Navistar International Corp. (NYSE: NAV) is regaining chunks of market share in medium- and heavy-duty trucks, winning back customers who walked away several years ago because they could not rely on the company’s products.

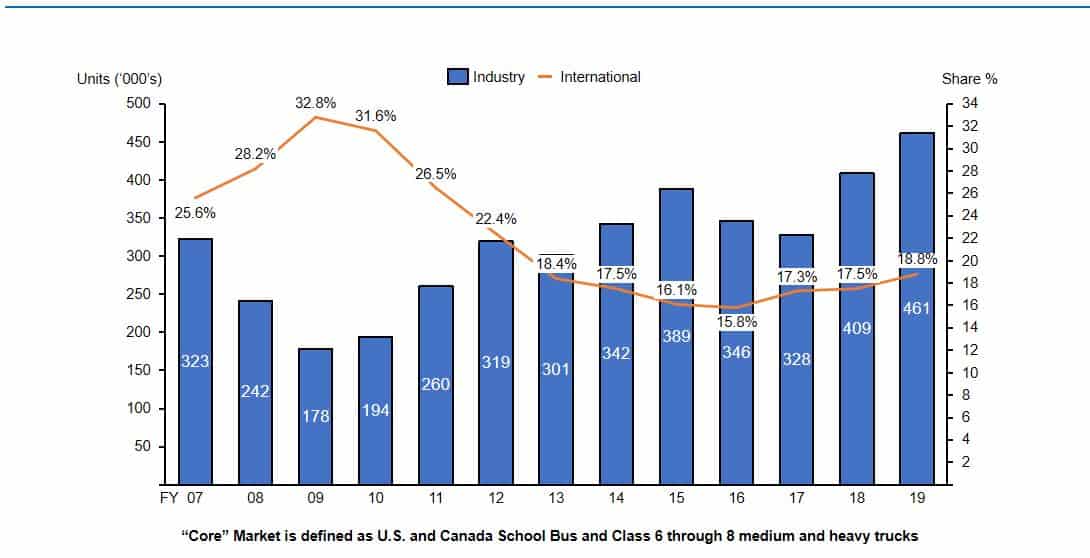

Navistar has averaged a percentage point of additional core share a year since 2016. It is noteworthy in an expanding market when growing sales and maintaining share is considered business success.

“The way we look at it in the investment community is the share has bounced back nicely from its low point,” Stephen Volkmann, an analyst with Jefferies & Co., told FreightWaves. “Part of that was they had capacity where others didn’t. Part of that was their historical customers want them in the game and want them to be a viable second source to keep everyone else honest.”

Certainly, being able to build more trucks than a capacity-constrained competitor helps, but there is more to the story.

“In a down market, you can gain share and still have your volume go down,” said Steve Gilligan, Navistar vice president of Product Marketing. “Growing share in an up market is what we have done in the last couple years, which is a lot harder to do and has a lot more impact to the overall health of the company.”

Navistar ended its 2019 fiscal year with a combined core share of 18.8%, up 1.3 points from 17.5% in 2018. That consists of school buses, Class 6-7 medium-duty and Class 8 heavy-duty tractors sold in the United States and Canada.

.

The backstory

Navistar wearies of the retelling of its decade-old decision to go its own way on pollution control equipment for its heavy-duty trucks. It bet on exhaust gas recirculation (EGR) technology when competitors adopted selective catalyst reduction (SCR) to meet federal standards for lower emissions.

EGR technology performed well for about the first 18 months of the engine’s life, said Mike Baudendistel, a market expert at FreightWaves. But when problems began showing up, they often repeated. Navistar spent billions for maintenance fixes, recalls and replacement of its Maxxforce engines. Around the same time, the company stopped offering Cummins Inc. (NYSE: CMI) engines after dropping Caterpillar (NYSE: CAT) as a supplier.

As reliability declined, many customers headed for the exits. Others hung on.

“It was a rough road during the Maxxforce days,” said Matt Decker, vice president of sales for Garsite Progress LLC in Kansas City, Kansas. “When we could, we were dealing with Freightliner because we did not want the Maxxforce and (medium-duty) N9 engines.

“Sometimes when you try to be ahead of technology and your competition, you slip up,” Decker said. “Navistar and their engineering group tried to be different and be ahead of the curve and got burnt. But at the end of the day, it’s how you recover.”

Garsite typically purchases Class 5-8 chassis for the manufacture of aviation fueling equipment sold domestically, globally and to the military. The Progress Tank division purchases Class 5-8 chassis for use in regional and over-the-road fuel delivery and tank wagons and vacuum truck equipment for the septic and portable restroom industry.

Navistar accounts for 60-70% of Garsite’s total fleet. its purchases have grown about 10% in the last two years as the Maxxforce experience has faded from memory.

“They realized the missteps they had and they made the changes they needed to make,” Decker said. “Their service and support has been second to none.”

Cummins factor

Navistar relied on Cummins to fill powertrain gaps as it rationalized its own engines, reintroducing the option of a 6.7-liter Cummins engine in 2013 and a 9-liter Cummins engine in 2016. It ended production of its N9 and N10 medium-duty engines in 2017. Earlier the same year it introduced the 12.4-liter A26 engine for heavy-duty use.

“They have a full line of products available with the Cummins engine which people know and trust,” Volkmann said. “When they launched the A26 engine, that was a little bit of a boost as well.”

As a supplier of engines when Navistar needed them, Cummins gets some credit for the market-share recovery. Cummins declined to comment for this story.

“I wouldn’t diminish the role that Cummnis played because of our need for a technology shift,” Gilligan said. “I think saying they are responsible understates an incredible amount of other activity that Navistar implemented to improve overall operations, quality, profitability, restructuring. I think it sells it short.”

Customer loyalty

Former Navistar executive and current dealer Terry Minor said Cummins was “integral to our recovery and our future [but] the biggest thing that was transformational was customer service [and] holding hands to get through that process.”

Baltimore-based Cowan Systems stuck with Navistar during its rough period because of the service and support it received. About six in 10 Cowan trucks are International brand models, and purchases have grown about 7% over the past year,” Cowan President Dennis Morgan told FreightWaves.

“We have two primary original equipment manufacturers that we work with. Both are excellent partners,” Morgan said. “Navistar went through a rough patch, but they have always been there to support us. Their commitment to Cowan is a major reason for our loyalty to them.”

Customer focus

Navistar has trained 7,000 dealership and 3,500 company employees on the tenants of its customer-focused Vision 2025 plan. The company also has launched other large-scale plans to draw customers closer. Even its first electric truck will be sold as an all-in package of services tailored to the needs of the individual customer.

“It is crucial that both our dealer network as well as the brand are growing and moving in the same direction to serve our joint customers better than anybody else,” said Friedrich Baumann, Navistar president of Aftersales/Alliance Management.

In August, Navistar began a partnership with Love’s Travel Stops and Country Stores to add more than 320 service and light-repair bays at Love’s and Speedco locations. That raised Navistar’s total service outlets to more than 1,000.

“We are extremely happy with our collaboration and partnership with Love’s,” Baumann said. “It has been very well received, especially by our over-the-road long-haul customers.

“I am absolutely convinced that service sells trucks,” he said. “You have the chance to create additional opportunity with your existing and new customers to consider you for purchases going forward.”

Future share

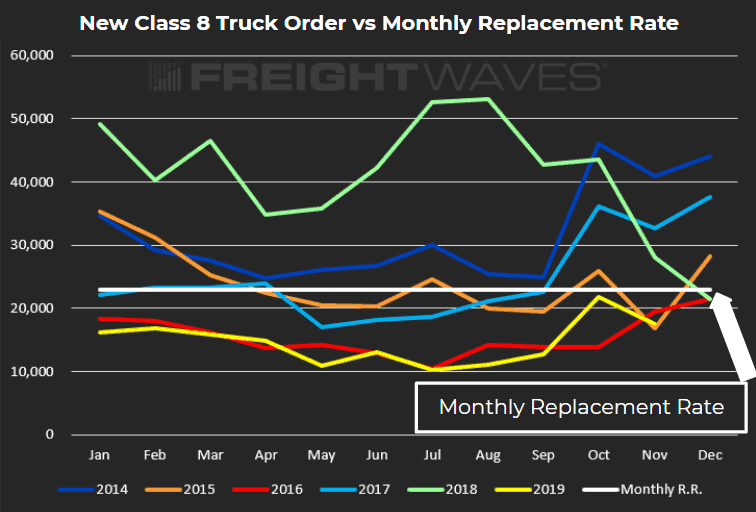

With new Class 8 truck orders across the industry running below replacement demand, Navistar expects to gain share for a fourth consecutive year in 2020 because its roughly 50-50 mix between bus/medium-duty and heavy-duty trucks shelters it from the downturn better than competitors whose mix is closer to 2:1 heavy-duty.

Still, Navistar has cut production in Ohio and Mexico 25% and laid off about 1,300 workers — 10 percent of its worldwide workforce.

A share gain in 2020 would be another step toward its Vision 2025 goal of 25% share.

“There’s many different ways to get to 25% overall,” Gilligan said. “We can overperform in one area and underperform our objective in another area and still get to the target.”

Volkmann sees continued share growth but at a slower pace.

“I still think they can gain some share. Personally, I would picture it being 50 to 100 basis points a year rather than 200 or 300 basis points a year,” he said.

Minor, who grew his Cumberland, Tennessee, International dealership from 1% share when he purchased it to more than 40% over the last dozen years, said the moves Navistar is making and the treatment of customers makes the 2025 share goal “very attainable, barring anything we don’t have control over.”