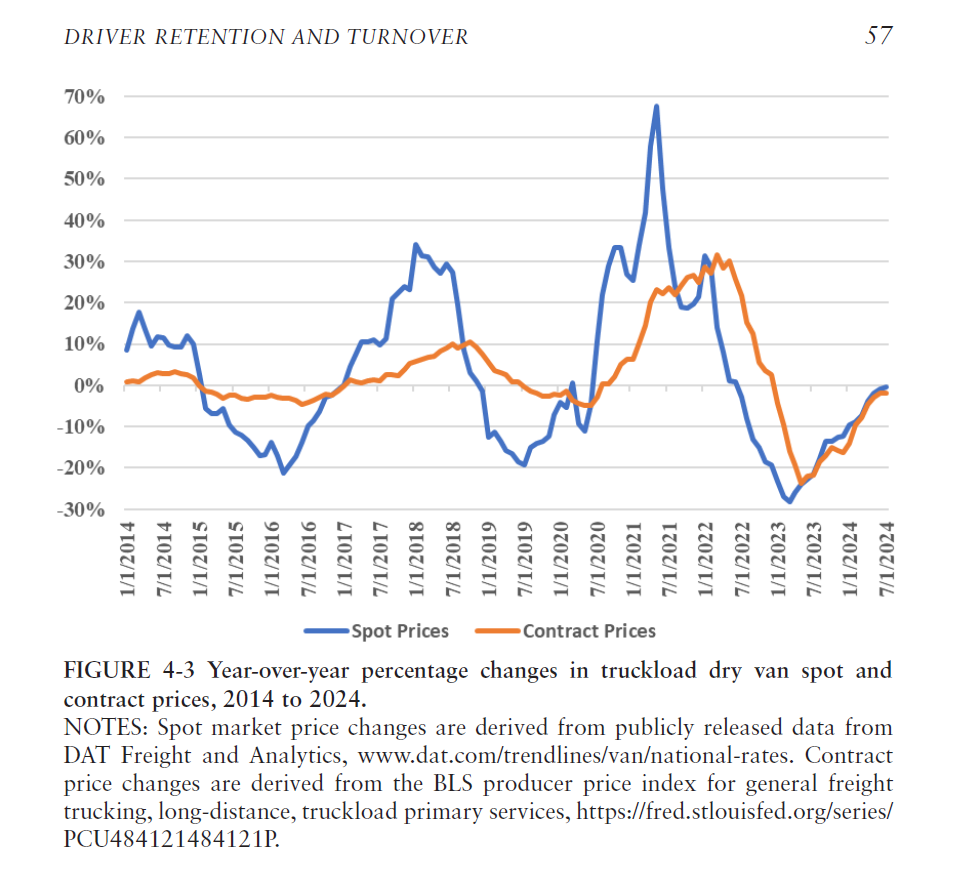

The second thing necessary would be to look at overall supply and demand of drivers, in this case through contract and spot prices. One would need to find lags in the supply of long-distance truckload service relative to demand. That is, we need to see that this “shortage” keeps prices rising for rates, since intuitively, fewer drivers means fewer trucks on the road to haul and thus higher prices.

The problem, the report adds is, “There are observable service price indicators of shortages in capacity, including spot prices in short-term auction markets and prices for longer-term service contracts,” e.g., spot and contract rates.

The report continues, “In both markets, periods of increasing rates are routinely followed by periods of decreasing rates, consistent with increases in service capacity and/or decreases in the demand for service.” The pattern even persisted through the pandemic.

Matt Cole with the Commercial Carrier Journal reported that the ATA “challenged this finding, noting that the study’s authors ignored certain aspects of the trucking industry.” The ATA stood by its claim of a shortage, telling the CCJ that the NASEM report “fail[ed] to account for several important points and distinctions that are critical to understanding the market for professional truck drivers.”

The ATA’s challenge was two-pronged. First, the organization argued the researchers “entirely ignore the issue of driver quality and the fact that this is a highly regulated industry by multiple state and federal agencies.” These can include barriers to entry like age, drug and alcohol screenings, and CDL requirements that may not apply to blue-collar construction jobs.

The ATA said that while carriers have reported they have enough applicants, the problem is that out of that pool, not enough meet the qualifications to be hired. In a statement to CCJ, the ATA added, “In some cases, carriers report having to reject 90% of applicants out of hand, because the applicants fail to meet at least one of the prerequisites to drive in interstate commerce.”

Both of these issues – regulations impacting the pool of drivers and the quality of potential drivers to hire – “mean that the classic economists’ definition of a ‘shortage’ – that the workers don’t exist to fill jobs even when wages are raised – is not applicable to the dynamics of the driver market.”

For carriers, the issue is complex with a less clear-cut solution. The report notes that truckload carriers are stuck with a choice between cost savings and maximizing revenue. For a low-margin business like trucking, money and the bottom line have a say. The report adds, “A typical long-distance TL carrier will tend to favor the cost-minimizing choices of an intense, efficient dispatching practice and controlling driver pay expenses while accepting the costs associated with the resulting high turnover.”

FreightWaves SONAR spotlight: Great expectations for tender rejection rates heading into peak season

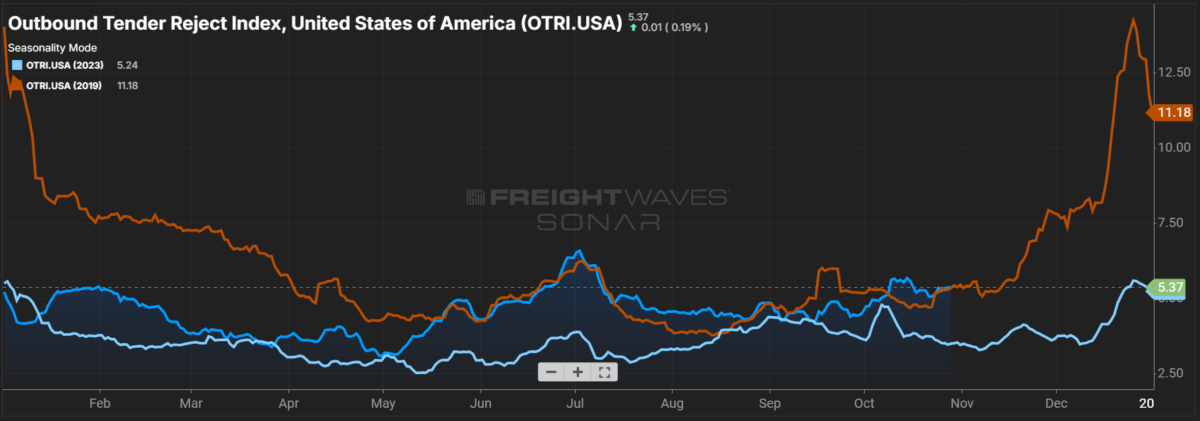

Summary: A sustained uptick in nationwide outbound tender rejection rates which began in October is creating conditions more similar to 2019 than the previous year. The gains in OTRI are mostly driven by improvements in the smaller but more volatile flatbed and reefer segments. FOTRI rose 534 basis points m/m from 6.12% on Sept. 29 to 11.46% while ROTRI is up 520 bps m/m from 9.02% to 14.22%. The dry van segment continues to trail the combined nationwide average but rose 40 bps m/m from 4.33% to 4.73%.

In a post on the X platform, FreightWaves founder and CEO Craig Fuller is betting on a bullish scenario based on observing how current outbound tender rejection rates are trending similarly to 2019 levels. Fuller writes, “If the 19/24 similarity holds, it will be a huge Christmas gift for truckers.” These add to comments from a recent State of Freight webinar on which Fuller cited improvements in both spot market and contract outbound tender rejection rates as key indicators to watch.

For tender rejection rates, sustained improvement in the form of higher rejections may cause a cascading impact on spot market rates as carrier routing guides fail, forcing contract freight onto the spot market. This waterfall theory of freight will be put to the test as trucking executives from J.B. Hunt to Knight-Swift comment on the return to seasonality during their Q3 earnings calls.

The lingering question moving into Q4 and trucking’s peak season remains whether the eventual freight market upswing will be demand-driven or truckload supply-driven. On one hand, the upcoming presidential election with threats of tariffs or a tentative contract with unionized East and Gulf Coast workers set to expire Jan. 15 could see demand-side changes. On the other hand, the ongoing bleed-off of capacity through trucking bankruptcies will put the supply side argument to the test. An honorable mention for demand-driven upswing or lack thereof is the U.S. Manufacturing Purchasing Managers’ Index, which is in its fourth straight month of contraction. For the truckload sector, conditions are becoming more favorable for an upswing, but a specific catalyst remains elusive.

The Routing Guide: Links from around the web

Truckload breakeven price jumps, poised to increase in 2025 (Commercial Carrier Journal)

Freight market unlikely to rebound before 2025, Ryder says (Trucking Dive)

Automation, speed limiters on former FMCSA deputy’s radar for 2025 (FreightWaves)

Werner CEO stands out for optimistic trucking market outlook (FreightWaves)

Losses at Heartland Express continue to mount (FreightWaves)

AI will have huge impact on freight but also overhyped, says Transflo exec (FreightWaves)